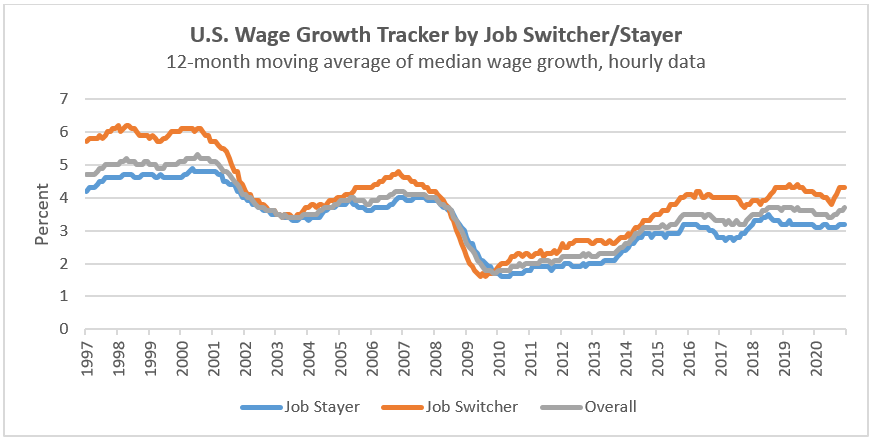

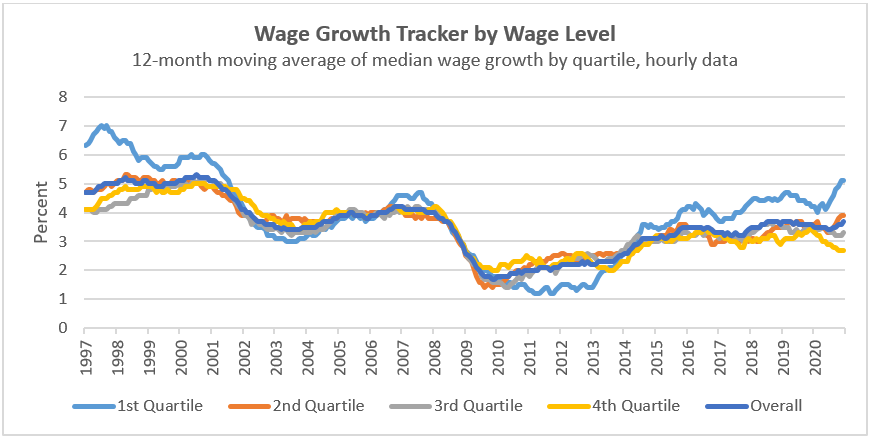

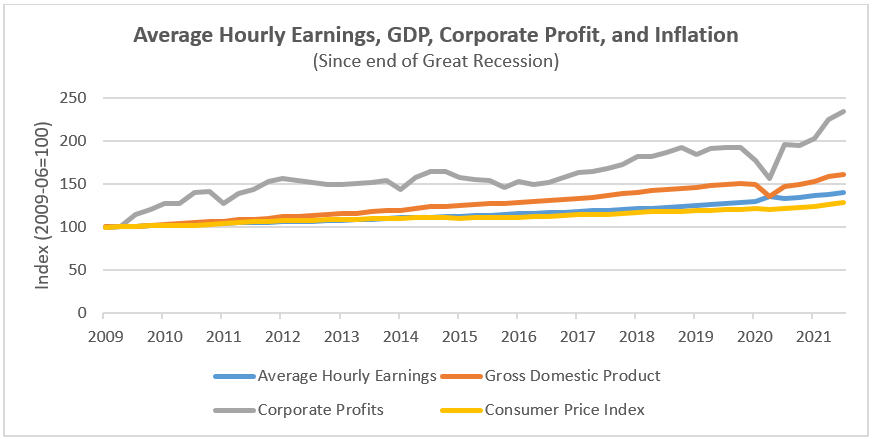

Much has been made of the increased leverage workers have had lately to negotiate higher wages. Looking at national data, it is true that some workers are experiencing stronger wage growth than others, including “job switchers” who leave one job to take another, as well as lower-wage workers. But historically, that’s common during periods of economic expansion. In fact, growth in median wages has been quite modest – and only began to approach pre-Great Recession levels in mid-2021. By contrast, corporate profits have grown far faster than wages, outpacing even the nation’s GDP.

As of November 2021, nationwide year-over-year median wage growth averaged 4.3% for job-switchers versus 3.2% for job-stayers. While that’s better than June’s rate, it’s hardly unprecedented: except in periods immediately following a recession, job switchers almost always see larger wage gains than other workers – because people often switch jobs for better pay. In fact, recent wage gains by job-switchers are actually lower than during other periods of economic recovery/expansion.[i]

Source: Atlanta Federal Reserve

For all workers, median wages grew an average 3.7% over the 12 months ending November 2021. That’s a high point since the end of the Great Recession – but below previous norms. And while workers in the bottom quartile have seen strong wage growth since January 2021 (a welcome trend!) that too is not a new development. On a percentage basis, gains for low-wage workers have outpaced average wage gains for all workers since mid-2015.[ii]

Source: Atlanta Federal Reserve

But perhaps most striking is the contrast between increases in corporate earnings and worker pay. From June 2009 through September 2021, average hourly earnings for production and nonsupervisory employees (private sector) increased 40.3% – but after-tax corporate profits (with inventory and capital cost adjustments) increased 133.7% – far exceeding national GDP growth of 61.2%.[iii]

Source: U.S. Bureau of Labor Statistics and U.S. Bureau of Economic Analysis.

Note: Average Hourly Earnings: Production and Nonsupervisory Employees, Total Private; Corporate Profits: After Tax with Inventory Valuation Adjustment and Capital Consumption Adjustment; Consumer Price Index: for All Urban Consumers (CPI-U), All Items in U.S. City Average

Previous: Part 2 – Business and Jobs | Next: Part 4 – Wealth Inequality

[i] Federal Reserve Bank of Atlanta, https://www.atlantafed.org/chcs/wage-growth-tracker. NOTE: data reflect only people who have a job now and had a job 12 months ago, and may not illustrate wage dynamics for people re-entering the workforce after losing employment.

[ii] Federal Reserve Bank of Atlanta, https://www.atlantafed.org/chcs/wage-growth-tracker. NOTE: data reflect only people who have a job now and had a job 12 months ago, and may not illustrate wage dynamics for people re-entering the workforce after losing employment.

[iii] Federal Reserve Bank of St. Louis, accessed December 18, 2021, https://fred.stlouisfed.org/graph/?graph_id=966035#0

More To Read

August 10, 2021

New State Programs May Ease a Short-Term Evictions Crisis, but Steep Rent Hikes Spell Trouble

State and local lawmakers must fashion new policies to reshape our housing market

November 20, 2020

We Can Invest in Us

Progressive Revenue to Advance Racial Equity