Washington’s outdated, unfair, and inadequate tax code needs both reform and transformation. This session, lawmakers have set their eyes on reforming one of the more progressive taxes in Washington’s otherwise regressive tax code: the real estate excise tax (REET). Making the proposed changes to REET will make our tax code fairer and bring in much needed public dollars for affordable housing programs.

What is REET?

The real-estate excise tax, often referred to as a “transfer” tax, is a tax on the sale of real property (homes, land, buildings). It is structured with tiered rates. As the selling price increases, the top rate paid does, too. The rate used to be a flat 1.28%, but in 2020 the legislature passed a bill sponsored by Senator Joe Nguyen. That bill amended the tax to be progressive, which means the rates increase as the selling price increases.

The tiered system put in place was as follows:

- 1.1% if the selling price is equal to or less than $525,000;

- 1.28% on the portion of the selling price between $525,000 and $1,525,000;

- 2.75% on the portion of the selling price between $1,525,000 and $3,025,000;

- 3% on the portion of the selling price that is greater than $3,000,000

The rates were adjusted by the Consumer Price Index (i.e. inflation) in 2022 and then will be nudged up by the inflation index every fourth year thereafter. The Department of Revenue has a worksheet to determine how much home sellers would pay under the current system.

Which changes are lawmakers considering?

There are two companions bills in the Legislature right now: HB 2276, sponsored by Representative April Berg and SB 6191, sponsored by Senator Noel Frame. They would do the following:

- Adjusts the top rate on high-priced real estate sales to bring in hundreds of millions of dollars each budget cycle;

- Funds five different housing programs including establishing a permanent funding source for the Housing Trust Fund

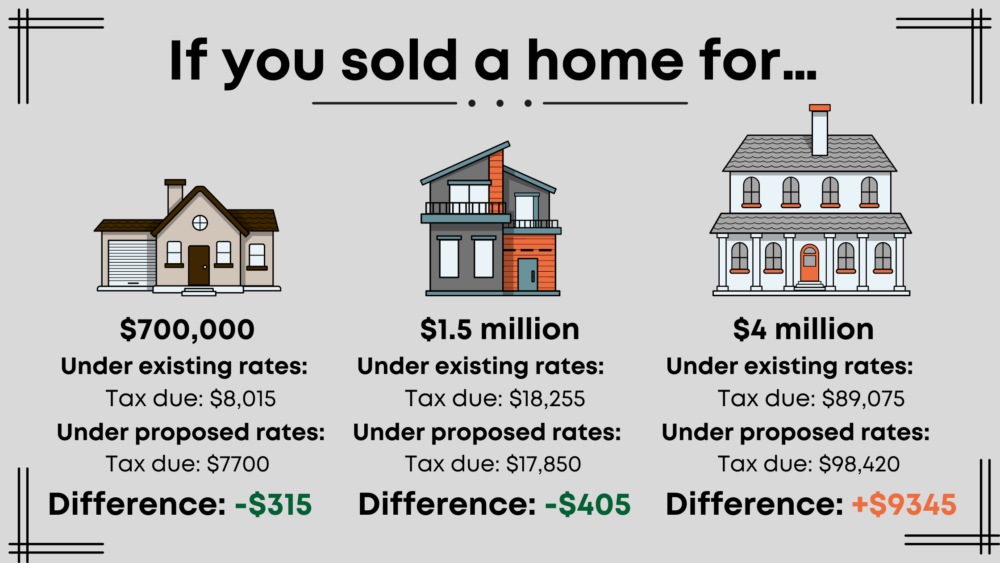

Lawmakers would like to see the top rates increase while adjusting the lower tiers. As a result, most lower- and middle-income home-sellers would see a modest tax cut – without overall cuts to statewide revenue.

For an idea of what might be considered a “middle-income” house, here’s an important fact: The median home price in Washington in 2022 was $647,900.

Proposed changes:

- 1.1% for portion of selling price that is less than or equal to $750,000

- 1.28% for portion of selling price between $750,000 and $1.525 million

- 2.75% for portion of selling price between $1.525 million and $3.025 million

- 3% for portion of selling price greater than $3.025 million

- Starting in 2025, an additional 1% surcharge for properties selling for more than $3.025 with the 1% surcharge applying to the portion of the selling price above $3.025 million

These reforms would result in a small tax cut for those selling homes worth up to $3.025 million and a tax increase for those selling properties worth for more than $3.025 million.

Dedicated funding for housing:

The 1% surcharge on properties valued at $3 million and up would raise an estimated $100 million a year. That revenue, with would be entirely new, would be used to fund housing programs, including:

-

25% to the The Washington Housing Trust Fund.

This fund supports building affordable housing units across the state. Of these funds, 5% must be dedicated to housing for low-income migrant, seasonal, or temporary farmworkers. Critically, this bill establishes the first dedicated funding source for the Housing Trust Fund.

-

25% to the The Apple Health and Homes Account

This pairs healthcare services with housing resources for some of the state’s most vulnerable residents.

-

15% to the Developmental Disabilities Housing and Services Account.

Created by the bill, this account provides grants and forgivable loans to housing programs to support people with developmental disabilities.

-

25% to the Affordable Housing for All Account

This account provides operations, maintenance, and service costs for permanent supportive housing.

-

10% to the Housing Stability Account

Created by the bill, intended to support housing operations, maintenance, and service costs for low-income households.

Who’s in opposition?

Despite the well-coordinated talking points of the powerful real-estate lobby that were brought out in both bills’ hearings, this modest reform to the real estate tax won’t lead to higher rents or higher home prices for an already cost-burdened populous.

And despite what the real estate lobbyists might say, this isn’t uncharted territory or an untested whim. A recent study out of UCLA of a similar measure in Los Angeles found that “there is no evidence that the tax would impact rents for commercial or resident tenants.” Instead, we know that prices for market-rate housing are determined by what the market will bear, not taxes and fees.

Why we need REET reform

Our tax system should be one that is based on individuals’ and corporations’ capacity to pay. We must move away from our over-reliance on regressive taxation, a system in which low-and middle-income working people subsidize the rich and profitable corporations; a system that is not keeping up with the needs in our state.

The proposed changes to the REET, then, are a step in the right direction. Dedicated funding for affordable housing is direly needed as Washington faces a housing and homelessness crisis.

It is also imperative that our lawmakers finally ensure the wealthiest among us to pay their share by passing a state wealth tax – however, this is a much bigger political lift than reforming an existing policy. While we work toward systemic changes, reforming existing taxes to be more fair and bring in public revenue from those who can afford to pay is a must.

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families

July 19, 2024

What do Washingtonians really think about taxes?

Most people understand that the rich need to pay their share