In 2024, Washington’s tax code remains what it has been for years: one of the least fair in the nation, with only Florida behind us in the infamous “worst tax code” rankings. The lowest 20% of Washingtonians in terms of household income pay 13.8% of their income in state and local tax while the wealthiest 1% pay less than 4.1%. Meanwhile, Washington’s tax code is riddled with big tax breaks for big companies. In aggregate, these tax breaks amount to hundreds of millions of dollars of lost revenue for the state each year.

This fundamental unfairness has ruinous consequences for family budgets, as working-class Washingtonians try to make ends meet while navigating a high tax bill alongside rising prices. But it also means that Washington – over-reliant on sales and property taxes to make budgets work – is significantly underinvesting in the kinds of public programs that create durable prosperity and opportunity. We’re stuck shaking the couch cushions (every year) for spare change.

One such investment – one we’re not making at present, in favor of a few extra dollars every year for the rich – is cost-free community college. Providing tuition and fee-free community college with wrap-around services to every Washingtonian who wants it would cost the state something on the order of a few hundred million dollars a year, and create tens of thousands of pathways to solid, middle-class jobs. Cost-free college would be transformational for first generation students, students with children or families to support, and for those students who have been historically furthest from opportunity.

And we could pay for it by closing one small loophole in our tax code. Read on:

A quick review of higher education funding

Washington has forty public, postsecondary institutions of higher education: 34 community and technical colleges and six four-year public universities. These institutions are funded by a variety of different revenue streams, including tuition, state appropriations, federal grants, private gifts, and funds received from operating “auxiliary enterprises,” such as dining halls and housing.

Historically, public colleges and universities were largely funded by the state. But since the early 1980s, the state’s funding of degrees has plummeted, while the amount that students pay in the form of tuition and fees has dramatically increased. For example, in 1988, University of Washington students paid 18 percent and the state paid 82 percent of the total cost of a degree. In 2019, students are paying 64 percent and the state just 36 percent. This is regressive taxation by another name.

The Washington College Grant

Lawmakers made great strides toward supporting working class college students by creating the Washington College Grant in 2019. The College Grant is available to anyone in Washington who qualifies based on income to cover tuition at both private and public institutions and both full-time and part-time students. Because this is a grant program and not a loan, students never have to pay the money back or get a certain type of job after graduating to keep eligibility.

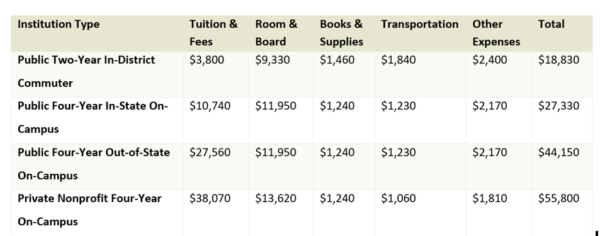

While the College Grant was a significant win for students and equity, the grant has a steep benefits cliff, so students in families with incomes just below or at the state median household income ($120,500 for a family of four) get only 10% of their tuition covered. Meanwhile, the total cost of attending college (including tuition, fees, housing, food, transportation, and incidentals) has increased dramatically. Data from the College Board shows that while public institutions have more affordable tuition and fees, housing and food are equally expensive across institution types:

Clearly, more support for Washington’s students is needed. The good news is that we can make that happen with only a small change to our tax code.

Tax break for big tech is a big loss for students

The current college grant program is funded by Business & Occupation tax surcharges on the types of companies that most need college-trained workers. That original bill had a tiered structure such that the biggest technology companies paid a higher rate … with one important catch: the very biggest technology companies were capped in the total amount of taxes they paid. The legislature has since changed this structure slightly, but a cap on taxes paid by the biggest technology companies remains in the law.

Specifically, taxes toward the College Grant fund are capped at $9 million per year for “advanced computing businesses” that have greater than $25 billion in worldwide revenue per year. According to estimates provides by the Department of Revenue, the estimated loss in public revenue to the state has ranged from around $91-155 million per year since the change in structure was fully implemented in 2021.

Corporate tax breaks are a big deal. These are real dollars lawmakers could spend to make lives better. For giant tech companies, in which profits run into the billions of dollars per year, these tax breaks are budget dust. Nice to have, but not a “make or break” scenario.

But it is make or break for Washington’s college students. Estimates for providing for cost-free community and technical college have ranged between $100 to $150 million a year. In other words, closing this loophole on big tech would essentially pay for tuition and fee-free community college at every single community college in the state.

What would that mean to real people? A single parent trying to save for their kids’ futures could increase their skills and hiring power and get that higher paying job they’ve been dreaming about. A student fresh out of high school, not sure if college is right for them, could try some classes out at the local college without the financial risks of taking on a loan or moving to a new place. Free college would be transformative and it is relatively low cost to achieve, especially when put in the context of a totally unnecessary tax break for companies like Microsoft and Amazon.

Lawmakers can easily close this big tech loophole next legislative session and greatly expand supports for Washingtonians seeking higher education.

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax loopholes for big tech are costing Washington families

Subsidies for big corporations in our tax code come at a cost for college students and their families

August 16, 2022

2022 Inflation Reduction Act: A Strong Step Toward Rebuilding our Economy but Families Need More

We applaud the swift passage of this historic legislation and will continue to advocate for investments in the care economy