Washington’s tax system is the most unfair in the nation. While regular people pay taxes on purchases and properties, millionaires and billionaires are shielded from paying their share. Not only is this unfair, it’s not functional. It’s not efficient. And it’s not good enough.

From high housing costs to dangerous, cracked sidewalks, to the crimes of opportunity that stem from systemic inequalities, we feel the impacts of this woeful system every day. By failing to proportionately tax the ultra-rich, we are costing ourselves the kind of safe, vibrant, affordable neighborhoods we deserve.

It doesn’t have to be this way

There are ample examples of nations that are benefiting from a tax structure that actually works. My sister, for example, lives in Germany, a country with a much better functioning social safety net than ours. I can make direct comparisons to my friends’ experiences looking for childcare and trying to afford healthcare in Washington state. And I can see one system that clearly works better.

My sister in Berlin has access to affordable (a couple hundred of dollars a month per child) and high-quality childcare that is easily accessible from her home without the use of a car. She also receives a monthly check for each child from the German government, without having to fill out forms to means test the benefit. This amount is meant to supplement her income and almost entirely pays for her monthly childcare costs.

By contrast, it is not unusual to pay thousands of dollars per month for childcare in the Seattle metro area and have to drive 30 minutes or more to get to the childcare location. The providers there are likely underpaid and themselves struggling to make ends meet.

My sister also has access to top quality medications to manage a health condition that costs her less than $10/month in Germany. Meanwhile, my Seattle friends ignore bodily ailments because they’re already in medical debt and can’t afford to see a doctor. That same drug would cost thousands of dollars in the US – if the pharmacy can even fill it.

Germany isn’t more wealthy than the United States – they just have a different tax system

These stories may be anecdotal, but they’re backed up by the realities of our tax system. In Berlin, my sister’s family pays more in taxes than my friends here in Washington, largely due to higher income tax rates. But her family feels the positive returns every day. They experience less financial stress and worry. They don’t have the hassle of the U.S. system, which makes even accessing means-tested benefits a challenge. People looking for social services in the United States can expect to spend hours on the phone and collect piles of paperwork to prove their need. That’s not the case in Germany where these benefits are freely available.

When critics counter that European systems cost more, it brings up an important question. What do we mean by “cost”? Perhaps we should consider healthcare premiums and other fees (time-wasting bureaucracy is its own kind of fee) from private entities as ineffective, non-democratic taxes?

If we factored these in, we are paying much more for worse outcomes than our European counterparts. In order to correct this imbalance, though, Washington’s legislature would need to find more funding.

We don’t even need to raise taxes on regular people and their families to get these benefits

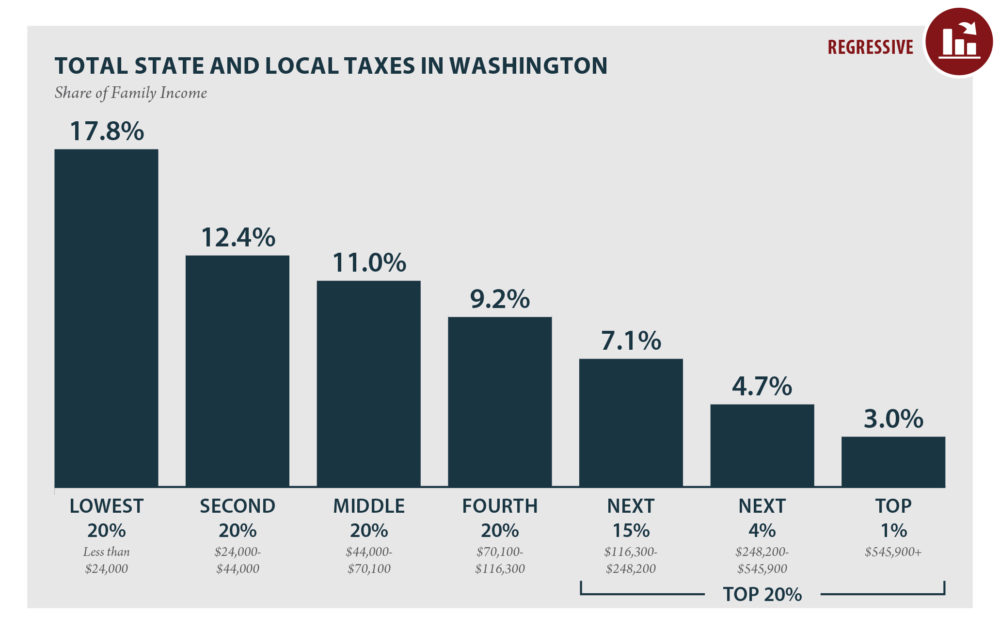

Those with the least spend the most in state and local taxes. If we look at percent household income spent on state and local taxes in WA, we see that the top 1% (making in excess of $545k a year) spend around 3.3%. The middle 20% ($44 -$70k a year) spends around 11%. And the bottom 20% of yearly income earners (making less than $24k in a year) spend the most, 16.6%. This estimate of who pays factors in the impacts of the Working Families Tax Credit and the Capital Gains tax.

The reason for this regressivity (versus progressivity, in which those with more resources would pay more in relation to their resources) is the state’s lack of an income tax and reliance on sales and property taxes to fund the public good.

Via ITEP

The resulting system encourages austerity. When lawmakers need to pay for things, the main levers at their disposal are regressive ones. Taxing poor and working people more to pay for a patchwork of means-tested benefits for some of those same overtaxed people is an illogical system.

At the same time, the rich get richer. They are able to keep more of the wealth they earn through untaxed methods of accumulation. Can we be surprised, then, that the racial wealth gap remains almost impossible to overcome? When, in this highly financialized system, most of the wealth being generated is in corporate equity traded on Wall Street, largely by white folks? The top 400 wealthiest people in the U.S. are overwhelmingly white. Black and other families of color, meanwhile, hold disproportionately less of that wealth than white families – which means they’re paying a greater share in taxes.

We can fix Washington’s tax structure – but not without a paradigm shift

We must decide that a functioning social safety net, funded through progressive taxes, will benefit Washingtonians. We must vocalize our support. And we must make it clear that this current, broken system is not good enough.

That shift is coming. The capital gains tax, passed in 2021, is a step in that direction.

The tax on the sale of assets like stocks and bonds has only directly impacted 0.2% wealthiest Washingtonians (~8000 taxpayers). Even still, it is projected to raise $849 million in the first year. This will send hundreds of millions more than expected to early learning and public schools across the state.

The success of the capital gains tax underscores several important facts. First, it points to how much wealth is tied up in financial assets. Second, it underscores the idea that taxing these assets could be a huge boon to our state. And third, it demonstrates that the state has the ability and the mandate to make this kind of enormous change.

If we taxed wealth in financial assets, we could raise billions of dollars a year

That is just what some lawmakers want to do. That’s why, last year, they filed bills that would create the state wealth tax.

Policy presented in the last legislative session would tax the financial property of multi-millionaires and billionaires at a 1% rate. This is expected to raise $3 billion a year. The proposal included a $250 million exemption level, meaning the first quarter billion in assets is exempt from the tax and the first dollar in value above this level is taxed at 1%. As a result, only around 700 taxpayers would be wealthy enough to qualify.

This tax is pragmatic and progressive and, perhaps not surprisingly, very popular. Two statewide polls in late 2022 and early 2023 showed that a full 2/3rds of Washingtonians support this tax – including nearly 50% of self-identified Republicans. And why wouldn’t it be?

Residents in other countries enjoy accessible, affordable childcare – and are horrified by the high cost of care in the United States. They can access social services when they need them, have access to ample public transportation, and know that their children’s schools are well funded.

Meanwhile, we in the United States continue to suffer under an outdated, unfair system. We require our most marginalized people to struggle for even the bare minimum. We are confronted with the reality of poverty every day. We experience these impacts in so many ways – these little fees that add up.

But more and more of us are starting to realize that we don’t need to live this way.

There are examples of other places that already do exactly what we’re proposing – and it works. If we want to build a functional, fair state, it’s time to look elsewhere for inspiration and try something new.

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families

July 19, 2024

What do Washingtonians really think about taxes?

Most people understand that the rich need to pay their share