By many measures, Washington is an affluent state. As a long-time home to drivers of industry and technology, Washington draws and creates wealthy individuals. A recent study by the Institute on Taxation and Economic Policy describes the geography of extreme wealth in the United States and notes that Washington is one of a handful of states with a high concentration of multi-millionaires (defined as those with wealth in excess of $30 million). While the rapid growth of technology companies over the last two decades is the most significant factor in the concentration of wealthy individuals in Washington, to get an accurate picture of affluence in our state, we must also explore how wealth is distributed across the region.

Understanding Wealth and Income

To understand what it means to be affluent in Washington, we must first distinguish income from wealth. Income arises from an exchange or an activity, such as selling something or working for an employer. Wealth, on the other hand, is property or something you hold. Property can be tangible assets like real estate or intangible assets like stocks, bonds, and other financial assets. Meaning someone can be very wealthy yet still have a relatively low income. Data from the 2019 Survey of Consumer Finances shows that over half of the top 1% of wealthiest households have incomes that put them outside of the top 1% of income groups. Said another way, more than half of the wealthiest households don’t have correspondingly high incomes.

Extreme examples of high-net-worth individuals with low incomes abound. Infamously, in 2011 Jeff Bezos, worth $18 billion at the time, claimed a child tax credit intended for families earning less than $100,000 a year. A series of articles from ProPublica explores how the ultra-wealthy use various tax tricks to simultaneously maintain extreme levels of wealth and low incomes.

Delving into the seeming contradiction between high-wealth and low-income individuals reveals how the tax code favors wealth over income and the property of the very wealthy over that of middle-income Americans. Specifically, the wealthy tend to hold their wealth in financial assets such as stocks and bonds. The market value accrued on financial assets is called “capital gains.” If the assets remain unsold, those are called “unrealized capital gains”; if sold, the gains are “realized.” Currently, there are no state or federal taxes on the unrealized gains of financial property. Moreover, financial assets are not taxed unless sold or the property holder dies. Even then, these taxes are limited and feature easily exploitable loopholes.

In contrast, middle-income Americans derive their wealth primarily from the equity in their homes. In Washington, the market value of a family’s home is taxed annually through local and state property taxes whether or not the property is sold. In other words, Washington’s tax code annually taxes the wealth of regular, working-class Washingtonians but not that of the extremely wealthy.

A Wealth Tax is the Missing Link to Washington’s Tax Code

Taxing extreme wealth held in unrealized gains is a missing link in Washington’s tax code, which is the most regressive in the country. In Washington, low-income people pay a much higher percentage of their income to taxes than the wealthy due to our state’s reliance on the sales tax for revenue. In addition to our tax code being inequitable, it also sets us up for an ongoing deficit of public spending relative to the growth and needs of our state. A state wealth tax would introduce greater fairness in the tax code and raise public revenue from those with the greatest capacity to pay. Working as an annual 1% property tax on the market value of financial intangible property like stocks and mutual funds, the tax would include a high exemption threshold to exempt 99.8% of Washingtonians from the tax.

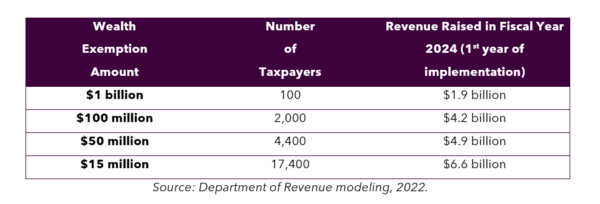

A state wealth tax can collect significant revenue from the wealthiest in Washington. At a $1 billion exemption threshold, wherein the first $1 billion in wealth held in financial assets is exempt, nearly $2 billion in revenue would be collected annually from approximately 100 taxpayers. If the exemption threshold were set to $15 million, the tax would raise $6.6 billion a year from several thousand taxpayers. It should be noted that “wealth” in this context only refers to that held in financial intangible property. It does not include wealth from other sources such as real estate, intellectual property, and personal property such as fine art and jewels.

Where is Wealth in Washington?

Extreme wealth is concentrated on the west side of the state along the I-5 corridor. King County is home to 9,680 tax units (individuals or households filing taxes) worth $15 million or more. This corresponds to 56% of the wealth-tax payers. When broken down by legislative district (LD), the top six LDs are all within King County, followed by LD 40. At the $50 million threshold, 58% of the total wealth tax payers are residents of King County. As a point of comparison, the recently passed tax on realized capital gains impacts just over 8,000 taxpayers in Washington, with a majority also living in King County.

This data shows that Washington is home to incredibly wealthy individuals concentrated near the state’s major cities. Yet, even in these urban centers, the percentage of residents who would pay the wealth tax is minuscule. At the $50 million threshold, wealth tax paying households make up just 0.3% of all households in King County. For all other counties, the percentage of households paying the wealth tax at the $50 million threshold would be 0.18% or lower.

In contrast to the concentration of wealth near Washington’s metropolitan centers, poverty is common in every county on both the east and west sides of the state. In fact, all Washington counties have a poverty rate at or above 18.4%, with a median poverty rate by county of 31%. Here poverty is defined as 200% of the Federal Poverty Rate, which is $46,060 of income a year for a family of three. For reference, a “self-sufficiency” wage for a family of three (what it costs to provide basic shelter, food, and care for one parent and two children) is $49,040 a year in Yakima County and $82,045 a year in King County.

Our state and country face severe economic, health, and climate challenges, with wealth inequality at staggering highs across the nation. Here in Washington, one out of four lives at or below an annual $46,060 income for a family of three, while thousands in our state have more wealth than they could spend in a lifetime. Now more than ever, we need significant investments in public services to support working people in our state. We can fully fund and expand the social programs that make a difference for everyday people by asking those with extreme wealth to pay what they owe through a state wealth tax. When everyone pays their fair share, we can foster thriving communities and build a Washington that serves all our communities.

More To Read

May 2, 2024

Baby Bonds: A Step Toward Racial and Economic Equity

The Washington Future Fund would bring this innovative, anti-racist policy to the Evergreen State

May 1, 2024

Laws Targeting LGBTQ Youth Aren’t Just Bad for Kids – They’re Bad For The Economy

The harm done by anti-LGBTQ laws expands so much further than queer children and teens

March 20, 2024

I-2111: The Income Tax Ban Is A Spectacle, but One We Can’t Ignore

A way to waste time, energy, and money, I-2111 is costing more than just taxes

Linda Greene

I have read that the WA State Constitution forbids income tax. If this is true, what article and section of the constitution states that fact?

Oct 29 2022 at 5:50 PM

Paul Taylor

Read the article above re: wealth distribution. I’m not one of those with wealth above $15M. Wouldn’t that be nice!

Just one comment though. I’m not a big fan of Jeff Bezos, but how is claiming an IRS published, Congress approved, tax credit, a “tax trick”?

These are tax rules approved by Congress. You also say that the child tax credit was “intended for families earning less than $100,000 per year”. That isn’t even true. It would be very simple in the tax code to disallow that credit for earners greater than $100K, if that was, in fact, the intention. Shouldn’t we be campaigning to change these codes if we believe them to be tax loopholes? Just implying these ultra-rich people are cheating on their taxes is disingenuous and gives fodder for the other side, because it is so obviously ridiculous, and appears to be an effort to mislead your less-informed constituents.

Thanks! Loved the map!

Jan 12 2024 at 10:16 AM