Lopsided income growth in Washington via EPI

When we talk about “getting us out of the recession”, who are we really talking about? A recent report by the Economic Policy Institute reveals that the top 1% has captured the lion’s share of economic growth since 1979, even shrugging off the Great Recession with a 13.1% income gain.

But with gains concentrated at the top rung of the economy, the majority of American families and the Middle Class are being left behind.

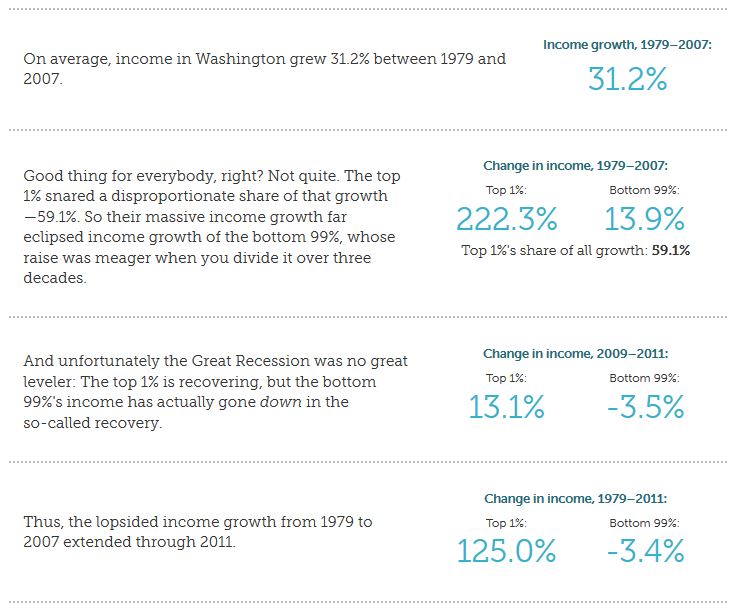

In Washington, income growth for 99% of income earners has decreased by 3.4% since 1979. From 2009-2011, the bottom 99% in Washington lost 3.5% of total income.

For the top 1%, it’s a different story. Top income earners in Washington state saw a 13.1% increase of income during the economic downturn. Since 1979, Washington’s top 1% have seen a 125% growth in income.

Overall, the top 1% have snagged a whopping 59.1% of all income growth in Washington state since 1979.

The sharp disparity in growth between top earners and the middle-class has led to stagnated wages, rising costs of living, declining workplace benefits, high debt burdens for education and rampant retirement insecurity. In a nutshell: the Middle Class is disappearing while corporate coffers flourish.

Washington needs innovative ways to fight economic inequality and restore a prosperous Middle Class. We can’t afford to wait on the ‘other Washington’ to take action and fight for working families. A strong minimum wage, family and medical leave insurance for all, affordable higher education and universal retirement savings accounts are simple, proven policies that will support working families through the predictable booms and busts of life.

It’s also time to have a serious conversation about revenue. There’s no reason to give big tax breaks to billion-dollar oil companies at a time when schools are struggling and our roads and bridges are falling apart. Together, we can can make our state a more vibrant, prosperous place for every family – not just the ones fortunate enough to have millions.

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families