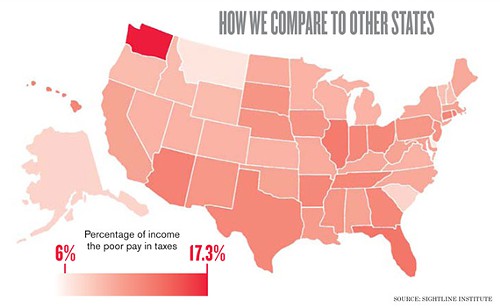

Washington’s tax system is by far the least fair in the nation: low-income workers pay much higher tax rates than the wealthy few. It doesn’t have to be this way. In two weeks, Washington’s legislators can chart a new course when they release their budget proposals and revenue options for 2015 – 2017.

Washington’s tax system is by far the least fair in the nation: low-income workers pay much higher tax rates than the wealthy few. It doesn’t have to be this way. In two weeks, Washington’s legislators can chart a new course when they release their budget proposals and revenue options for 2015 – 2017.

EOI is proud to be a member of Washington United for Fair Revenue, a statewide grassroots campaign fighting to replace our state’s unfair and unreliable revenue system with a fair, accountable and shared tax system producing stable and sufficient revenues.

Please sign this petition – and get 10 of your friends to do the same – so we can send a clear message to Governor Inslee and our elected representatives in support of fair, accountable and shared revenue sources, so everyone may share in Washington’s growing prosperity :

Loading…

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families