On the list of things that cross the minds of most young people, Social Security usually ranks near the bottom – somewhere below flossing your teeth but above Justin Bieber’s latest single. It’s understandable. Social Security is usually viewed as a benefit for seniors. But that couldn’t be farther from the truth.

On the list of things that cross the minds of most young people, Social Security usually ranks near the bottom – somewhere below flossing your teeth but above Justin Bieber’s latest single. It’s understandable. Social Security is usually viewed as a benefit for seniors. But that couldn’t be farther from the truth.

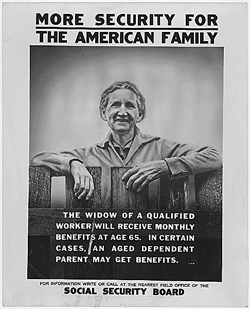

Social Security covers nearly every American worker and their families – regardless of age – in case of the injury or death of a breadwinner. Nearly 3.5 million children receive Social Security benefits, helping to keep families that have experienced a tragedy out of poverty.

Here are four reasons why Social Security matters to every generation – especially young people:

1) Economic independence for all

In addition to keeping workers and the families out of poverty, Social Security provides economic independence for seniors. That means a dignified retirement for our parents and grandparents, and also good news for us now. Think about it: our generation is already hobbled by student debt, affecting everything from our prospects of owning a home to finding true love. Social Security takes some of the pressure off by ensuring our parents’ financial security and allowing us to pursue careers and start families with peace of mind.

2) Safeguarding your retirement from the stock market since 1935

It’s called Social “Security” for a reason. Steady contributions and secure investments provide insulation from market fluctuations and a stable source of retirement income – no small thing, as the Economic Policy Institute noted in their recent report, A Young Person’s Guide to Social Security:

On the day you begin your first job, someone who began work 45 years earlier, in 1967, will retire. In his or her 45 years, this worker witnessed seven recessions… he or she lived through inflation, stagflation, oil shocks, oil rationing, the stock market crash of 1987, the savings and loan collapse, the bursting of the dotcom bubble, the bursting of the housing bubble, the stock market crash of 2008, and the bailout of AIG, the financial industry, and the auto industry; he saw unemployment climb above 10% twice; and all this over a time period with slowing wage growth for the bottom 50% and the decline of traditional pensions…This worker faced risks beyond his control and so will you.

The latest recession made the importance of Social Security even more clear: as 401Ks suffered a staggering 51% reduction in value, Social Security didn’t miss a beat – continuing to pay on time and in full as it has done for seven decades. What’s more, benefits are indexed to inflation so the real value of your contributions won’t erode over time, and surpluses in the system are invested in U.S. securities backed by the full faith and credit of the U.S. government, the safest investment around.

3) America’s poverty-fighting superhero

Think fast – what’s America’s most effective anti-poverty program? The Supplemental Nutrition Assistance Program (formerly food stamps)? The Earned Income Tax Credit? Unemployment insurance? Keep going – the effects of all these together don’t add up to the amount of people kept out of poverty by Social Security. Our Social Security system keeps an estimated 20 million Americans above the poverty line, and has helped cut the rate of poverty among the elderly in half since its inception.

4) Social Security is strong, but a few small tweaks could make it even better

Don’t let the alarmists fool you. Social Security is strong and sound. Even without congressional action, it is forecasted to pay 100% of benefits through 2033, after which benefits would still be funded at 77%.

But with one small tweak, we can set the ship straight. If Social Security taxed all earnings equally instead of giving a pass to those earning over $110,100 – known as “scrapping the cap” – the shortfall would be eliminated, and benefits could even be improved.

This isn’t the time to take an axe to our Social Security system, it’s the time to pursue a sensible, fair pathway to reaffirm our commitment to American economic security. It’s a plan that makes sense, no matter your age.

By EOI Intern Ashwin Warrior

More To Read

July 19, 2024

What do Washingtonians really think about taxes?

Most people understand that the rich need to pay their share

July 18, 2024

Protect Washington’s Kids by Protecting the Capital Gains Tax

Vote NO on I-2109 to keep funding for public education and childcare

July 15, 2024

It’s too expensive to get sick – it’s time to protect Washington patients

The extraordinary cost of medical debt.