On August 24, 2022, the Biden Administration announced they will be canceling student loan debt for millions of borrowers across the country. Up to $10,000 (i.e., whatever the remaining balance is up to $10,000) will be forgiven for those student loan borrowers with loans held by the Department of Education and up to $20,000 for Pell Grant recipients. Loan forgiveness is limited to those borrowers with a yearly income below $125,000. This announcement is a major part of President Biden’s three-part plan to support student loan holders and higher education students. Most student loans, corresponding to roughly 37 million borrowers, are held by the federal government in the Department of Education. In general, private student loans are not eligible for forgiveness. The Department recently clarified that federal loans held by other departments and agencies, such as Federal Family Education Loans, will not be eligible for loan forgiveness at this stage.

On August 24, 2022, the Biden Administration announced they will be canceling student loan debt for millions of borrowers across the country. Up to $10,000 (i.e., whatever the remaining balance is up to $10,000) will be forgiven for those student loan borrowers with loans held by the Department of Education and up to $20,000 for Pell Grant recipients. Loan forgiveness is limited to those borrowers with a yearly income below $125,000. This announcement is a major part of President Biden’s three-part plan to support student loan holders and higher education students. Most student loans, corresponding to roughly 37 million borrowers, are held by the federal government in the Department of Education. In general, private student loans are not eligible for forgiveness. The Department recently clarified that federal loans held by other departments and agencies, such as Federal Family Education Loans, will not be eligible for loan forgiveness at this stage.

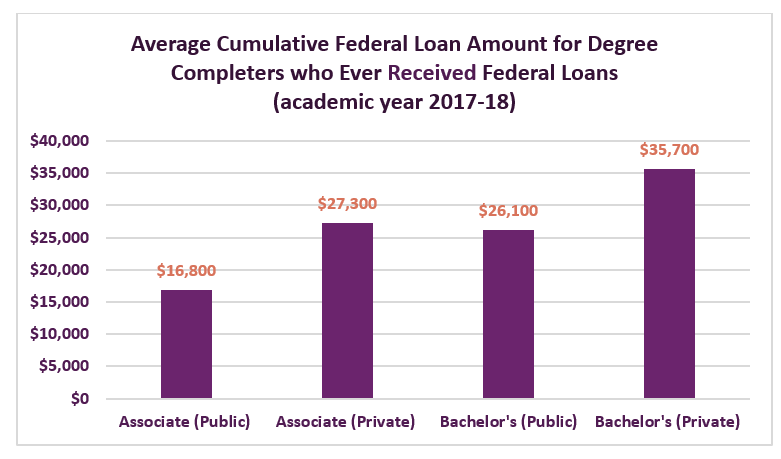

According to a Department of Education analysis, the typical undergraduate student with federal student loans now graduates with nearly $25,000 in debt. Analyses of current student loan demographics show that Black graduates are more likely to take out a loan to attend college in the first place and owe higher amounts than White students after graduation. A report on student debt and the racial wealth gap from Brandeis University states that in a 1995-1996 cohort “The typical Black student borrower took out about $3,000 more in loans than their White peers; yet 20 years after starting school, the typical Black borrower owed about $17,500 more than their White peers.” Many student loan holders are years if not decades beyond their time spent enrolled in higher education institutions. Of the $1.6 trillion in total student debt owed in 2020, borrowers 50 and older owed about 22 percent. Given these statistics, the Biden administration should have forgiven at least $25,000 to address the uneven distribution of debt and the drag this debt has on so many communities across the nation.

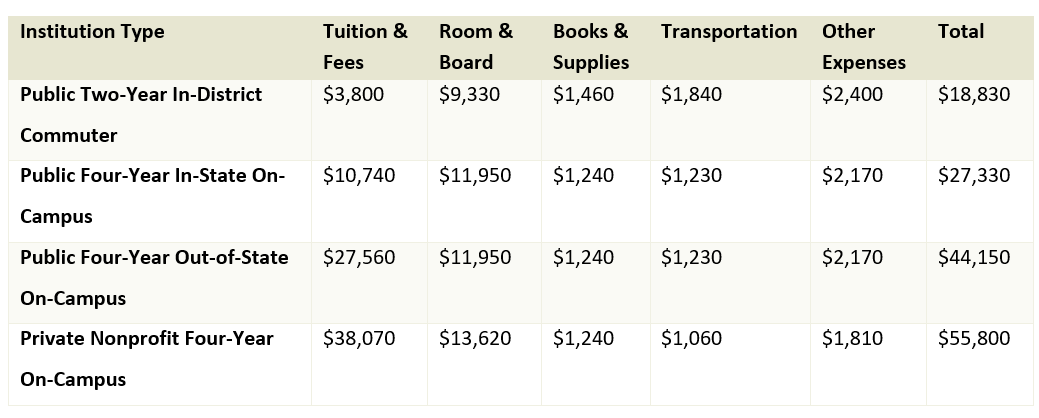

Alarmingly, nearly one-third of borrowers have debt but no degree. One major driver of this trend is that the total cost of attending college, which includes tuition, fees, housing, food, transportation, and incidental costs, has increased dramatically. Data from the College Board shows that while public institutions have more affordable tuition and fees, housing and food are equally expensive across institution types:

Adapted from College Board 2021 Trends in College Pricing Research

Student loan forgiveness as outlined by President Biden is a step in the right direction and will provide immediate psychological, and material benefits for borrowers, their families, and their local communities. Despite the positive impact student loan forgiveness will have, a federal judge heard the first set of legal challenges to the program brought by six Republican-led states and the court has temporarily blocked the program from moving forward. While the program will likely be held valid in the face of these challenges, it will face additional legal challenges, including from the private-loan industry.

Beyond these legal hurdles, more should be done from a policy standpoint to increase equity and address the unequal distribution of debt across race, gender and income group. First, President Biden should go further and cancel all student debt. Second, the system should shift to one that is both free for all who attend public institutions and supports the cost of living for students.

Washington has one of the best student aid programs in the country in the form of the Washington College Grant. However, the Washington College Grant only covers tuition and fees, leaving students to cover housing, food, and other needs. In addition, the grant has a steep benefits cliff based on the household income of the attending student (families with incomes just below or at the state median household income of $102,000 for a family of four get only 10% of their tuition covered), leaving middle class families without support for higher education costs. The Washington College Grant could be expanded to cover all public university and community college students’ tuition and fees as well as provide stipends for housing and food for students from low-income families. New Mexico recently passed legislation to make all public colleges and universities, community colleges, and tribal colleges tuition-free for all residents, regardless of income and immigration status. Eliminating tuition and fees, versus expanding grant opportunities, is a simpler approach because it doesn’t require means testing or complicated forms. Washington ranks 49th on FAFSA completion, which is the first step toward receiving the Washington College Grant.

The Biden Administration’s program for loan forgiveness is a necessary step in the right direction. Lawmakers should take advantage of this political moment to go several steps further. Providing for universal student loan forgiveness and establishing tuition-free public universities and colleges would have widespread, positive impacts on Americans’ well-being.

More To Read

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families

April 4, 2024

Is There a Valid Argument Against Cost-Free College in Washington?

Cost-free college is a meaningful investment that would change lives. What's stopping Washington from making it happen?

October 20, 2022

Biden’s Student Loan Forgiveness is A Necessary Step in the Right Direction

Student loan forgiveness will provide immediate psychological, and material benefits for borrowers and their communities.