Today, the Washington Court of Appeals released its ruling on the lawsuit against Seattle’s income tax on the affluent. The court found Seattle to be completely within its rights to implement its own income tax.

“Seattle has the statutory authority to adopt a property tax on income,” the ruling says.

The Economic Opportunity Institute helped write this income tax on the affluent and is defending it in this lawsuit alongside the City of Seattle. The cities of Olympia, Port Townsend and Port Angeles, as well as the Association of Washington Cities and other parties have also submitted amicus briefs in favor of the tax.

We at EOI are elated. On a scale of 1 to 10, where 10 is the best ruling possible, this is a 9. Having clarified Seattle’s authority to tax income, and cleared away the underlying impediments, we are ready to appeal this decision to the Washington State Supreme Court. Seattle has the most regressive tax system of any city in the country, and we will finally have the forum to start correcting that.

The Court of Appeals found Chapter 36.65’s (Revised Code of Washington’s ban on cities implementing taxes on net income to be unconstitutional and no longer valid.

The Court of Appeals could not, however, overturn the 1933 prohibition on progressive income taxes, as only the Washington State Supreme Court can do that.

“We are constrained … to follow our Supreme Court’s existing decisions that an income tax is a property tax,” Judge James Verellen wrote. “Our state constitution’s uniformity requirement bars Seattle’s graduated income tax.”

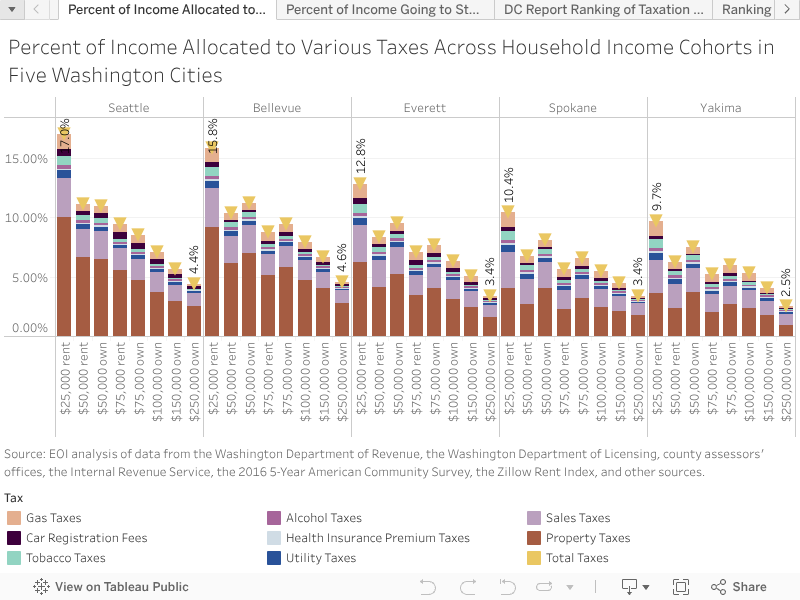

As Seattle grows and changes, it faces an increasing number of crises – a lack of affordable housing, people without shelter on our streets, families struggling to pay for child care and college, environmental challenges, and streets clogged with traffic. Yet, wealthy residents pay a tax rate five times lower than the rates working-class people pay.

As residents, we want a city where everyone can flourish with world-class schools, diverse neighborhoods, and reliable public transportation.

If we want major improvements necessary to maintain the economic and cultural diversity that give Seattle so much vibrancy, we need new progressive sources of public revenue to invest in our future.

The Court of Appeals’ decision enables us to take the next step to the Washington State Supreme Court in order to overturn the 5 to 4 decision from 1933 disabling progressive property and income taxes.

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

July 19, 2024

What do Washingtonians really think about taxes?

Most people understand that the rich need to pay their share

July 18, 2024

Protect Washington’s Kids by Protecting the Capital Gains Tax

Vote NO on I-2109 to keep funding for public education and childcare

Andrea Faste

The prospect of a state income tax would fulfill the wishes of my father, back in the 1950’s, when he was on the School Board in Edmonds. I won’t hold my breath, but it would be so nice to share the funding burden equally, allowing for solid funding for schools and so many other projects, and giving folks struggling to get by in this state a chance to deduct a state income tax from their federal income taxes, like most of the other states in the country.

Jul 27 2019 at 3:19 PM