Research and data updated December 2022

For PDF report, click here.

Executive Summary

Health care costs in the United States are out of control. As a nation, we spend double what similar countries spend – and our costs continue to rise. Higher costs don’t lead to higher quality, better health outcomes, or improved equity, but they do put families, employers, and governments under enormous strain, and make health care harder to access.

A lack of governmental regulation, as well as increasing market consolidation and a lack of transparency, drive our health care costs to exorbitant proportions. Hospitals and providers are increasingly merging under unified ownership. Consequently, they are more able than ever to exert significant leverage and set prices for services and products to maximize revenue, rather than based on operating costs to provide quality and accessible care. As fewer and fewer companies own and control a larger share of the industry, we see higher costs for patients, fewer available provider and drug options, and downward pressure on health care worker wages. Federal agencies such as the Federal Trade Commission lack the capacity, resources, and regulatory authority to effectively evaluate and curtail potential harmful effects of health system mergers and acquisitions, which are very difficult to reverse once in place.

A lack of sufficient federal and state regulation aimed at cost has led to opaque and profit-centered business models, making it difficult for patients and policymakers to understand the true costs of care. Secretive hospital price setting mechanisms, industry contract negotiations, and pharmaceutical price setting practices lead to wild price variation and higher costs for consumers without improving conditions for patients. In fact, even though the United States health care system is the most expensive in the world, studies repeatedly show that higher health care spending doesn’t translate to better quality, access, improved health outcomes, or to resolving longstanding inequities.

Half of U.S. adults reported putting off or skipping health or dental care in the first year of the pandemic due to cost, with disproportionate impact among communities of color.[1]

In a comparison of peer countries, the U.S. ranks last overall on health care outcomes, with the highest infant mortality rate and lowest life expectancy at age 60. Looking at the 10-year trend in avoidable mortality, the US reduced avoidable deaths by the least (5%) compared to other countries.[2]

Innovations at the state level show that advocates and policymakers can work together to use evidence-based strategies to put patients first and rein in corporate industry control. While fully and sustainably addressing the health care price and cost conundrum requires federal action, states can take important steps to support health care cost containment and to help enforce federal regulations.

The following policy recommendations are tailored to Washington State’s particular policy context:

- Establish targeted price regulation to allow state agencies to exert downward pressure on prices set by hospitals, public employee health coverage plans, and public option plans.

- Expand transparency and cost-growth benchmarks by strengthening state-based enforcement of federal transparency rules and adding financial penalties to assist with enforcement of the state cost-growth benchmarks created by the Health Care Cost Transparency Board.

- Strengthen antitrust enforcement and consumer protection by increasing penalties to enforce existing laws, expanding pre-merger review to limit consolidations that undermine equity and access to care or involve private equity firms, and establishing post-merger monitoring.

- Improve drug affordability by allowing states to regulate Pharmacy Benefit Managers and by creating a prescription drug affordability board to create upper payment limits on pharmaceutical products, fine manufacturers for unsupported price increases, and improve data transparency in drug price setting.

Improving oversight over mergers and acquisitions, as well as hospital and drug price transparency can assist advocates, regulators, and policymakers to curtail market dominance by industry giants and moderate price increases. Driving down health care costs and controlling prices will advance equity, improve health outcomes, and make high-quality health care more affordable and accessible for all Washingtonians.

Introduction

Washington state has made strides towards increasing health care affordability but still faces a crisis in access to care. Without increased price regulation and transparency, costs for consumers, employers, and the state will continue to spiral out of control. For a health care system that consumes nearly one out of every five dollars in the U.S. economy, we must ask ourselves, why are our costs so high – and what can we do about it?

This report explores the underlying drivers of U.S. health care costs and highlights state-based solutions to protect consumers by controlling costs and prices. A lack of targeted industry regulation as well as the rapid growth rate of market consolidation and concentration are at the core of high health care costs, worsened by a lack of transparency. While Medicare and Medicaid are able to set reimbursement rates for medical care, commercial health care prices remain unregulated, which allows providers like major hospital systems to charge as much as the market will bear.[3] Profits for pharmaceutical, hospital, and insurance companies continue to grow at an alarming rate, even during the COVID-19 pandemic. Consolidation leads to higher costs for patients, in large part because of hospital and drug companies’ unfettered ability to set prices for their services and products without regard for the impact on access, equity, or affordability.

In order to regulate prices and improve transparency, advocates and policymakers will need to consider and implement multiple and interrelated strategies. While federal policy change will be necessary, states can actively partner with federal agencies and, in many ways, act with more expediency and flexibility to limit corporate power and regulate imbalanced markets. Recommendations in this report are targeted toward state-based legislative solutions and are broken down into four sections: targeted price regulation; transparency and cost-growth benchmarks; antitrust enforcement and consumer protection; and drug affordability.

Advocates and policymakers can work together to use innovative, evidence-based strategies to transform our health care system into one that effectively curbs market dominance by industry giants and centers patient access to high-quality, affordable health care. Washington State can learn from other states’ successes to build on our progress and take advantage of current opportunities to regulate hospital and drug price setting, reverse rapidly consolidating markets, and improve overall accountability and transparency in our health care system.

U.S. health care costs are out of control

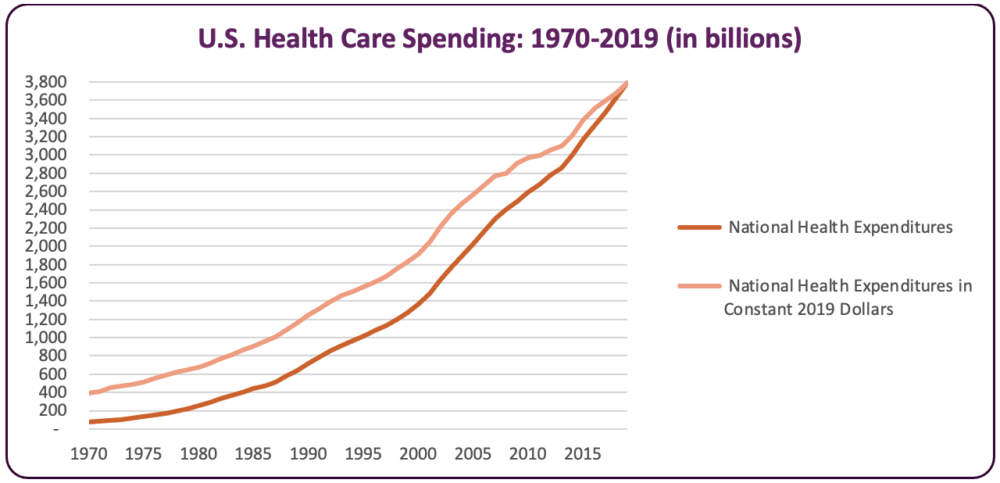

U.S. health care costs have reached exorbitant proportions. Health care expenditures now outpace total American economic growth, inflation, and worker wages.[4] As a nation, the amount of money we spend on health care each year is nearly twice that of similar countries – and our costs are rising steadily.[5] In 1970, health care spending represented less than 7% of our national gross domestic product.[6] By 2028, one out of every five dollars in the U.S. economy will be spent on health care, with a total cost of $6.2 trillion annually.[7] Adjusted for inflation, total U.S. health care spending grew by 878% in five decades, from $388 billion in 1970 to $3.8 trillion in 2019, as shown by Figure 1.[8] Debt from unpaid medical bills reached $140 billion in 2020, with nearly one in five people in the U.S. reporting some level of medical debt.[9]

Figure 1: U.S. Health Care Spending: 1970-2019 (in billions)[10]

The United States health care system is the most expensive in the world – but it doesn’t translate to better quality, improved health outcomes, or to resolving inequities. We are the only wealthy nation with an increasing mortality rate, even pre-COVID.[11] We have the lowest life expectancy rate among peer nations, with glaring disparities for Black, Latino, and Native populations due to the legacy of structural racism and colonization. Black and Latino Americans experienced a particularly severe drop in life expectancy during the first year of the pandemic, with a three-year average decrease, compared to an approximately one-year decrease for White Americans. American Indian and Alaska Native people have a life expectancy that is 5.5 years less than all other racial groups.[12]

The U.S. also has the highest rate of avoidable deaths and more “deaths of despair”, such as death by suicide, substance abuse, and untreated mental health conditions – with higher rates for Black, Native, and low-income populations. We also have fewer physician visits and fewer nurses, physicians, and hospital beds per capita than many peer nations. [13]

The high cost of health care is not born by all stakeholders equally. High costs place a particularly severe strain on individuals and families. People in the U.S. consistently rank the cost of health care as a top concern.[14] One out of every six U.S. workers reports staying in a job they didn’t want for fear of losing their health insurance and half of adults report that they or a family member have delayed or foregone needed medical care due to the high cost.[15] When medical care is out of reach, patients forego needed care or sacrifice their financial security—but skipping needed medical care results in a lower quality of life, poor health outcomes, and premature and avoidable deaths.

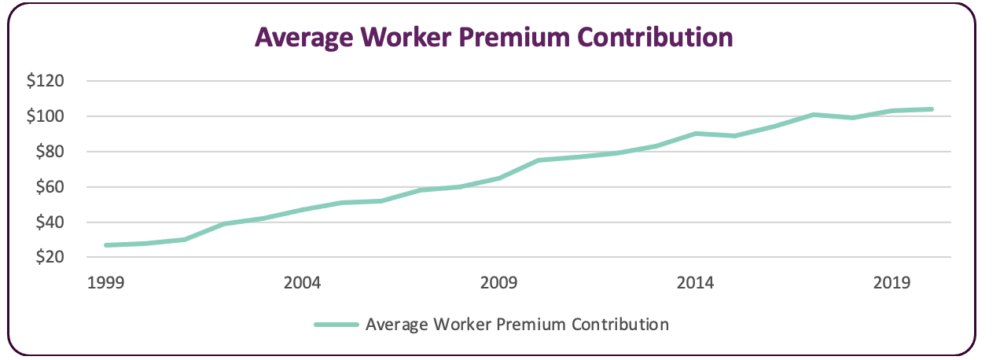

Even for people with insurance, costs remain a barrier. One-third of U.S. residents with insurance report difficulty affording care.[16] For example, as shown in Figure 2, for workers with employment-based coverage, the average monthly worker premium contribution for single adult coverage has increased by 285% in current dollars in the past two decades, reaching a total annual contribution of more than $1,200 per year by 2020.[17] In addition to premiums, out-of-pocket costs for deductibles, co-insurance, and other expenses have increased and create an obstacle to accessing care. Average deductibles in employer plans more than doubled between 2008 and 2017. Costs for combined premiums and deductible spending for people with employment-based insurance rose to an average of $7,240 in 2017, representing nearly 12% of median income that year. A decade earlier, the average cost represented less than 8% of median income.[18] Costs are even higher for people who are uninsured, have chronic medical conditions, or are low-income.[19]

Figure 2: Average worker monthly premium contribution in current dollars[20]

Drug affordability, in particular, is a pressing concern for patients. Americans spend more than $1,500 per year on average for medicines alone, far more than peer nations.[21] Some drugs, such as insulin, have increased in price by as much as 70% in just five years.[22] A Kaiser Family Foundation survey taken in 2021 found that nearly a third of people reported not taking medication prescribed by their doctor due to the high cost.[23]

Rising health care costs impact more than just consumers. The high cost of providing health care for employees stymies entrepreneurship and puts downward pressure on wages; the more employers spend on benefits, the less they are able or willing to spend on wages. Four out of five business executives and key decision-makers at large companies surveyed by the Kaiser Family Foundation in 2021 reported that they expect providing employee health insurance to become unsustainable sometime in the next 5 to 10 years due to the rising price tag.[24] The average employer contribution to monthly premiums has increased by 232% for single coverage and 271% for family coverage over the past two decades.[25] As a result, nearly 9 out of 10 business leaders recently surveyed reported they are considering shifting costs to employees by taking steps like selecting plans with much higher deductibles.[26]

While large companies and nonprofits often have significant reserves and endowments to support increasing costs, small and family-owned businesses, as well as small nonprofits, often lack the resources. One in three small business owners providing health coverage have considered dropping it, largely due to the high costs.[27]

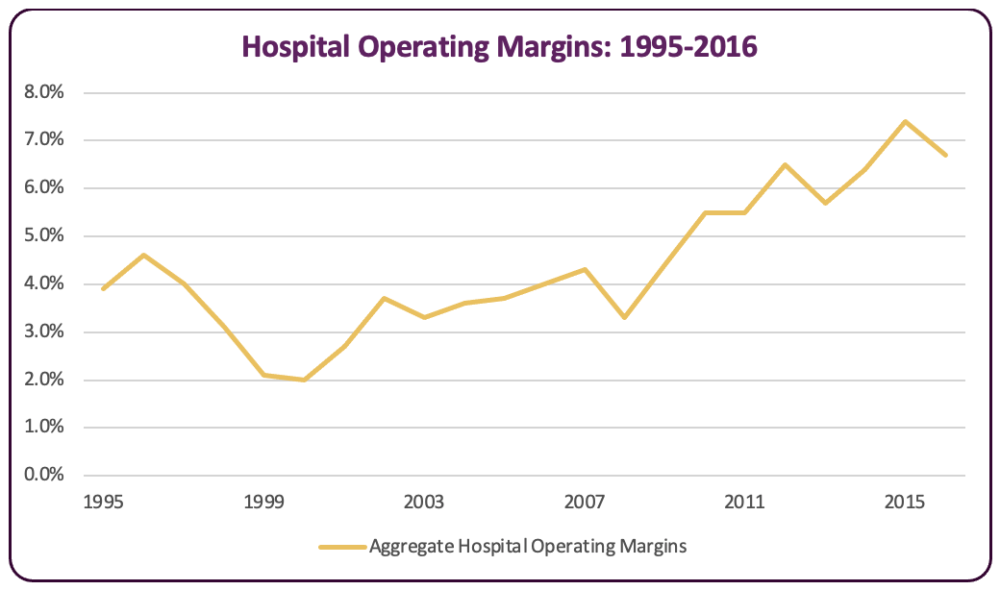

As costs rise, public investments in health care also have to stretch further to cover fewer services for consumers, leaving less funding available for other important public investments such as infrastructure, affordable housing, child care, and addressing climate change – many of which may contribute more to overall population health than medical care. More and more of our private and public dollars are being funneled to pharmaceutical, insurance, and hospital companies – all of which continue to see record profits and growing reserves. For example, profit margins for large pharmaceutical corporations have grown significantly, seeing 15-20% profit between 2006 and 2015, compared to an average 7% profit margin in similarly sized non-pharmaceutical companies during the same period.[28] Insurance carriers continue to maintain strong profits and reserves, even during the COVID-19 pandemic, with individual and fully-insured group market plans seeing up to 16% higher gross margins in 2020 than in the prior year.[29] Large hospital systems also continue to see record-breaking profits, year after year. In 2016, U.S. hospitals brought in their highest profits ever.

Even during the global COVID-19 pandemic, large hospital systems are continuing to break records. Providence Health System received more than $500 million in federal pandemic assistance in 2020, adding to its existing reserves of nearly $12 billion. This hospital chain also collects around $1 billion per year from its hedge fund investments while paying zero in federal taxes due to its nonprofit status.[30] In the same year, struggling rural hospitals also broke records – with an unprecedented number of the most closures in one year.[31]

Figure 3 Aggregate Hospital Operating Margins (1995-2016)[29]

Many factors contribute to our country’s high health care costs.

Researchers have spent decades exploring why health care costs so much more in the United States compared to our peer nations. The answer, year after year, is that prices drive costs. “Price” refers to the payment rates medical providers or companies negotiate and assign to the services they provide, such as what a hospital might set as the rate for conducting an MRI, or what a pharmaceutical company charges for a given drug.[33] While some have asserted that the number of services rendered and an over-utilization of services are what drive up overall costs, the evidence clearly shows that utilization rates in the U.S. are either similar or lower than peer nations, even as our costs dwarf those of other countries. [34]

This report delves into why prices are so high and solutions that states can take to save money for consumers, employers, and taxpayers. Digging deeper to understand why prices in the U.S. health care system continue to increase without limit enables advocates and policymakers to find and implement effective solutions.

Consolidation and lack of competition

A legacy of laissez-faire, “let the market decide” policies preventing governmental regulation has resulted in a rapidly consolidating health system. Consolidation takes place when a company acquires, merges, or affiliates with another and is strongly linked to monopolies, highly concentrated markets, and reduced competition. Consolidation can occur either horizontally, when a company acquires or merges with its competitors, or vertically, when a company acquires companies up and down the supply chain. In the rush to increase profits for investors and shareholders, consolidations have been on the rise in recent years for hospitals, insurance companies, providers, and drug manufacturers:

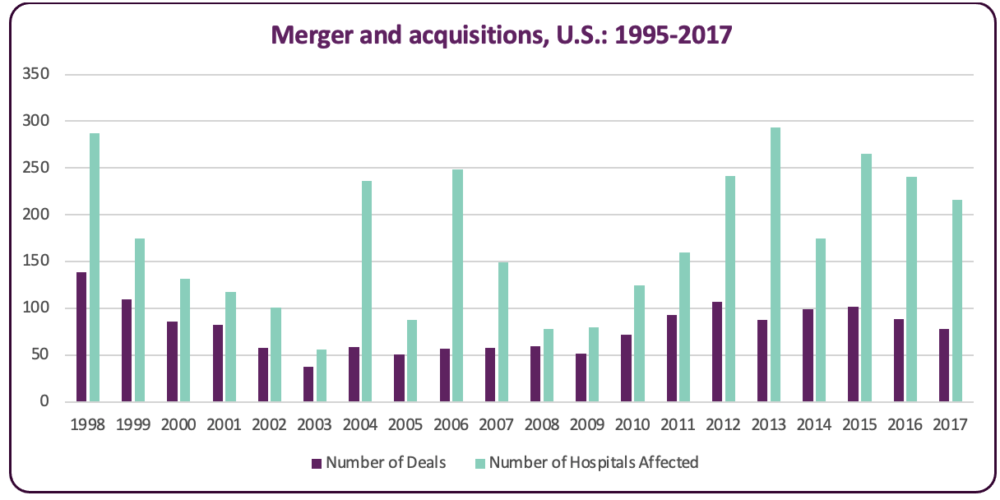

- Nearly 1,600 hospital mergers have occurred in the U.S. in the past two decades, resulting in many local areas being dominated by one large hospital system (see Figure 4).

- The two largest insurance carriers dominate more than 70% of the market in more than half of insurance markets.

- Two-thirds of specialist physician markets are highly concentrated. Many physician practices have been acquired by hospitals, so that nearly half of all primary care physicians are now employed by hospitals.

- More than half of the pharmacy market is now dominated by the top five drug companies.[35]

Figure 4 Merger and acquisition deals and number of hospitals affected (1995-2017)[36]

An extensive and increasing body of evidence leaves no question about the link between consolidation and higher costs for consumers.[37] Without effective governmental regulation, health system consolidation leads to reduced market competition, which in turn results in an over-inflated ability for large hospital and drug company conglomerates to set prices without regard for the actual cost of care or the impact on access, equity, or affordability for everyday consumers. A 2020 report from the Medicare Payment Advisory Commission (MedPAC), the federal agency that advises Congress about Medicare policy and spending, found that increasing costs for privately insured people over the past decade were overwhelmingly driven by health system consolidation.[38]

Here in Washington, the Attorney General sued CHI Franciscan in 2017 because the hospital system’s consolidation resulted in increased costs for patients, larger profit margins for the hospital, and decreased market competition.[39] A recent study from the Office of Financial Management shows how dramatically our hospital landscape has changed. In the 1980s, only 10% of our hospitals were part of larger health care systems, but now almost half of our hospitals are part of chains.[40]

The rapid increase of private equity firm buyouts over the past several decades is of particular concern, due to growing evidence that private equity influence is causing higher costs for patients and an increase in predatory billing practices. Private equity is a form of private financing where company shares are not publicly traded. In 2018 alone, private equity firms invested $100 billion into the health care sector, making 855 health care deals. Private equity firms are almost completely unregulated under state or federal law, leaving an enormous absence of accountability and transparency in the health care industry.[41] A study released by the Journal of American Medical Association in 2022 found that private equity-controlled physician practices charge an average of 20% more per claim in the months following the acquisition.[42]

A 2016 Federal Trade Commission report found that hospital monopolies were able to charge 15% more than those with more competitors.[43] Vertical consolidation, such as when a hospital acquires a physician clinic, can result in price increases up to 14%.[44] For example, Optum, a pharmacy benefit manager and care provider, is a subsidiary of UnitedHealth Group, (which also owns the major insurance conglomerate, UnitedHealth Care). In recent years, Optum purchased two major clinic systems, The Everett Clinic and the Polyclinic, resulting in increased market concentration and reduced competition for both insurance coverage and access to care.[45]

Acquisitions in highly concentrated markets can result in price increases of more than 20% in hospital systems and up to 30% in physician clinics.[46] Sharp price increases occur when hospitals acquire others, even when they are outside of their market and geographic location, because of the hospital system’s increased negotiating power relative to insurance companies. The ability of insurance plans to remain competitive by keeping hospital prices down is severely hindered by hospital market dominance.[47] At the same time, insurance company consolidations also result in increased insurance company profits. Despite what some industry leaders claim, insurance company consolidations do not necessarily lead to lower premiums, deductibles, and co-insurance for consumers. These consolidations are associated with lower rates paid to providers, however, thereby transferring more profit to insurance companies.[48]

In addition to increased prices, consolidation often results in worse health outcomes, fewer provider and drug options for patients, downward pressure on worker wages and benefits, and lower rates of innovation, quality, and equity.[49] In fact, the literature suggests very little connection between higher prices and higher quality in hospital systems or physician services.[50]

As the rate of mergers and acquisitions continues to increase, small hospitals struggle to compete against wealthy large hospital systems, leading more and more small and rural hospitals to merge to keep up. Disparities worsened during the COVID-19 pandemic. Large hospital systems received vastly disproportionate federal relief in 2020-2021 at the expense of small, rural, and community hospitals, further concentrating wealth for major hospital conglomerates. Twenty of the largest hospital chains received more than $500 billion federal COVID relief, while community and public hospitals struggled to stay open.[51] CommonSpirit Health, which owns 142 hospitals in 21 states, is one of the largest hospital networks in the country and received over $1 billion in federal aid. CommonSpirit increased its market power in Washington in early 2021 by merging with Virginia Mason Health System. Tenet HealthCare, another large hospital chain, received more than $500 million in federal aid, and recently purchased 45 ambulatory surgery centers for $1 billion.[52]

The Federal Trade Commission (FTC) and the U.S. Department of Justice (DOJ) share responsibility for tracking and enforcing federal and state antitrust laws and maintaining competitive markets. The FTC monitors provider mergers while the DOJ maintains responsibility for reviewing insurance carrier mergers. These federal agencies have played a significant role in monitoring and challenging anti-competitive mergers among providers.[53] Almost half of all FTC merger challenges in the past twenty years have been in the health care industry. However, the FTC is failing to keep up with the level of health care industry consolidations, largely due to budgetary and authority limitations:

- Federal budget allocations for FTC workload have not kept up with the significant increase in mergers and acquisitions in recent years. The FTC budget remained constant from 2010 to 2016, even while hospital mergers have increased by 50% in the past decade.

- Federal authority is hindered by limited reporting requirements. In 2021, the threshold for notification of proposed transactions was $92 million, leaving a significant number of transactions, particularly vertical consolidations, outside of the federal review process, even though these mergers can result in severely reduced market competition.[54]

- The scope of federal agency enforcement is limited, particularly when it comes to mergers and acquisitions for nonprofit hospitals. Antitrust laws prohibit enforcement against nonprofits, leaving a significant portion of the health care market unregulated. Nonprofits represented 66% of hospital and health system mergers across the United States in 2019.[55]

Nonprofits receive benefits from state and federal governments but act like for-profit entities by maximizing revenue rather than community benefit. Nonprofits are exempt from paying federal and state income tax, sales tax, and property tax, and have no limits on the size of their reserves. In return, they are required to report the benefits they provide to the community. However, requirements don’t include any quantifiable standards, and many nonprofits have been found to stockpile billions in reserve and pay their top executives millions in annual compensation. In Washington, only seven hospitals out of 91 were for-profit in 2019.[56] One example is Providence Hospital System which runs Swedish Medical System. Providence paid its top executive $10 million in compensation in 2018, runs its own venture capital firms, and held $12 billion in reserves, even during the pandemic. The hospital system also collected $1.3 billion in 2019 from its investments alone.[57]

Amid growing public pressure and support, the federal government has taken steps in recent years to address the growing problem of high costs. Most recently, President Biden released an Executive Order in July 2021 to announce his intention to advance a vigorous effort to promote competition, and combat unfair business practices, health care industry monopolization, and market concentration, including a directive to the Attorney General to review and lead possible changes for current federal horizontal and vertical merger guidelines.[58]

Lack of transparency

A lack of targeted health care industry regulation at the federal and state levels has led to opaque and profit-centered business models, making it difficult for consumers and policymakers to understand the true costs of care. Limited regulation of industry price setting results in providers establishing prices to maximize revenue generation, with little relation to the actual cost of producing health care services or products.[59]

Improving price transparency can assist advocates, regulators, and policymakers to make needed changes and curtail industry influence and control on price setting. However, consumer-facing transparency requirements alone have limited effectiveness because the process places the burden on the shoulders of patients to find the best rate, often when acute medical care is needed, instead of curbing industry players’ ability to set their own rates without oversight or guardrails.[60] Additionally, consumer-facing transparency mechanisms only include a limited list of services, and patients are often unaware of the availability of prices or unable to interpret messy data systems.[61]

The federal government has attempted to improve transparency for hospitals in recent years. The Hospital Price Transparency Rule, a recent federal ruling that came into effect in early 2021, requires hospitals to post the prices they negotiate with insurance carriers for 70 “shoppable” services such as imaging and lab services and medical and surgical procedures.[62] The ruling uncovered the vastly different amounts hospitals charge for their services. A knee replacement can cost as low as $5,800 at Kirkland’s EvergreenHealth Medical Center or up to 13 times that amount at a Washington MultiCare Hospital.[63]The wide variation in hospital prices applies, even for patients receiving the same services at the same hospital. At Prosser Memorial Hospital in Central Washington, a vaginal childbirth can cost as little as $3,900 or up to $18,000, depending on your insurance plan.

Reimbursement rates negotiated by commercial carriers far exceed Medicare rates, sometimes by as much as 300%.[64] For example, the commercial insurance rate for a colonoscopy in the United States can cost anywhere from less than $500, to more than $27,000. In comparison, the bill for a Medicare patient will be only $793.[65] Although the new ruling has withstood several legal battles brought by hospital systems, it remains ineffective due to low hospital compliance, lack of enforcement or penalties, and data systems that are difficult to find and understand.[66] The maximum penalty per year is $109,500, a drop in the bucket for multimillion-dollar hospital budgets, and federal capacity for enforcement is limited.[67]

Lack of transparency is a particularly pressing issue when it comes to drug affordability, due to the secrecy and increasing consolidation of Pharmacy Benefit Managers (PBMs), which are hired by insurance carriers to manage a plan’s drug benefits. PBMs negotiate rates with manufacturers for plans and patients but are not subject to any accountability or transparency in their negotiated rates and are not legally required to pass along any savings from manufacturer rebates. Rebates are discounts that drug companies may give a PBM to encourage use of a brand name drug. Study after study has revealed PBMs are accruing large profits, particularly from manufacturer rebates, that should be shared with plans and plan enrollees.[68] High profit margins are largely linked to the increasing consolidation of PBMs. As of 2022, just three PBMs (Caremark, Express Scripts and OptumRx), control nearly 80% of the drug market.[69]

Other cost drivers

- In addition to the factors discussed above, other drivers of the high cost of health care include the fee-for-service payment model, health system waste, and exorbitant health system CEO compensation.The health care industry has begun to move away from the traditional fee-for-service payment model in recent years. This is due to findings that when health care services are paid for on a per-unit or quantity basis without overall spending limits, rather than on a value-based or quality basis, providers may be rewarded and incentivized to order additional and sometimes unnecessary tests, drugs, and services. In contrast, value-based payment (VBP) models have come into favor, particularly due to the Affordable Care Act, because they are thought to incentivize higher quality, lower cost, and increased efficiency in care delivery, such as preventive care.[70]However, studies are now emerging that VBP payment models, such as pay-for-performance programs, are also not a long-term solution to the cost conundrum. Reports, including from the Medicare Payment Advisory Commission, show that penalizing doctors for prescribing “too much care” can actually lead to worse health outcomes for poorer, sicker patients because they require more care than the average patient, and risk adjustment mechanisms are imperfect.[71]An oft-cited cause of ballooning health care costs, health system waste can include fraud, inefficient care delivery, unnecessary services, and failures to prevent disease and death. A 2012 report from the Institute of Medicine found that the U.S. wastes $750 billion annually, accounting for approximately a quarter of U.S. health care expenditures.[72]A particularly wasteful aspect of the U.S. health care system is the excessive administrative costs, which dwarf those of peer nations. Administrative costs, which can include billing and insurance-related costs such as processing claims and payments, as well as hospital or physician administration, make up for about 8% of overall health care costs, compared to 1-3% in other nations.[73] A report published by the National Academy of Medicine in 2010 found that the U.S. spends about twice as much as necessary on billing and insurance-related costs.[74] These administrative costs do not include the high costs to businesses and individuals shopping for insurance plans and disputing denied claims. Researchers estimated in 2017 that moving to a single-payer system would save the United States about $617 billion.[75]Corporate executives in the health care industry are paid some of the highest salaries of all U.S. companies. For the 100 highest \ million in 2020.[76] During the same period, thousands of essential health care workers, including 50,000 Kaiser Permanente workers, have gone on strike across the country to ask hospitals to address understaffing, low wages, unsafe working conditions, and a lack of affordable health care benefits.[77] In Washington State, Valley Medical Center CEO Rich Roodman received $8.2 million in total pay, including $7.4 million in bonus payments in 2020 – the same year that retirement contributions were frozen for UW Medicine/Valley Medical Center workers.[78]A strong pay disparity also persists between primary care and specialty care physicians, with the average primary care physician earning $247,000 in 2017, compared to approximately $400,000 for the average specialty care physician in the same year.[79] The high price of medical school, which can be as much as $250,000 for four years of public medical school for non-residents, also contributes to pushing medical doctors to choose careers in specialty care, rather than primary care, which further exacerbates our country’s primary care physician shortage.[80]

State-based solutions to address out-of-control health care costs

Fully and sustainably addressing the health care cost conundrum requires federal action, but states can take important steps to support health care cost containment at the state level and to enforce federal regulations.

While federal action is needed to effectively curtail excessive consolidations and monopolization of the health care industry, policy change will be slow, and immediate action is needed to rein in the swiftly growing rate of consolidations occurring in the U.S. health care system. Particularly as a result of the pandemic, where small providers and hospitals are at even greater risk of being bought out in the coming one to three years, state solutions are urgently needed. States can be more nimble in addressing and preventing unfair and anti-competitive business practices. States can also partner with the federal government to assist with review and enforcement.

Long term, expanding affordable and sustainable universal coverage is the best solution to fix our overly complex, wasteful, and profit-driven health care system, but we can take steps in the near-term to control costs, and to help pave the way for long-term solutions. Washington State has demonstrated a strong and historic commitment to advancing universal health coverage, including through creating a study commission in 1990, enacting comprehensive health system reform in 1993 (later mostly repealed), and a state-mandated Universal Health Care Work Group in 2019 to examine pathways to developing, implementing, and funding a state-based universal health coverage system. Most recently, the Legislature established the first permanent Universal Health Care Commission in 2021, which is made up of consumer advocates, legislators, state agency representatives, and is responsible for creating a health care system with a unified financing system, to be implemented when the appropriate federal permissions become available.[81]

As we advance discussions around universal coverage, Washington State is also taking important steps to improve transparency and control health care costs. Below is a brief summary of key steps Washington has taken, along with recommendations for how states can increase effectiveness, collaboration, and improve equity along the way.

Multiple, overlapping solutions will be needed to effectively regulate prices and drive down costs for consumers, employers, and the state and federal government. Recommendations target four main areas:

- Establish targeted price regulation to allow state agencies to exert downward pressure on prices set by hospitals, public employee health coverage plans, and public option plans.

- Expand transparency and cost-growth benchmarks by strengthening state-based enforcement of federal transparency rules and adding financial penalties to assist with enforcement of the state cost-growth benchmarks created by the Health Care Cost Transparency Board.

- Strengthen antitrust enforcement and consumer protection by increasing penalties to enforce existing laws, expanding pre-merger review to limit consolidations that undermine equity and access to care or involve private equity firms, and establishing post-merger monitoring.

- Improve drug affordability by allowing states to regulate Pharmacy Benefit Managers and by creating a prescription drug affordability board to create upper payment limits on pharmaceutical products, fine manufacturers for unsupported price increases, and improve data transparency in drug price setting.

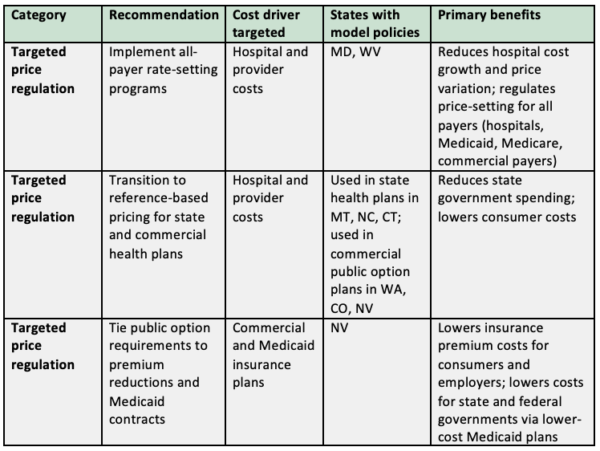

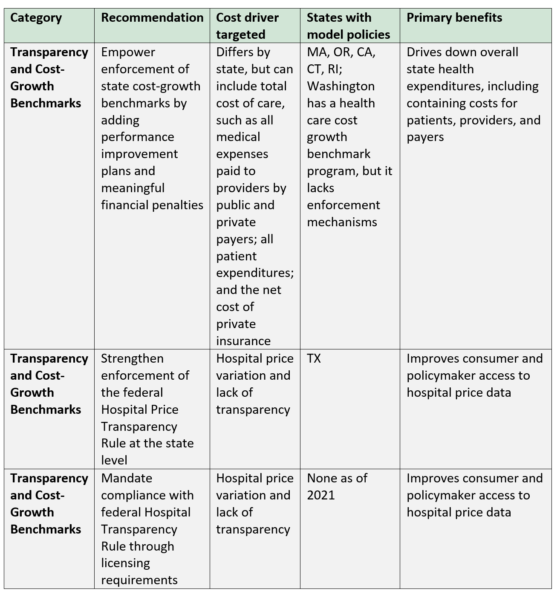

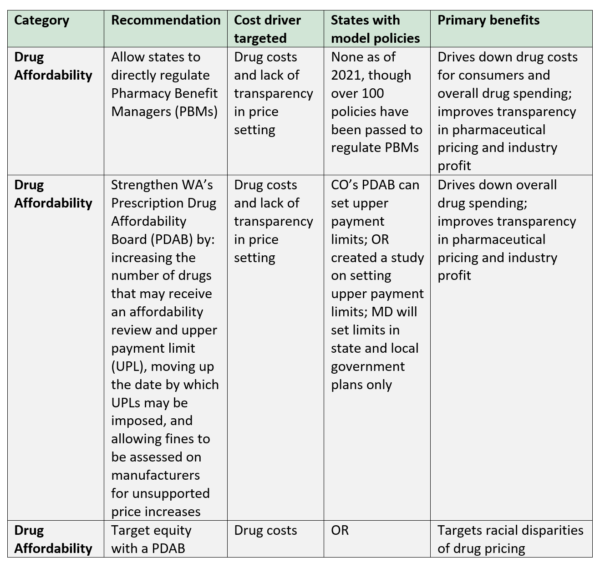

Tables 1-4 list key recommendations for each topic, outlining the cost drivers targeted by the policy, states with model policies, and the primary benefits of implementation. Recommendations are listed in order from strongest to least strong in each section.

Establish Targeted Price Regulation

Progress in Washington State

Washington State created the nation’s first public option plan through Cascade Care (SB 5526) in 2019, which is a public-private partnership, where the state contracts with private insurance companies. The public option plan, called Cascade Care Select, includes an aggregate reimbursement rate cap on providers at 160% of Medicare rates, with specific minimum reimbursement requirements for rural hospitals and primary care services. “Cascade Care 2.0,” a follow up bill that passed in 2021, added a requirement for hospitals to participate if they have contracts with Medicaid or through the Public Employees Benefit Board.[77]

Policy solutions and recommendations

The National Academy for State Health Policy’s recently released Hospital Cost Tool illuminates the difference between what a hospital needs to charge to break even, and what they actually charge. For example, in 2019, Swedish Medical Center Cherry Hill in Seattle could have covered its expenses if it charged 194% of what Medicare would have paid. But the hospital charged, on average, 295% of Medicare, signaling significant profit margins.[83] On average, employers and private insurers paid 224% of Medicare rates in to hospitals in 2020, which is, in many cases, far beyond what hospitals need to cover their costs.[84]

Unlike commercial rates, Medicare rates are set based on actual provider data that is collected and audited annually by the federal government, which lends transparency and consistency to prices. However, Medicare is prohibited from negotiating drug prices, and drug manufacturers have no price limits beyond market competition, leaving many drug prices out of control and beyond reach for consumers.[85] Congress passed the Inflation Reduction Act in the summer of 2022, which included a provision to allow Medicare to negotiate drug prices for a small but increasing number of brand-name drugs for the first time since the federal health care program’s inception.[86] Allowing Medicare to negotiate drug prices is an important step forward but does not replace state action to control costs and improve access to affordable drugs for consumers. Eight out of ten corporate executives surveyed by the Kaiser Family Foundation in 2021 believe that greater government involvement will be needed to regulate health care costs.[87] States have moved in recent years to regulate prices set by providers, drug companies and manufacturers, and insurance carriers.

Table 1. Policy recommendations: Targeted price regulation

Implement all-payer rate-setting programs: In previous decades, multiple states, including Washington, developed all-payer rate-setting systems, which effectively lowered their state’s growth in hospital expenses. As a result of industry pressure to allow providers to control prices rather than the government, these programs have fallen out of favor in recent years, and Maryland is the only remaining state with such a system.

Maryland’s Health Services Cost Review Commission sets uniform and mandatory hospital payment rates for all payers, including Medicaid, Medicare, and commercial payers. Maryland’s model has successfully decreased the growth in hospital cost per capita, reduced hospital price variation, helped finance hospitals’ uncompensated care, and has continued to be strongly supported by the state’s hospital industry. The average cost per hospital admission in Maryland dropped from being 26 percentage points higher than the national average in 1976, to two percentage points lower than the national average in 2007.

In 2014, Maryland partnered with CMS to improve its program to convert from paying for services in a fee-for-service method to using a global hospital budget, aligned with a cost-growth rate ceiling. Global budgets can provide hospitals with fixed and predictable revenues each year, which allows them to invest in care and infrastructure for all providers while prioritizing value and efficiency. Maryland’s global budget model saw savings of nearly $800 million for hospital expenditures for Medicare patients and a 6% expenditure decrease in hospital spending for patients with commercial plans. Going forward, Maryland will include all providers both in and outside of hospital settings.[88]

Transition to reference-based pricing for state and commercial health plans: Similar to what Washington, Colorado, and Nevada are doing with their public option plans, states can set or suggest price ceilings linked to a percentage of Medicare prices for services in their state plans or for all commercial plans.[89] Montana’s state employee health care program reduced prices and improved its sustainability by setting prices at a range of 220-250% of Medicare rates. Prior to implementation, Montana paid as much as 611% of Medicare rates for hospital outpatient services. Since implementing the program in 2016, the state employee health program has gone from projecting bankruptcy to collecting $48 million in savings as of 2021.[90] Evaluations of Montana’s program have revealed that all hospitals agreed to participate, no hospitals have closed, and costs have not been shifted to consumers or other payers as a result of the program.[91]

While reference pricing can encourage providers to set fair prices by giving a state purchaser more leverage when establishing provider networks, careful attention needs to be paid to patient protections in the program implementation, given the possibility of balance billing and increased patient cost sharing when costs exceed the reference price. Such protections could include only establishing reference prices for services with significant price variation.[92] In Washington State, the Health Care Authority has expressed interest in investigating reference-based pricing in their PEBB and SEBB programs for public employees by 2025.[93]

Tie public option requirements to premium reductions and Medicaid contracts: States can drive down insurance plan costs for consumers, employers, and governments by taking Nevada’s approach, which requires public option plans to charge premiums that are 5% lower than the previous year’s rates for a benchmark plan in the short term and by requiring plans to set premiums 15% below benchmark private plans in the long term. Nevada’s plan also leverages state purchasing power by requiring health plans that serve Medicaid enrollees to make competitive bids to offer public option plans. [94]

Expand Transparency and Cost-Growth Benchmarks

Progress in Washington State

The Washington State Legislature has taken important steps to improve transparency and set cost-growth benchmarks in recent years:

- All Payer Claims Database (APCD): The APCD is a tool created in 2014 and administered by the Health Care Authority (HCA) to collect health care claims and payment data from entities that pay for health care for the purpose of increasing transparency in the health care delivery system.[95] As of 2020, 23 states had created an APCD. While the APCD provides important data for Washington consumers and policy makers, the reach is limited due to a 2016 Supreme Court case, Gobeille vs. Liberty Mutual Insurance, which prohibits state APCDs from requiring self-insured/private employer group health plans to submit their data. These plans represent a third of coverage, rendering APCDs less effective.[96]

- Health Care Cost Transparency Board (HCCTB): The Washington State Legislature created the HCCTB in 2020 to identify cost trends, set a cost-growth benchmark, and develop recommendations to reduce health care costs. The work builds off of similar work done in Massachusetts, Rhode Island, and Delaware.[97] The Board has set a benchmark value measured against historical median wage and Potential Gross State Product, with a target of 3.2% in 2022, phasing down to 2.8% by 2026. This benchmark amount is in line with other states’ cost-growth benchmark targets.[98]

- Health System Transparency (HB 1272): The Washington State Legislature passed this bill in 2021 to require hospitals to share more detailed information regarding hospital expenses and revenue, patient discharge data, federal relief funds, charity care, and community needs assessment reporting.[99]

Policy solutions and recommendations

Cost-growth benchmark programs like Washington’s Health Care Cost Transparency Board mentioned above have been created in response to a lack of transparency and targeted price regulation. Massachusetts’ groundbreaking 2012 health care cost control law was the first in the nation to set a statewide spending growth benchmark, and several other states have followed suit, including Washington State. While health care spending growth fell in Massachusetts during the first few years following the passage of the law, total health care costs began to rise again in 2018, largely due to insufficient enforcement mechanisms, as well as a lack of authority to limit health care consolidations. Recognizing the rising spending rate, the state’s Health Policy Commission took steps in early 2022 for the first time to enforce a cost-control plan on the Massachusetts General Hospital (MGH). The Commission found that the hospital’s prices and spending were “excessive”, were unrelated to utilization, outpaced spending for all other providers in the state, and had largely caused the state’s failure to reach its spending benchmark. The performance improvement plan was approved by the Commission, placing MGH in an 18-month improvement process.

Consumer advocates aren’t the only ones who want to improve transparency. A Kaiser Family Foundation survey from 2021 found that nine out of ten corporate business executives and decision makers surveyed approved of increasing price transparency to drive down health care costs.[102] Washington can take important steps to improve transparency efforts that are tied to enforcement mechanisms, increase the effectiveness of the Health Care Cost Transparency Board, and expand our current regulatory authority.

Table 2. Policy recommendations: Transparency and cost-growth benchmarks

- Empower enforcement of state cost-growth benchmarks by adding financial penalties: The potential success of Washington State’s Health Care Cost Transparency Board may be hindered by the lack of enforcement authority. States can improve the effectiveness of cost-growth benchmarks by adding enforcement mechanisms, as Oregon has done by adding “accountability mechanisms” including allowing the Oregon Health Authority to assess financial penalties for payers and providers that exceed the benchmark.[94]

- Strengthen enforcement of the federal Hospital Price Transparency Rule at the state level: States can assist CMS in enforcing the federal Hospital Price Transparency Rule, which requires hospitals to openly share their chargemaster price data. This can serve as additional enforcement capacity for CMS, which currently lacks sufficient capacity and resources to fully enforce the rule. One approach is to increase enforcement mechanisms at the state level by fining non-compliant hospitals that bring in more than a certain amount, as Texas has done for hospitals with more than $100 million in annual gross revenue. Legislation passed in 2021 enables the Texas Health and Human Services Commission to assess administrative fees on non-compliant facilities, though it remains to be seen if these fees will be high enough to motivate compliance [95]

- Mandate compliance with the federal Hospital Transparency Rule through licensing requirements: States can also require hospitals doing business in their state to fully comply with federal laws like the Hospital Price Transparency Rule as a requirement for licensure.[96]

Strengthen Antitrust Enforcement and Consumer Protection

Progress in Washington State

Washington passed the Consumer Protection Act (CPA) in 1961 to create guardrails around unfair and anti-competitive business practices, such as monopolizing trade or substantially decreasing market competition. The CPA is enforced by the Consumer Protection Division and Antitrust Division of the Washington State Office of the Attorney General, which has the authority to prosecute antitrust violations.[107] More recently, the Washington State Legislature passed the Notice of Material Change (HB 1607) bill in 2019 to require entities to provide the Attorney General at least 60 days prior notice of all mergers, acquisitions, or contracting affiliations of hospitals, hospital systems, and provider organizations, with no minimum dollar threshold. The requirement includes transactions between a Washington State entity and an out-of-state entity if the latter generates $10 million or more in revenue from Washington State patients. Any pre-merger notifications made to the FTC in compliance with the Scott-Hart-Rodino Act of 1976 (which requires notifications to the FTC of mergers and acquisitions) must also be submitted to the Washington Attorney General.[108] Washington is one of only five states that require notice of transactions for more than just hospitals, which includes both for- and nonprofit hospitals and providers.[109]

Policy solutions and recommendations

Table 3. Policy recommendations: Antitrust enforcement and consumer protection

- Strengthen penalties to enforce existing laws: The effectiveness of Washington’s Notice of Material Change law is hindered by the low penalty level, which is currently set at $200 per entity per day for noncompliance. This penalty isn’t high enough to motivate entities with multi-million-dollar budgets to comply with existing antitrust laws and needs to be increased to strengthen enforcement.

- Limit consolidations that increase patient costs or have adverse impact on equity, quality, or access to care: Health care consolidations have been linked to increased patient costs and poor health outcomes. Consolidations within some Catholic hospital systems in particular have resulted in reduced access to comprehensive, reproductive, gender-affirming, and end-of-life care, because of their restrictive religious refusal directives.[110] Without sufficient governmental regulation, consolidations will continue to drive up patient costs and reduce patient access. Federal law permits state attorneys general to enforce federal antitrust laws. States can increase state attorney general oversight and allow limitations on consolidations that fail to reduce patient costs. States can also require impact reviews of consolidations to enable the attorney general or other reviewing entity to evaluate potential health care transactions for any harmful impacts on equity, health outcomes, patient costs, and reductions to access to care such as reproductive, end-of-life, and gender-affirming care, as New York did recently in June of 2021.[111] States like Oregon and Massachusetts have passed stronger consumer protection laws on health care transactions in recent years; changes include ensuring that the public benefits of a proposed merger outweigh any anti-competitive effects and to also require conditional approval of transactions based on additional criteria. Oregon’s recently passed Equal Access to Care Act enables the Oregon Health Authority to block mergers that undermine access to health care.[112]

- Expand health care entity consolidation oversight scope to include consolidations involving private equity groups: Private equity firm investments have skyrocketed in the health care industry in recent years as a way to extract more profits. In 2018, private equity firms invested $100 billion into the health care sector, and private equity deals represented 45% of all mergers and acquisitions.[113]Expanding state authority and scope to include private equity is an important step for states to take to ensure all health care entity consolidations are reviewed and evaluated for antitrust practices. In the 2020 legislative session, the California Legislature considered but did not pass a bill that would have added pre-transaction approval for private equity investors to its current antitrust review laws.[114]

- Increase long-term monitoring of consolidation trends and improve post-transaction oversight: Because federal agencies lack the capacity to fully address and oversee health system consolidations, it is left to states to monitor trends and data. States can increase attorney general or Department of Health capacity and scope to include ongoing research and study of state trends in consolidations. This will enable the state to track problems and tighten existing enforcement as needed to corral harmful cost and health outcome consequences for patients. State attorneys general can also increase their post-merger monitoring to ensure that any previously and/or conditionally approved transactions follow guidelines and won’t cause egregious increases in price or total health care expenditures.

- Prohibit unfair hospital contract negotiations: Hospitals have been found to engage in unfair practices such as requiring insurance companies to contract with multiple hospitals owned by the same entity or place certain hospitals in insurance plan metal tiers that favor hospitals at the expense of consumers. In one recent case, California’s Sutter Health System was accused of violating the state’s antitrust laws by using its market power to require insurance companies to include all of Sutter’s hospitals in the insurance network – even when they were significantly more expensive for patients. Sutter agreed to stop this requirement and also agreed to pay damages to the self-funded employers and unions that brought the case.[115] The Washington State Legislature considered implementing stronger consumer protections in health provider contracts (HB 1741) in the 2022 legislative session, but it failed to gain enough votes to pass.[116]

- Require health care entities to pay for the cost of the review and ongoing monitoring: Effectively reviewing and monitoring health care transactions can strain an underfunded state agency’s capacity; states can require transacting parties to pay for reviews, as proposed in the National Academy for State Health Policy model legislation.[117]

- Limit facility fees on par with Medicare ruling: Facility fees are one of the key causes of increased patient costs resulting from health care consolidations. In the past, hospitals charged facility fees for “stand-by” emergency department services, but facility fees are increasingly used for primary care as hospitals purchase more physician clinics.[118] Medicare prohibits usage of facility fees for any health care facility located within 250 yards of a hospital. States can limit facility fees using a National Academy of State Health Policy model law developed to create parity for commercial payers with Medicare limitations.[119]

Improve Drug Affordability

Progress in Washington State

The WA State Legislature has explored a number of bills to improve drug affordability in recent years, including establishing a Prescription Drug Affordability Board (PDAB) in 2022; creating a Total Cost of Insulin Work Group to review and design strategies to reduce the cost of and total expenditures on insulin; passing a bill to cap insulin cost-sharing; and instituting a program to produce, distribute, and purchase generic prescriptions[120] While these bills are important steps forward, additional legislation is needed to meaningfully reduce high drug costs.

Other bills the Legislature has explored, but not yet passed, in recent years include: creating a centralized insulin purchasing program; exploring a prescription drug import program, which would have enabled the HCA to design a wholesale prescription drug program; and developing a pharmacy tourism program that would allow state employees to purchase more affordable drugs from Canadian pharmacies.[121] Some of these solutions have emerged from the Washington State Prescription Drug Purchasing Consortium and the Department of Health task force on reducing out-of-pocket drug costs.[122]

Policy solutions and recommendations

Table 4. Policy recommendations: Drug affordability

- Allow states to directly regulate Pharmacy Benefit Managers (PBMs): As referenced earlier in this report, PBMs operate with little to no transparency or regulation, driving up costs for consumers and overall health spending as a result. States can pass legislation as modeled by the National Academy for State Health Policy by allowing a selected state agency to regulate PBMs by introducing a review process with requirements for licensure, mandating annual transparency reports including rebates received and retained, and by allowing the state agency to revoke licensure if a PBM operates outside of the guidelines established by the agency. An alternative approach could allow state insurance departments to regulate PBMs, as Maine established with the passage of a bill in 2019 (LD 1504).[123]

- Strengthen WA’s Prescription Drug Affordability Board (PDAB): PDABs have gained momentum in policy considerations in recent years as a mechanism to control drug prices and improve access to affordable pharmaceuticals, with seven states creating PDABs between 2019 and 2022.[124] The Washington State Legislature passed a law to create a PDAB in 2022, and remains one of the few states that allow an upper payment limit to be set on drugs. However, Washington’s Board still lacks sufficient strength and authority to address the drug affordability crisis. The new Board’s authority is limited to conducting only 24 affordability reviews per year and may only impose upper payment limits on 12 drugs per year starting in 2027. Additionally, the provision was removed that would have allowed financial penalties on drug manufacturers for unsupported price increases, significantly weakening the Board’s ability to meaningfully control prices.[125] Strengthening the Board serves to address multiple problems – both overpriced drugs and unsupported drug price increases. Pharmaceutical companies have been known to charge somewhat lower rates for new drugs, then drastically increase the price over time, which puts patients at a disadvantage once they have found a drug that helps their condition.

- Target equity with a PDAB: PDABs can also support equity as an Oregon law does, by adding criteria to the board’s evaluation process to assess whether drugs have contributed to inequities in communities of color.[126]

Conclusion

In a system where health care costs continue to skyrocket unchecked, patients will continue to pay more and more for needed care or forego care altogether – all while industry giants compete for a larger share of the pie. Urgent reforms are needed to increase state leverage and oversight, rein in hospital market dominance, reverse rapidly consolidating markets, and improve accountability and transparency in our health care system.

Advocates and policymakers in Washington can look to the successes and innovative policy solutions in other states to build on our progress to transform our health care system into one that puts patients at the center, advances equitable access to care, and promotes healthier outcomes for all communities. Developing and enforcing guardrails for unregulated industry giants will help make efficient use of consumer, employer, and government dollars, leaving more resources for other important investments like addressing the child care crisis, the housing shortage, and climate change.

Until we address rapidly growing market consolidation and concentration, and improve industry regulation and transparency, large conglomerates will continue to reap increased profits – and consumers, employers, and governments will pay the price.

Endnotes

[1] Montero, Alex, Audrey Kearney, Liz Hamel, and Mollyann Brodie. “Americans’ Challenges with Health Care Costs.” Kaiser Family Foundation. July 14, 2022. https://www.kff.org/health-costs/issue-brief/americans-challenges-with-health-care-costs/

[2] Schneider, Eric, Arnav Shah, Michelle Doty, Roosa Rikkanen, Katharine Fields, Reginald Williams. “Mirror, Mirror 2021: Reflecting Poorly. Health Care in the U.S. Compared to Other High-Income Countries.” Commonwealth Fund. August 4, 2021. https://www.commonwealthfund.org/publications/fund-reports/2021/aug/mirror-mirror-2021-reflecting-poorly

[3] Catalyst for Payment Reform and The Source on Healthcare Price and Competition. “State Policies on Provider Market Power.” June 2020. https://www.catalyze.org/product/state-policies-market-power/

[4] OECD. “Health spending set to outpace GDP growth to 2030.” July 11, 2019. https://www.oecd.org/health/health-spending-set-to-outpace-gdp-growth-to-2030.htm; Peterson-KFF Health System Tracker. “Tracking the rise in premium contributions and cost-sharing for families with large employer coverage.” Access and Affordability. August 14, 2019

https://www.healthsystemtracker.org/brief/tracking-the-rise-in-premium-contributions-and-cost-sharing-for-families-with-large-employer-coverage/; Kamal, Rabah, Daniel McDermott, Giorlando Ramirez, and Cynthia Cox. “How has U.S. spending on healthcare changed over time?” Peterson-KFF Health System Tracker. “December 23, 2020. https://www.healthsystemtracker.org/chart-collection/u-s-spending-healthcare-changed-time/#item-usspendingovertime_17

[5] Tikkanen, Roosa, Melinda K. Abrams. “U.S. Health Care from a Global Perspective, 2019: Higher Spending, Worse Outcomes?” The Commonwealth Fund. January 30, 2020. https://www.commonwealthfund.org/publications/issue-briefs/2020/jan/us-health-care-global-perspective-2019

[6] Kamal, Rabah, Daniel McDermott, Giorlando Ramirez, and Cynthia Cox. “How has U.S. spending on healthcare changed over time?” Peterson-KFF Health System Tracker. “December 23, 2020. https://www.healthsystemtracker.org/chart-collection/u-s-spending-healthcare-changed-time/#item-usspendingovertime_17

[7] Centers for Medicare & Medicaid Services. “NHE Fact Sheet.” National Health Expenditure Data. Accessed September 23, 2021. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet; Keehan, Sean, Gigi A. Cuckler, John A. Poisal, Andrea M. Sisko, et al. “National Health Expenditure Projections, 2019-2028: Expected Rebound in Prices Drives Rising Spending Growth.” Health Affairs, Vol. 39, no. 4 (2020). https://doi.org/10.1377/hlthaff.2020.00094

[8] Kamal, Rabah, Daniel McDermott, Giorlando Ramirez, and Cynthia Cox. “How has U.S. spending on healthcare changed over time?” Peterson-KFF Health System Tracker. “December 23, 2020. https://www.healthsystemtracker.org/chart-collection/u-s-spending-healthcare-changed-time/#item-usspendingovertime_17

[9] Kluender R, Mahoney N, Wong F, Yin W. “Medical Debt in the US, 2009-2020.” JAMA, Vol. 326, no. 3 (2021): 250–256. doi:10.1001/jama.2021.8694

[10] Centers for Medicare & Medicaid Services. “Historical.” National Health Expenditure Data. Accessed September 23, 2021. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical; Kamal, Rabah, Daniel McDermott, Giorlando Ramirez, and Cynthia Cox. “How has U.S. spending on healthcare changed over time?” Peterson-KFF Health System Tracker. “December 23, 2020. https://www.healthsystemtracker.org/chart-collection/u-s-spending-healthcare-changed-time/#item-usspendingovertime_17

[11] Graham, Carol. “Racial gaps in hope, ill-being, and deaths of despair.” Brookings, February 27, 2020. https://www.brookings.edu/blog/up-front/2020/02/27/racial-gaps-in-hope-ill-being-and-deaths-of-despair/

[12] Arias, Elizabeth, Betzaida Tejada-Vera, Farida Ahmad, and Kenneth D. Kochanek. “Provisional Life Expectancy Estimates for 2020.” NVSS Vital Statistics Rapid Release, No. 15. 2021. https://www.cdc.gov/nchs/data/vsrr/vsrr015-508.pdf; Indian Health Service. “Disparities.” Accessed December 6, 2021. https://www.ihs.gov/newsroom/factsheets/disparities/

[13] Taylor, Jamila. “Racism, Inequality, and Health Care for African Americans.” The Century Foundation. December 19, 2019. https://tcf.org/content/report/racism-inequality-health-care-african-americans/?session=1; Graham, Carol. “Racial gaps in hope, ill-being, and deaths of despair.” Brookings, February 27, 2020. https://www.brookings.edu/blog/up-front/2020/02/27/racial-gaps-in-hope-ill-being-and-deaths-of-despair/; Tikkanen, Roosa, Melinda K. Abrams. “U.S. Health Care from a Global Perspective, 2019: Higher Spending, Worse Outcomes?” The Commonwealth Fund. January 30, 2020. https://www.commonwealthfund.org/publications/issue-briefs/2020/jan/us-health-care-global-perspective-2019; Shanosky, Nicolas, Daniel McDermott, and Nisha Kurani. “How do U.S. healthcare resources compare to other countries?” Peterson-KFF Health System Tracker. Quality of Care. Accessed October 15, 2021. https://www.healthsystemtracker.org/chart-collection/u-s-health-care-resources-compare-countries/#item-start; Feldscher, Karen. “What’s behind high U.S. health care costs.” The Harvard Gazette. March 13, 2018. https://news.harvard.edu/gazette/story/2018/03/u-s-pays-more-for-health-care-with-worse-population-health-outcomes/; Anderson, Gerard, Peter Hussey and Varduhi Petrosyan. “It’s Still the Prices, Stupid: Why the US Spends so Much on Health Care, And a Tribute to Uwe Reinhardt.” Health Affairs, Vol. 38, No. 1. January 2019. https://www.healthaffairs.org/doi/10.1377/hlthaff.2018.05144

[14] Kirzinger, Ashley, Cailey Muñana, Bryan Wu, and Mollyann Brodie. “Data Note; Americans’ Challenges with Health Care Costs.” Kaiser Family Foundation. June 11, 2019. Accessed September 28, 2021. https://www.kff.org/health-costs/issue-brief/data-note-americans-challenges-health-care-costs/

[15] Witters, Dan. “1 in 6 U.S. Workers Stay in Unwanted Job for Health Benefits.” Gallup. May 6, 2021. https://news.gallup.com/poll/349094/workers-stay-unwanted-job-health-benefits.aspx?utm_source=alert&utm_medium=email&utm_content=morelink&utm_campaign=syndication

[16] Kirzinger, Ashley, Cailey Muñana, Bryan Wu, and Mollyann Brodie. “Data Note; Americans’ Challenges with Health Care Costs.” Kaiser Family Foundation. June 11, 2019. Accessed September 28, 2021. https://www.kff.org/health-costs/issue-brief/data-note-americans-challenges-health-care-costs/

[17] Kaiser Family Foundation. “2020 Employer Health Benefits Survey.” October 8, 2020. https://www.kff.org/report-section/ehbs-2020-section-6-worker-and-employer-contributions-for-premiums/#figure63

[18] Glied, Sherry, Benjamin Zhu. “Catastrophic Out-of-Pocket Health Care Costs: A Problem Mainly for Middle-Income Americans with Employer Coverage”. The Commonwealth Fund. April 17, 2020. https://www.commonwealthfund.org/publications/issue-briefs/2020/apr/catastrophic-out-of-pocket-costs-problem-middle-income#2; Collins, Sara, David Radley. “The cost of employer insurance is a growing burden for middle income families.” The Commonwealth Fund. December 7, 2018. https://www.commonwealthfund.org/publications/issue-briefs/2018/dec/cost-employer-insurance-growing-burden-middle-income-families

[19] Kirzinger, Ashley, Cailey Muñana, Bryan Wu, and Mollyann Brodie. “Data Note; Americans’ Challenges with Health Care Costs.” Kaiser Family Foundation. June 11, 2019. Accessed September 28, 2021. https://www.kff.org/health-costs/issue-brief/data-note-americans-challenges-health-care-costs/

[20] Kaiser Family Foundation. “2020 Employer Health Benefits Survey.” October 8, 2020. https://www.kff.org/report-section/ehbs-2020-section-6-worker-and-employer-contributions-for-premiums/#figure63

[21] Becerra, Xavier. “Report to the White House Competition Council: Comprehensive Plan for Addressing High Drug Prices: A Report in Response to the Executive Order on Competition in the American Economy.” U.S. Department of Health and Human Services. September 9, 2021. https://aspe.hhs.gov/sites/default/files/2021-09/Competition%20EO%2045-Day%20Drug%20Pricing%20Report%209-8-2021.pdf

[22] United States Senate Finance Committee. “Insulin: Examining the Factors Driving the Rising Cost of a Century Old Drug: Staff Report.” Accessed November 20, 2021. https://www.finance.senate.gov/imo/media/doc/Grassley-Wyden%20Insulin%20Report%20(FINAL%201).pdf

[23] Hamel, Liz, Lunna Lopes, Ashley Kirzinger, Grace Sparks, et al. “Public Opinion on Prescription Drugs and Their Prices.” Kaiser Familiy Foundation. October 18, 2021. https://www.kff.org/health-costs/poll-finding/public-opinion-on-prescription-drugs-and-their-prices/

[24] Claxton, Gary, Larry Levitt, Shawn Gremminger, Bill Kramer, et al. “How Corporate Executives View Rising Health Care Cost and the Role of Government.” Kaiser Family Foundation. April 29, 2021. https://www.kff.org/report-section/how-corporate-executives-view-rising-health-care-cost-and-the-role-of-government-findings/

[25] Kaiser Family Foundation. “2020 Employer Health Benefits Survey.” October 8, 2020. https://www.kff.org/report-section/ehbs-2020-section-6-worker-and-employer-contributions-for-premiums/#figure63

[26] Claxton, Gary, Larry Levitt, Shawn Gremminger, Bill Kramer, et al. “How Corporate Executives View Rising Health Care Cost and the Role of Government.” Kaiser Family Foundation. April 29, 2021. https://www.kff.org/report-section/how-corporate-executives-view-rising-health-care-cost-and-the-role-of-government-findings/

[27] Small Business for America’s Future. “Survey: Small Business Owners Say High Drug and Healthcare Costs are an Urgent Problem that is Keeping them from Growing.” May 18, 2021. https://irp.cdn-website.com/b4559992/files/uploaded/SBAF%20Healthcare%20Survey%20May%202021%20–%20FINAL.pdf

[28] Ledley, Fred, Sarah Shonka McCoy, Gregory Vaughan. “Profitability of Large Pharmaceutical Companies Compared With Other Large Public Companies.” JAMA, Vol. 323, no.9. (March 2020): 834–843. https://doi.org/10.1001/jama.2020.0442; United States Government Accountability Office. “Drug Industry Profits, Research and Development Spending, and Merger and Acquisition Deals.” November 2017. https://www.gao.gov/assets/gao-18-40.pdf

[29] McDermott, Daniel, Lina Stolyar, Elizabeth Hinton, Giolando Ramirez, et al. “Health Insurer Financial Performance In 2020.” Kaiser Family Foundation. May 3, 2021. https://connect.kff.org/e2t/tc/VWKDNr8t6gYxN4g228vqZkHdW58c1_74r735QMtGxkV5nxG7V3Zsc37CgBn7W7J5X-x1LDPgvVXv28W4VY86lW6GQhv-6WpxdsW6f2fkZ8dtKVCW44Dw_h6X83H3N7xBqlbw9kLWW8Nt0Vn7_FPT8W61NcVq5Q6g0QW4fBg3R8HlrgXN5qwW-qXB888W4jf3CY4qnVPyW4Z8qVK5d55mQW81MXbF8v_509W94Ww1h1F_1S5VKRKcz4lS5_-W6pNSGd7vH1HnW4Y7C302p5bqcW4rgN6w3Tn2-TW687tBN5RfkbwW7DH3ln58Xh36W8zRDLk4PGVsrW3x3Nv28XwkRCW29Gtt26blwNzW6dGKVx4bKjNlW8VBbJk3zKFwQW6dCz-X22TR17W7W-zQJ6XLxKvN377TwLDynqZW5qkTLt90fz-bW29bVZ6758pJmN6FkrlL-7tzTN2LFw6dcx75_35b61

[30] Bannow, Tara. “Hospital profits continued their rise in 2016.” Modern Healthcare. January 4, 2018. https://www.modernhealthcare.com/article/20180104/NEWS/180109966/hospital-profits-continued-their-rise-in-2016; American Hospital Association. 2016. “Trendwatch Chartbook 2016: Organizational Trends, Chart 2.9: Announced Hospital Mergers and Acquisitions, 1998–2015.” Accessed December 10, 2021. https://www.aha.org/system/files/2018-01/2016-chartbook.pdf; Drucker, Jesse, Jessica Silver-Greenberg, and Sarah Kliff. “Wealthiest Hospitals Got Billions in Bailout for Struggling Health Providers.” New York Times, May 25, 2020. https://www.nytimes.com/2020/05/25/business/coronavirus-hospitals-bailout.html

[31] Ellison, Ayla. “Why rural hospital closures hit a record high in 2020.” Becker’s Hospital CFO Report. March 16, 2021. https://www.beckershospitalreview.com/finance/why-rural-hospital-closures-hit-a-record-high-in-2020.html

[32] American Hospital Association. “Table 4.1: Aggregate Total Hospital Margins and Operating Margins (1995-2016).” Trendwatch Chartbook 2018. Accessed December 10, 2021. https://www.aha.org/system/files/2018-05/2018-chartbook-table-4-1.pdf

[33] Riley, Trish, Ellen Schneiter, Maureen Hensley-Quinn, Christina Cousart, et al. “Cross-Agency Strategies to Curb Health Care Costs: Leveraging State Purchasing Power.” National Academy of State Health Policy. April 2019. https://www.nashp.org/wp-content/uploads/2019/04/States-Leverage-Purchasing-Power.pdf

[34] Altarum Healthcare Value Hub. “The Price Isn’t Right: Strategies to Address High and Rising Healthcare Prices.” Research Brief No. 43, March 2021. https://www.healthcarevaluehub.org/advocate-resources/publications/price-isnt-right-strategies-address-high-and-rising-healthcare-prices#note1; Anderson, Gerard, Peter Hussey and Varduhi Petrosyan. “It’s Still the Prices, Stupid: Why the US Spends so Much on Health Care, And a Tribute to Uwe Reinhardt.” Health Affairs, Vol. 38, No. 1. January 2019. https://www.healthaffairs.org/doi/10.1377/hlthaff.2018.05144; Anderson, Gerard, Uwe Reinhardt, Peter Hussey, and Varduhi Petrosyan, “It’s the Prices, Stupid: Why the United States is So Different From Other Countries.” Health Affairs, Vol. 22, No. 3. Spring 2003. https://www.healthaffairs.org/doi/10.1377/hlthaff.22.3.89; Papanicolas, Irene. “Health Care Spending in the United States and other High-Income Countries.” JAMA, Vol. 319, No. 10. (March 2018): 1024-1039. https://pubmed.ncbi.nlm.nih.gov/29536101/

[35] David M. Cutler, Fiona Scott Morton. “Hospitals, Market Share, and Consolidation.” JAMA, Vol. 310, no. 18. (November 13, 2013): 1964-1970. doi:10.1001/jama.2013.281675; Fulton, Brent. “Health Care Market Concentration Trends in The United States: Evidence And Policy Responses.” Health Affairs, Vol. 36, no. 9 (September 1, 2017): 1530–38. https://doi.org/10.1377/hlthaff.2017.0556; Gaynor, Martin. “Examining the Impact of Health Care Consolidation: Statement before the Committee on Energy and Commerce Oversight and Investigations Subcommittee, U.S. House of Representatives. February 14, 2018. https://docs.house.gov/meetings/IF/IF02/20180214/106855/HHRG-115-IF02-Wstate-GaynorM-20180214.pdf; Gee, Emily, Ethan Gurwitz. “Provider Consolidation Drives up Health Care Costs: Policy Recommendations to Curb Abuses of Market Power and Protect Patients.” Center for American Progress. December 5, 2018.

https://www.americanprogress.org/article/provider-consolidation-drives-health-care-costs/; Sood, Neeraj, Tiffany Shih, Karen Van Nuys, Dana Goldman. “The Flow of Money through the Pharmaceutical Distribution System.” Leonard D. Schaeffer Center for Health Policy and Economics. June 2017. https://healthpolicy.usc.edu/wp-content/uploads/2017/06/USC_Flow-of-MoneyWhitePaper_Final_Spreads.pdf

[36] American Hospital Association. “Trendwatch Chartbook 2016: Organizational Trends, Chart 2.9: Announced Hospital Mergers and Acquisitions, 1998–2015.” Accessed December 10, 2021. https://www.aha.org/system/files/2018-01/2016-chartbook.pdf; American Hospital Association. “Trendwatch Chartbook 2018: Organizational Trends, Chart 2.9: Announced Hospital Mergers and Acquisitions, 2005–2017.” https://www.aha.org/system/files/2018-07/2018-aha-chartbook.pdf

[37] Schwartz, Karyn, Eric Lopez, Matthew Rae, and Tricia Neuman. “What we know about provider consolidation.” Kaiser Family Foundation. September 2, 2020. https://www.kff.org/health-costs/issue-brief/what-we-know-about-provider-consolidation/

[38] Medicare Payment Advisory Commission (MedPAC). “March 2020 Report to the Congress: Medicare Payment Policy.” March 13, 2020 https://www.medpac.gov/document/http-www-medpac-gov-docs-default-source-reports-mar20_entirereport_sec-pdf/

[39] Washington State Office of the Attorney General. “AG Ferguson Sues CHI Franciscan Over Price-Fixing and Anticompetitive Kitsap Deals.” August 31, 2017. https://www.atg.wa.gov/news/news-releases/ag-ferguson-sues-chi-franciscan-over-price-fixing-and-anticompetitive-kitsap

[40] Bolton, Dan. “Hospital Mergers in Washington 1986-2017” Washington State Health Services Research Project (Brief # 105), Office of Financial Management. March 2022. https://ofm.wa.gov/sites/default/files/public/dataresearch/researchbriefs/brief105.pdf

[41] Arnold Ventures. “Part 1: In pursuit of profit, private equity expanded into health care. The results raise concerns about cost and quality.” News and Stories. September 7, 2020. https://www.arnoldventures.org/stories/part-1-in-pursuit-of-profit-private-equity-expanded-into-health-care-the-results-raise-concerns-about-cost-and-quality; Appelbaum, Eileen, Rosemary Batt. “Coronavirus and the implications of private equity buyouts in healthcare.” Center for Economic and Policy Research. March 25, 2020. https://cepr.net/coronavirus-and-the-implications-of-private-equity-buyouts-in-healthcare/

[42] Singh, Yashaswini, Zirui Song, Daniel Polsky, et al. “Association of private equity acquisition of physician practices with changes in health care spending and utilization.” JAMA Health Forum, 3(9). September 2, 2022. https://jamanetwork.com/journals/jama-health-forum/fullarticle/2795946?utm_campaign=articlePDF&utm_medium=articlePDFlink&utm_source=articlePDF&utm_content=jamahealthforum.2022.2886

[43] Altarum Healthcare Value Hub. “The Price Isn’t Right: Strategies to Address High and Rising Healthcare Prices.” Research Brief No. 43, March 2021. https://www.healthcarevaluehub.org/advocate-resources/publications/price-isnt-right-strategies-address-high-and-rising-healthcare-prices#note1

[44] Capps, Cory. David Dranove, and Christopher Ody. “The Effect of Hospital Acquisitions of Physician Practices on Prices and Spending.” Journal of Health Economics, Vol. 59 (May 1, 2018): 139–52. https://doi.org/10.1016/j.jhealeco.2018.04.001

[45] Snowbeck, Christopher. “Seattle-based Polyclinic being sold to United Health Group.” Seattle Times. November 27, 2018. https://www.seattletimes.com/business/seattle-based-polyclinic-being-sold-to-unitedhealth-group/

[46] Chernew, Michael, Hongyi He, Harrison Mintz, and Nancy Beaulieu. “Public Payment Rates for Hospitals and the Potential for Consolidation-Induced Cost Shifting.” Health Affairs, Vol. 40, No. 8. (August 2021). https://doi.org/10.1377/hlthaff.2021.00201; Cooper, Zack, Stuart Craig, Martin Gaynor, and John Van Reenen. “The Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured.” National Bureau of Economic Research. December 2015. https://www.nber.org/system/files/working_papers/w21815/w21815.pdf;