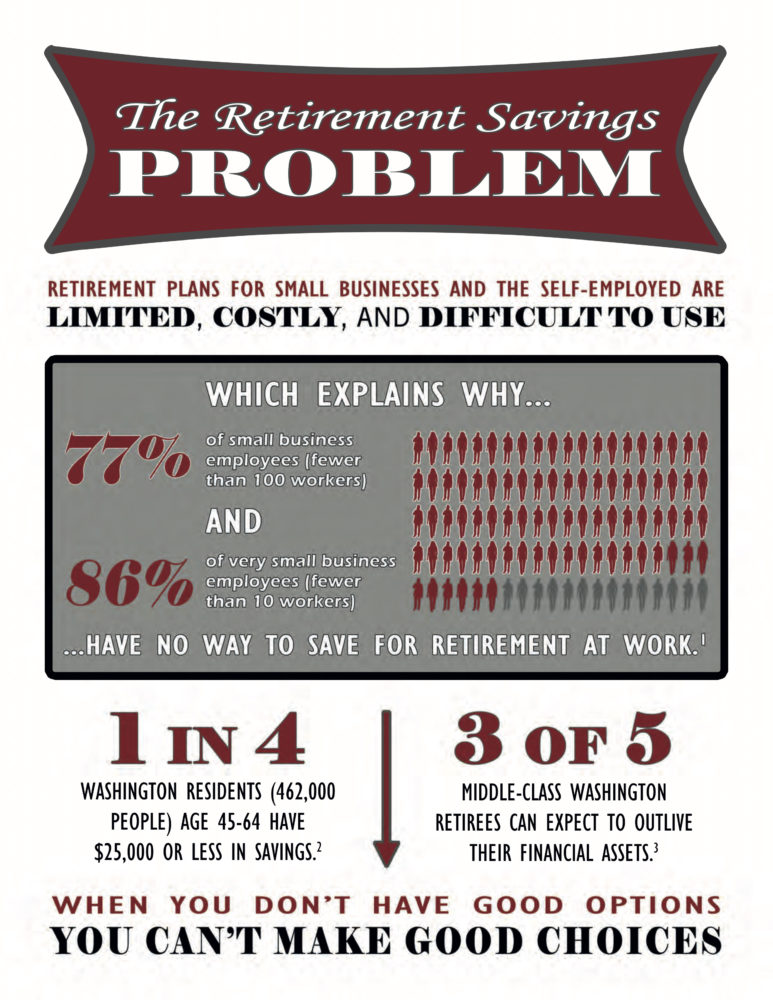

Retirement plans for small businesses and the self-employed are limited, costly and difficult to use. Which explains hwy 77% of small business employees (fewer than 100 workers) and 80% of very small business employees (fewer than 10 workers) have no way to save for retirement at work.1

When you don’t have good options, you can’t make good choices. 1 in 4 Washington residents (462,000 people) age 45-64 have $25,000 or less in savings.2 3 of 5 middle-class Washington retirees can expect to outlive their financial assets.3

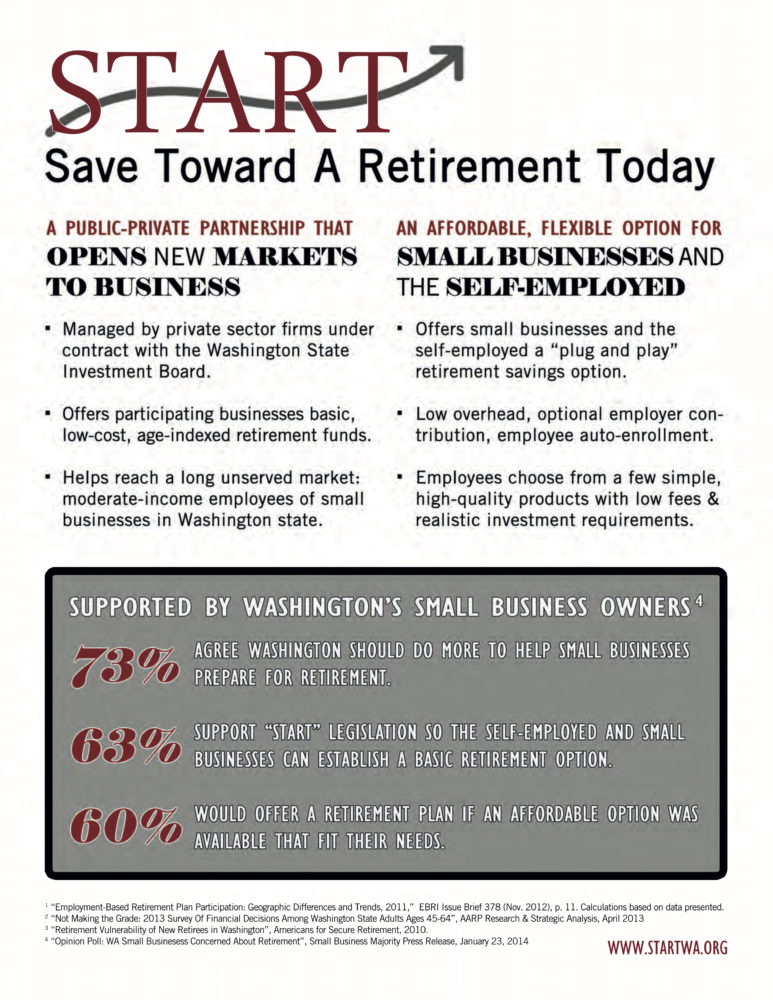

START (Save Toward A Retirement Today) is a public-private partnership that opens new markets to business. Managed by private sector firms under contract with the Washington State Investment Board, it offers participating businesses basic, low-cost, age-indexed retirement funds. It helps reach a long unserved market: moderate-income employees of small businesses in Washington state.

START is designed to be an affordable, flexible option for small businesses and the self-employed. It offers a “plug and play” retirement savings option with low overhead, an optional employer contribution, and employee auto-enrollment. Employees choose from a few simple, high-quality products with low fees and realistic investment requirements.

It’s an option that Washington’s small business owners support:4

- 73% agree Washington should do more to help small business owners prepare for retirement

- 63% support START-style legislation so the self-employed and small businesses can establish a basic retirement option.

- 60% would offer a retirement plan if an affordable option was available that fit their needs.

1 “Employment-Based Retirement Plan Participation: Geographic Differences and Trends, 2011,” EBRI Issue Brief 378 (Nov. 2012), p. 11. Calculations based on data presented.

2 “Not Making the Grade: 2013 Survey Of Financial Decisions Among Washington State Adults Ages 45-64”, AARP Research & Strategic Analysis, April 2013

3 “Retirement Vulnerability of New Retirees in Washington”, Americans for Secure Retirement, 2010.

4 “Opinion Poll: WA Small Businesess Concerned About Retirement”, Small Business Majority Press Release, January 23, 2014

More To Read

February 27, 2024

Which Washington Member of Congress is Going After Social Security?

A new proposal has Social Security and Medicare in the crosshairs. Here’s what you can do.

February 27, 2024

Hey Congress: “Scrap the Cap” to Strengthen Social Security for Future Generations

It's time for everyone to pay the same Social Security tax rate – on all of their income

January 22, 2024

“Washington Saves” legislation won’t solve our retirement security crisis. Lawmakers should pass it anyway.

The details of this auto IRA policy matter.