The COVID-19 pandemic has exacerbated existing wage inequality, as those workers who are younger, earning low to moderate wages, or without a four-year college degree have taken the brunt of unprecedented job losses. The pandemic has significantly impacted nearly all local economies, but unemployment has hit hardest in the Puget Sound and the Olympic Peninsula regions. Race/ethnicity shows a more mixed effect, and there is a minimal overall gender gap.

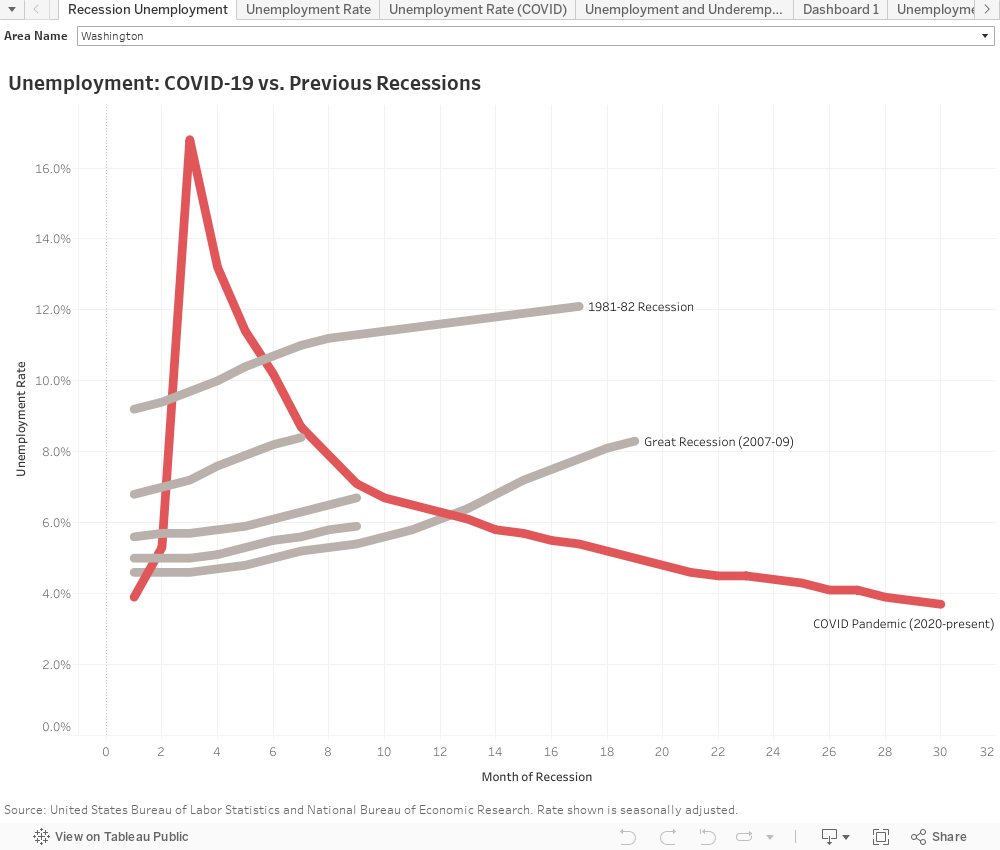

Pandemic-related job losses were unprecedented in magnitude and speed

In February 2020, the state’s jobless rate (not seasonally adjusted) was 4.2 percent. With the onset of the COVID-19 crisis and associated public health measures, unemployment spiked to 14.8 percent in May – an all-time high since 1976, the earliest date for which state-level data is available. Many cities and counties experiencing even higher rates. Nationally, unemployment had never been this high – nor had it increased by so much, so rapidly – since the Current Population Survey (CPS) began collecting unemployment data in 1947.

Low- and moderate-wage workers are taking the brunt of job losses

Job losses have been very high in several of Washington’s largest employment sectors, where typical pay is well below the state average. Accommodation and Food Services, and Health Care and Social Assistance, which had been among those sectors leading state job growth since the Great Recession, were hit particularly hard. Losses in the Arts, Entertainment and Recreation sector have been smaller in total, but highest overall as a percentage of previous employment.

Sectors that typically offer middle-class wages have also taken hits. As of June, net job losses in Government are second highest overall (and growing), putting a drag on the state’s nascent recovery. Losses in Manufacturing are also a blow, because this sector typically pays higher-than-average wages, and didn’t recover all of the jobs lost in the wake of the Great Recession until mid-2019. (Absent aerospace-related jobs, the sector still hasn’t recouped them.)

In sharp contrast, losses have been much lower in several smaller sectors where typical pay is well above the state average: Management of Companies/Enterprises; Finance and Insurance; Information; and Professional, Scientific, and Technical Services.

Age and education have greatest impact on unemployment claims; race, ethnicity, and gender show mixed effect

As a percentage of each age group’s working population, unemployment insurance (UI) claims remain highest among people age 16 to 24, followed by those ages 25 to 34. Unemployment among Caucasian, Asian and Latinx workers have been consistently lower than among those who identify as Native Hawaiian/Pacific Islander, African American, or American Indian.

Employment by gender varies widely between economic sectors – from Construction (81 percent male/19 percent female) to Health Care and Social Assistance (77 percent female/23 percent male). But while unemployment claims by gender within each sector likely show differences, there hasn’t been a large gender gap in UI claims overall.

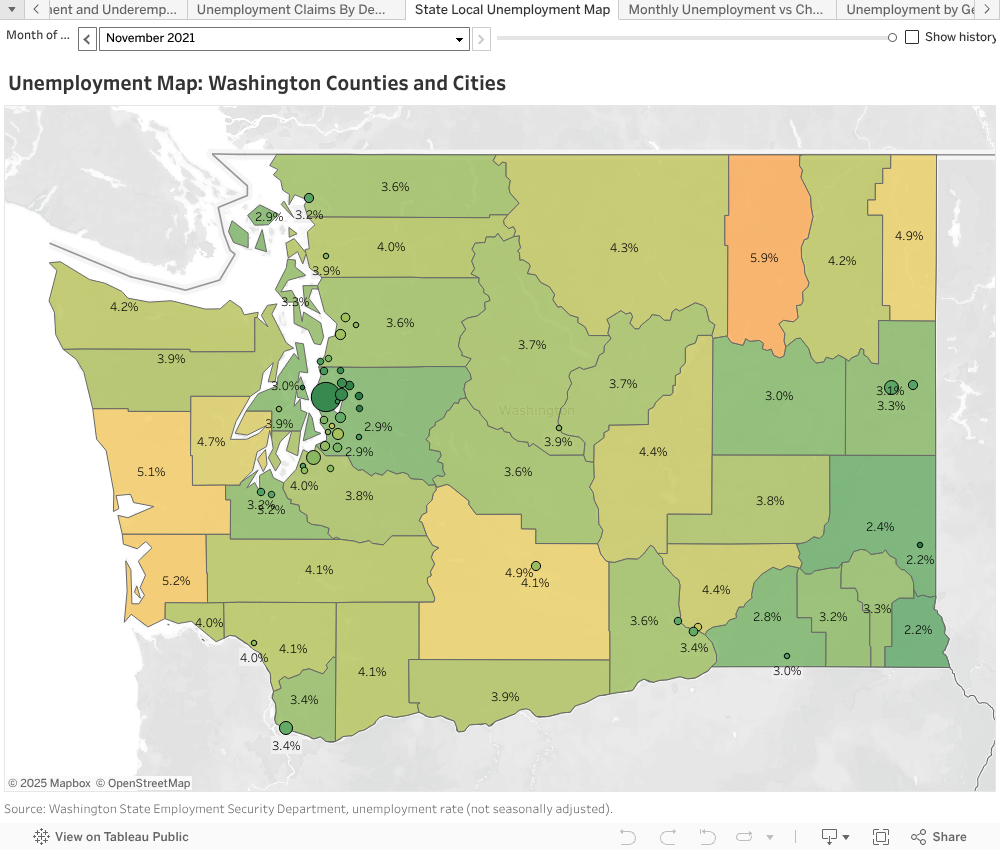

(Almost) no area spared, Puget Sound and Olympic Peninsula hit hardest

Job losses have touched nearly every area of the state. Through the end of May, unemployment is above the state’s overall rate in 13 of Washington 39 counties – including Pierce, Snohomish and Spokane County.

Twenty-six localities have a higher unemployment rate than the state as a whole, including Tacoma, Spokane and Everett, and smaller entities including Spokane Valley, Bellingham, Renton and Kent. Employment in the city of Pullman and surrounding Whitman County is – so far – less affected than the rest of the state.

The unemployment crisis brought on by the pandemic is especially hard on those with low-to-moderate incomes, who were already on an economic knife edge. Since 1979, wages for the bottom 60 percent of Washington workers have increased $1/hour – or less! – after adjusting for inflation; meanwhile, the top 10 percent have seen hourly wages jump nearly $18/hour.

Meanwhile, higher costs for rent or home ownership, health care, child care and higher education have far outpaced the (very) modest increases in a typical family’s income over the past decade. The Federal Reserve estimates that 39% of Americans don’t have enough savings to cover an unplanned $400 expense.

Crafting a humane and substantive response will require state leaders to think beyond their usual boundaries, both in terms of politics and policy – especially given the lack of federal leadership and support during this crisis.

With a special special session likely to occur this summer, legislators and the Governor will have their chance to step up to the challenge. Stay tuned.

More To Read

August 10, 2021

New State Programs May Ease a Short-Term Evictions Crisis, but Steep Rent Hikes Spell Trouble

State and local lawmakers must fashion new policies to reshape our housing market

November 20, 2020

We Can Invest in Us

Progressive Revenue to Advance Racial Equity