Child care expenses are so high in Washington, many jobs don’t pay enough for families with younger children to make ends meet, even with two adults working full time.

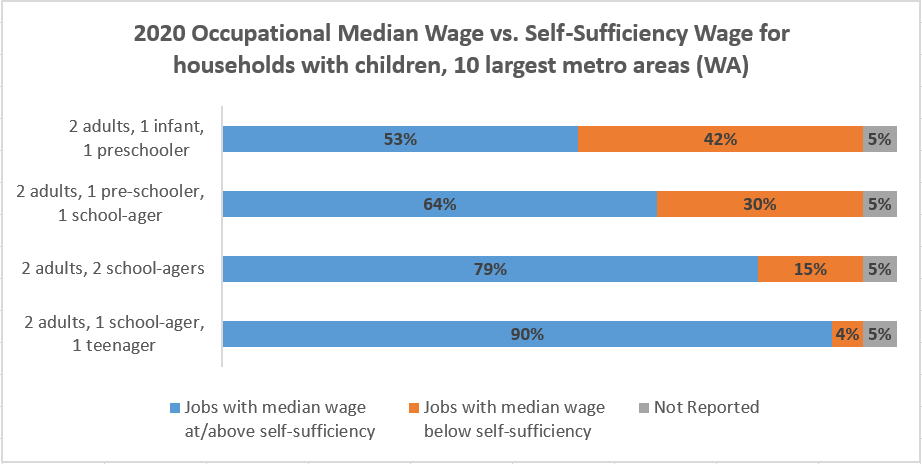

We looked at median wages (where half of all workers are paid more, and half are paid less) for hundreds of occupations in Washington* and compared annual earnings for two full-time working adults with a self-sufficiency budget for two adults working and two children across Washington’s 10 largest metro areas. We found that:

- Four in 10 jobs pay less than what it takes for two full-time workers to cover basic household expenses for a family with an infant and a preschooler.

- Three in 10 jobs pay below self-sufficiency for a household with a preschooler and a school-ager.

But — as soon as families don’t need full-time childcare, far more jobs have wages high enough to pay the bills:

- Eight in 10 jobs have a median wage at or above self-sufficiency for a household with two school-agers.

- Nine in 10 jobs have a median wage at or above self-sufficiency for a household with a school-ager and a teenager.

Source: 2020 Occupational Employment Statistics (Washington Employment Security Department) and 2020 Self-Sufficiency Wage (University of Washington Center for Women’s Welfare)

Washington cannot have a healthy economy without a functioning child care system. Lawmakers need to act now to strengthen our economy by boosting family incomes and making child care more affordable.

Washington’s Working Families Tax Exemption — first passed in 2008 but never funded — would help boost incomes by providing tax rebates for the state’s lowest-income families. This year, legislation to expand and simplify the program has bipartisan support for the first time. It awaits a hearing on potential funding in the House Appropriations Committee.

On the child care front, the state’s own Child Care Collaborative Task Force — comprised of a broad range of business, child care, government, and other stakeholders — has outlined immediate steps lawmakers need to take:

- Boost subsidies and increase the frequency of payments to child care providers.

- Increase income thresholds so more families qualify, and make parents entering (or preparing to enter) the workforce eligible, for subsidized child care.

- Improve compensation and professional development in the child care workforce.

Taking these steps toward restoring our economy will require public investment. House Bill 1496 would generate $1 billion in new funding for child care as well as other essential programs by enacting a tax on extraordinary wealth from gains on assets that are regularly sold by the ultra-wealthy. The bill includes several exemptions to avoid taxing working families.

*Data covers all 8,867 occupations with estimated employment figures across Washington’s 10 largest metro areas (Bellingham, Bremerton-Silverdale, Kennewick-Richland, Mount Vernon-Anacortes, Olympia-Tumwater, Seattle-Tacoma-Bellevue, Spokane-Spokane Valley, Walla Walla, Wenatchee, Yakima), as published in Washington Employment Security Department 2020 Occupational Employment Statistics.

More To Read

August 10, 2021

New State Programs May Ease a Short-Term Evictions Crisis, but Steep Rent Hikes Spell Trouble

State and local lawmakers must fashion new policies to reshape our housing market

November 20, 2020

We Can Invest in Us

Progressive Revenue to Advance Racial Equity