By Stan Sorscher, EOI Board Member, and Labor Representative at the Society for Professional Engineering Employees in Aerospace (SPEEA)

I’m a capitalist for one reason: to raise living standards in my community. A familiar mantra of capitalism guides me: Markets are powerful and efficient. I’m also a realist, so I temper that mantra: Markets are powerful and efficient. And markets fail.

Market failure is an established, well-understood field of study in mainstream economics. Generations of economists accept the basics of market failure. However, American economists turn their heads away at the mention of it, because it sounds like heresy. Consider the four biggest market failures in human history:

- Climate change: $40 trillion, so far

- Health care in America: trillions per year, ongoing

- The housing-financial asset bubble: at least $8 trillion

- Free trade: $8 trillion, so far

- Growing inequality with $1 trillion going to the top 1% each year

According to the chief economist for the World Bank, Nicholas Stern, climate change is the greatest market failure in human history. Greenhouse gas emissions are a classic externality, where everyone on earth subsidizes oil companies and consumers of fossil fuels. Fossil fuels are under-priced by $40 trillion — a rough estimate of the cost that future generations will pay for damage we’re doing to the Earth.

Health care in America wastes roughly $1 trillion per year, compared to other wealthy countries, and the problem is steadily worsening.

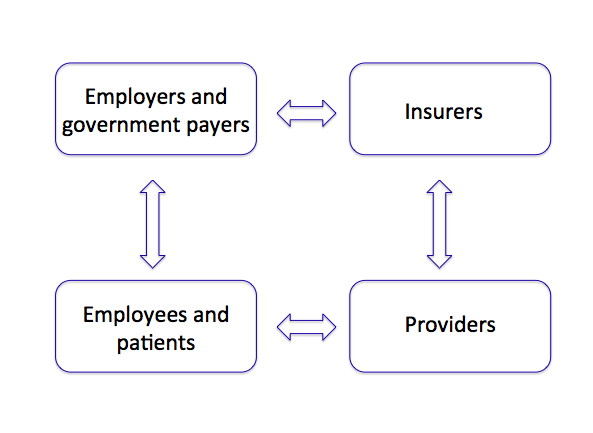

First, health care is not a market. A market involves buyers and sellers. In American health care, we’re not really sure who is a buyer and a seller. And very few patients shop around for deals. After the doctor says the word “cancer,” most people lose their shopping instincts. As a result, market incentives are badly misaligned.

The housing and financial asset bubble is a classic market failure. Mortgage brokers misled home buyers into bad mortgages. Banks bundled unaffordable mortgages into bogus securities and sold them to investors. Rating agencies provided false security to investors. Herd mentality and massive group-think inflated the asset bubble. Losses in housing values alone exceeded $8 trillion.

We should add costs for the recession, millions of foreclosed homes, personal bankruptcies, lost opportunities, millions of workers unemployed and careers damaged permanently. Markets rewarded bad behavior and punished millions who behaved responsibly.

Free trade is a market failure, but it is also an intellectual failure for the economics profession, and a policy failure on the part of elected officials. Our cumulative trade debt since NAFTA is well over $8 trillion. Our economy is de-industrializing, with thousands of factories closed, millions of jobs lost, and no improvement in sight.

Free trade has enjoyed inexplicably unassailable reverence since David Ricardo introduced it in 1817. It was unrealistic in 1817, and it is unrealistic today.

It starts with hopelessly idealized assumptions, applied blindly in the complex global economy, where trading partners and multinational companies exploit those assumptions for their own purposes. We were promised mutual gain, but we suffer huge deficits, concentration of wealth and power among trade’s “winners” and loss of bargaining power, de-industrialization and stagnant wages for the rest of us.

If the study of free trade were moved from economics departments in universities to mathematics departments, it would be discredited on logical grounds by the end of the first day. Similarly, its half-life in a physics, astronomy, or chemistry department would be a week or two — the time it would take to send graduates students to the lab to collect data.

It is worth noting that conventional free trade theory is considered largely irrelevant in business schools, where students learn the realities of how to move capital and production around the world. Worse by far, our so-called free trade agreements are really designed to protect and enrich global companies. These agreements toss aside democratic checks and balances, weaken civil society and erode the middle class.

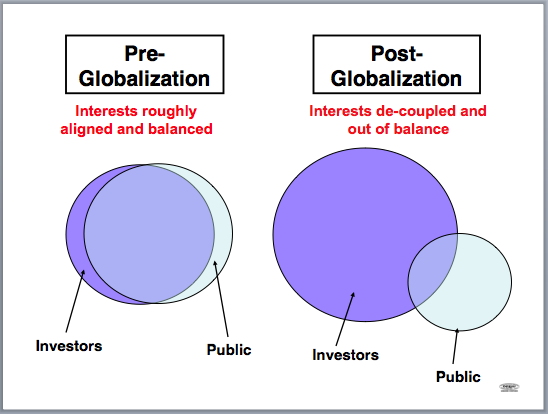

Under the right conditions, markets will, in fact, produce broad-based well-being. In 1776, Adam Smith argued that beneficial market control occurred when merchants in the village were personally connected to the well-being of their neighbors, who lived and shopped in the village. Social and economic cohesion would prevent market failure. But globalization, as we’ve managed it, de-couples modern corporate decision-makers from any obligation or connection to communities anywhere.

The test of a market economy is whether it raises living standards. We fail that test when we look at growing inequality and reduced career prospects for the next generations of Americans. As a society, we have stopped sharing the gains from productivity and trade. Almost all new income goes to the top 1 percent — more than $1 trillion per year.

Some economists object that inequality is beyond the narrow scope of economics, so it’s not “really” a market failure. Granted, our looming inequality has broad dimensions — social, political and moral, as well as economic.

However, when economists duck responsibility for inequality, they are really acknowledging that free markets and free trade will predictably create inequality, without strong intervention in the form of public policy and social values. That sounds like market failure to me.

Here’s the take-away message. The narrow orthodoxy of free markets and free trade says that markets will solve all our problems, and government intervention is bad. Look at politics in America, today.

Unfortunately, the real world is a very large system with many interacting forces and interests.

Markets fail. A legitimate purpose of public policy is to intervene in markets to prevent market failure. Public policy has a necessary role in protecting the environment, human rights, labor rights, education and public health, managing growth, regulating markets, and managing global trade.

That’s capitalism for realists.

More To Read

November 1, 2024

Accessible, affordable health care must be protected

Washington’s elected leaders can further expand essential health care

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.