From Slate.com:

Central to the intellectual debate about marginal tax rates has been the question of whether higher rates discourage people from working. President Reagan is famously reported to have observed that, as an actor, once he hit the top marginal rate—then 91 percent—he stopped making movies for the rest of the year. The result of sky-high marginal rates, this anecdote was supposed to prove, was declining productivity and economic growth.

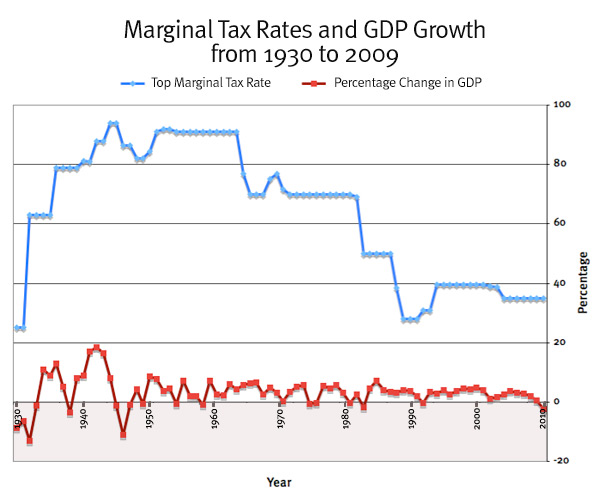

Is this true? Let’s look at a graph of the nominal top marginal tax rate in any given year and GDP growth in that year.

A caveat—obvious but critical—is in order. Simultaneity does not equal causation. Annual growth rates are a consequence of many factors, macro and micro, and the isolated impact of marginal tax rates on growth is hard, if not impossible, to discern from these numbers alone.That said, it’s obvious that there is no correlation between higher marginal tax rates and slowing economic activity.

Take a look – there’s lots more to think about in the original article.

More To Read

May 2, 2024

Baby Bonds: A Step Toward Racial and Economic Equity

The Washington Future Fund would bring this innovative, anti-racist policy to the Evergreen State

May 1, 2024

Laws Targeting LGBTQ Youth Aren’t Just Bad for Kids – They’re Bad For The Economy

The harm done by anti-LGBTQ laws expands so much further than queer children and teens

April 26, 2024

What is WA Cares and Why Does It Matter for Washingtonians?

We need to defend this important policy from billionaires looking to save a buck