What makes an economy grow? Don’t forget to add retirees to the list – especially those who have pensions.

Business start-ups, a prosperous middle class, high-quality schools, and good infrastructure come to mind as engines of economic growth. But Washington’s retired teachers, firemen, police officers and other public servants – who comprise 2% of the state’s total population – collectively spent $2.8 billion via benefits received from their state and local pension plans. That translated into a $4.5 billion boost to the state’s economy in 2009 alone, according to a new report by NIRS (the National Institute on Retirement Security):

“Washington retirees don’t put their pension checks in a drawer and forget about them,” explains Ilana Boivie, author of the report. “They use it for daily living expenses, and to pay taxes. The money goes right back into the economy, which means financial stability for the retiree and economic growth for Washington.”

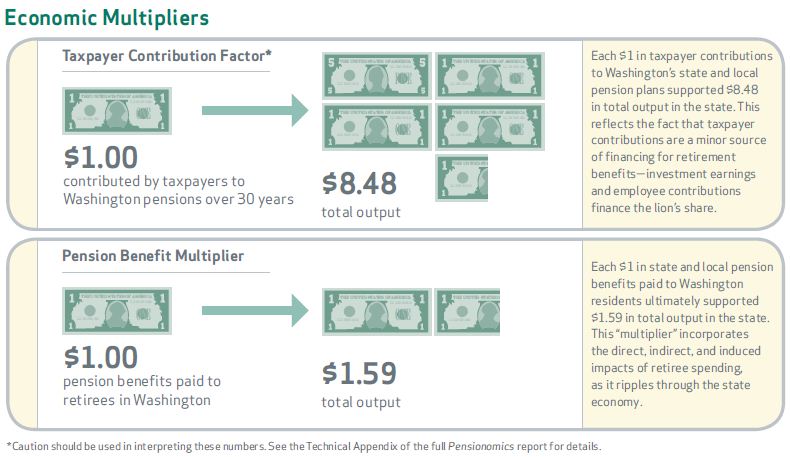

NIRS estimates that every dollar in taxpayer contributions to Washington’s pension plans resulted in $8.48 in economic output for the state in 2011. Pensions supported 30,605 jobs in Washington and brought in a total of $590.4 million in tax revenue – all while helping our retired public servants pay their bills and grow old with dignity. That’s a pretty good return – for all of us – especially as the state’s economy inches along toward recovery.

Read the full NIRS report here »

~By EOI Intern Ashwin Warrior

More To Read

November 1, 2024

Accessible, affordable health care must be protected

Washington’s elected leaders can further expand essential health care

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.