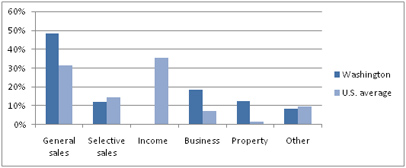

Other states have surpassed Washington in funding education and have less regressive tax systems, because most have an income tax. Washington is one of only seven states with no income tax. The other seven (Alaska, Florida, Nevada, South Dakota, Texas and Wyoming) have other sources of revenue, including from oil, minerals, gambling and tourism. On average among the states, individual income taxes contribute about one-third of General Fund revenues.

Sources of State Revenue, Washington and U.S. Average, 2007

Income taxes help other states keep up with the demand for services because personal incomes grow at the same rate as overall economic growth. In contrast, the sales tax, which provided 56.5% of Washington’s General Fund in the 2007-09 biennium, is growing much more slowly. From 2000 to 2009, personal income in Washington grew by 45.2%, but sales tax revenues grew by only 27.3%. This is because people are spending more on services on which sales tax is not charged, for example, health care, beauty salons, and attorneys. People are also buying more goods over the internet – often without paying sales tax.

Percentage Increase in Washington Sales Tax Revenue and State Personal Income, 2000 to 2009

How Initiative 1098 will help

I-1098 will not eliminate fluctuations in state revenue due to cyclical economic conditions – no tax system does that. However, unlike the state’s sales tax, revenue from I-1098’s income tax will help the state keep up with the need for investments in public structures like education and health services over the long run, promoting broad-based economic growth and prosperity in the years ahead.

Want to read more, view citations, or see full size graphs? You can find the full brief (from which this post was excerpted) here: Why I-1098 is Right for Washington ».

Looking for more information about Initiative 1098? Visit the Economic Opportunity Institute website.

More reasons why I-1098 is right for WA: 1 | 2 | 3 | 4 | 5 | 6

More To Read

May 2, 2024

Baby Bonds: A Step Toward Racial and Economic Equity

The Washington Future Fund would bring this innovative, anti-racist policy to the Evergreen State

May 1, 2024

Laws Targeting LGBTQ Youth Aren’t Just Bad for Kids – They’re Bad For The Economy

The harm done by anti-LGBTQ laws expands so much further than queer children and teens

April 26, 2024

What is WA Cares and Why Does It Matter for Washingtonians?

We need to defend this important policy from billionaires looking to save a buck