The U.S. Bureau of Economic Analysis recently published new personal income data that make a strong case for Washington’s new capital gains tax.

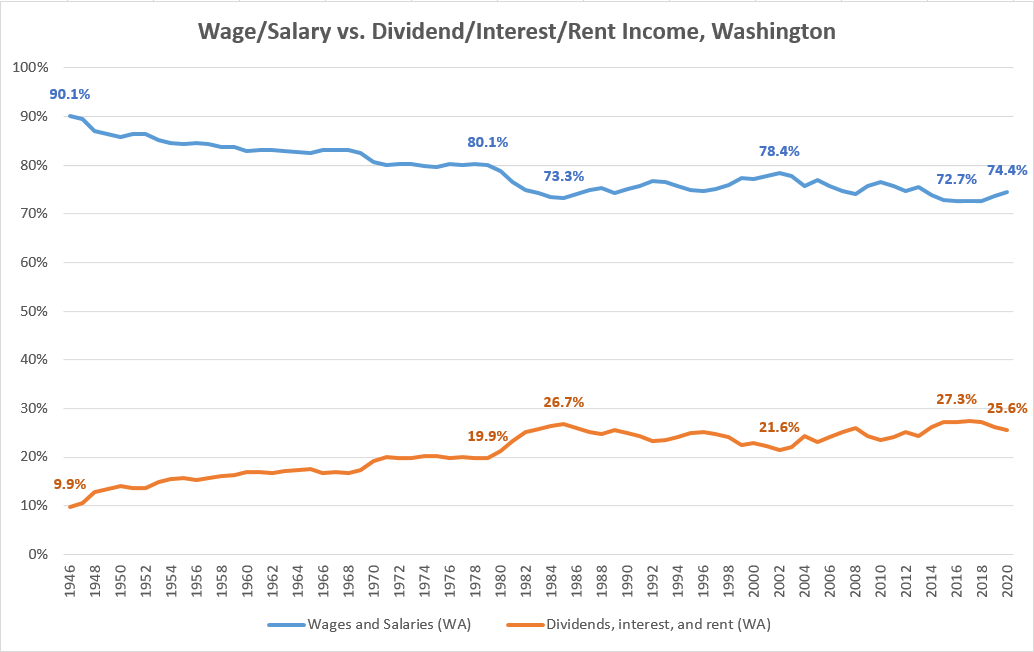

The numbers highlight a long-running trend: On the whole, Washingtonians are getting less of their income from paychecks (wages and salaries) and more from capital gains (dividends/interest) and rent.

At the close of WWII, wage and salary income represented 90 percent of state total personal income – while dividends, interest, and rent made up just 10 percent. (Setting aside income from government transfers, like Social Security.) Fast-forward to 2020, and those numbers are 74 percent and 26 percent respectively:

Source: U.S. Bureau of Economic Analysis, Regional Data: GDP and Personal Income, downloaded 4/28/21.

There are many reasons why taxing extraordinary profits (as Washington’s capital gains tax does) makes sense. Among the most important: it will raise much-needed revenue to support the state’s economic recovery, and it is a step toward both tax justice and broader prosperity for all. The BEA data highlight another reason: that’s where the money is.

The economic, social, and health implications of the COVID-19 pandemic will be with us years to come. Too many families were on the economic edge even before this pandemic struck – and as the World Health Organization and other experts have warned, this will not be the last pandemic we face.

It is crucial that Washington’s state and local policymakers continue strengthening supports for workers, families, children, and vulnerable populations by making additional bold public investments in health, education and other structures and services that promote strong and stable communities all across the state. With vaccines rolling out, that work isn’t ending – it’s just beginning.

More To Read

November 1, 2024

Accessible, affordable health care must be protected

Washington’s elected leaders can further expand essential health care

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.