NOTE: An updated version of this blog post and related fact sheet is now available at: http://www.eoionline.org/2010/06/22/initiative-1098-will-business-owners-pay-state-income-tax-updated/

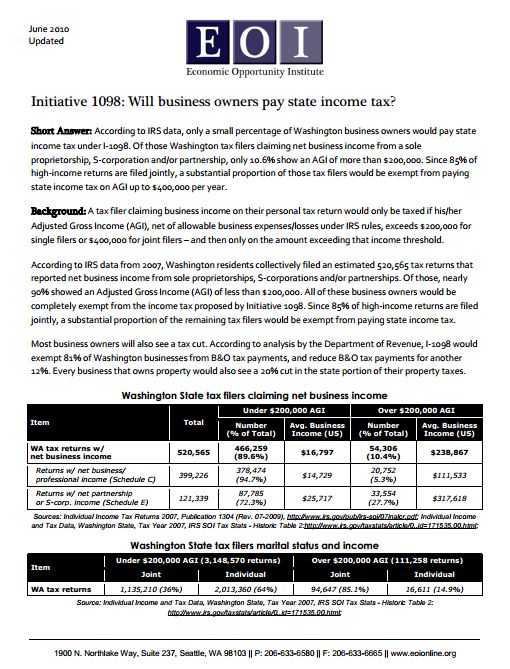

Short Answer: Very few business owners will pay state income tax under the provisions of I-1098. A person claiming business income on their personal tax return would only be taxed if his/her Adjusted Gross Income, net of allowable business expenses/losses under IRS rules, exceeds $200,000 for single filers or $400,000 for joint filers – and then only on the amount exceeding that income threshold.

Background: Of the 452,533 income tax returns reporting business income in 2007, 94% stated an adjusted gross income (AGI) of less than $200,000. All of these business owners would be completely exempt from the income tax proposed by Initiative 1098. Moreover, since 85% of high-income returns are filed jointly, and I-1098’s income tax threshold for households is $400,000, a substantial proportion of those tax filers reporting business income and an AGI above $200,000 will also be exempt from paying the income tax.

Contrary to recent assertion by the Association of Washington Business, only 25% of all returns over $200,000 filed in Washington in 2007 included any business income (not 68%). And only 3.4% of income earned by those over $200,000 came from business income (not 21%). The average business income for filers reporting an adjusted gross income of greater than $200,000 was $78,458 – meaning the majority of their income is derived from sources other than their businesses.

From EOI’s fact sheet: Initiative 1098: Will business owners pay income taxes?

Looking for more information about Initiative 1098? Visit the Economic Opportunity Institute website.

More To Read

November 1, 2024

Accessible, affordable health care must be protected

Washington’s elected leaders can further expand essential health care

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.