The inequalities of gender, race and income that plague U.S. society directly impact the lives of King County’s older residents. Income in retirement is based on earlier earnings, and so reflects inequities in educational and employment opportunity. A lifetime of stress and economic insecurity can result in poorer health and shorter life spans in later years.

Making policy changes that increase economic security for younger working families now, with particular attention to gender and racial disparities, will improve outcomes for all generations.

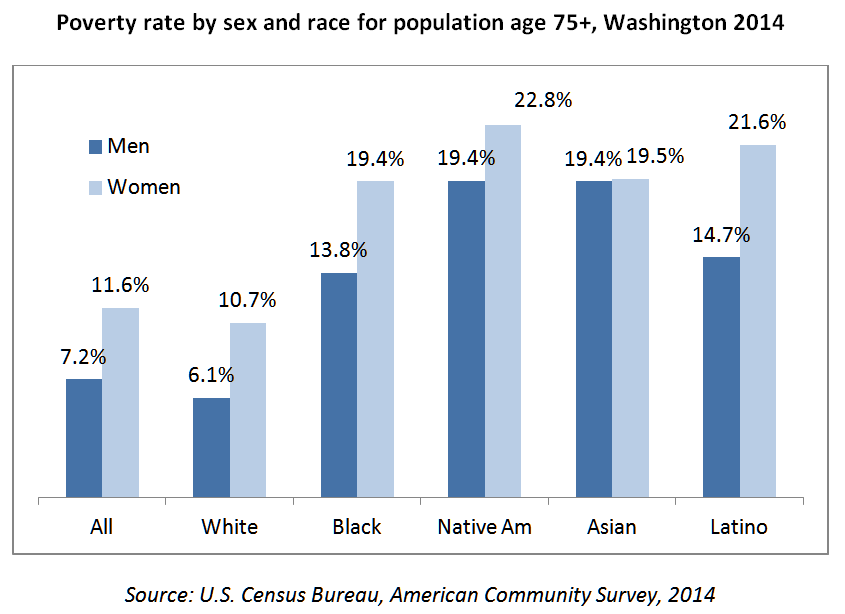

Among Washingtonians, 8.5 percent of women and 6.5 percent of men between the ages of 65 and 74 have incomes below poverty (about $12,000 for a single person or $16,000 for a couple). In later retirement, economic insecurity becomes more likely as partners die, assets are exhausted, and the possibility of earning additional income diminishes.

Disparities are more extreme by race than by gender—at every age. Older women of color are twice as likely as white women to experience poverty, and three times more likely than white men.

Many people above the federal poverty line also struggle to make ends meet. According to a Kaiser Family Foundation analysis, 27 percent of Washington seniors have incomes below 200 percent of poverty. Nationally, half of Blacks and Latinos over 65 as well as half of women over 80 of all races fall in that low-income range. Seniors at all income levels often feel the pinch of out-of-pocket health care costs, and the share of income that older Washingtonians must spend on housing has been rising steadily.

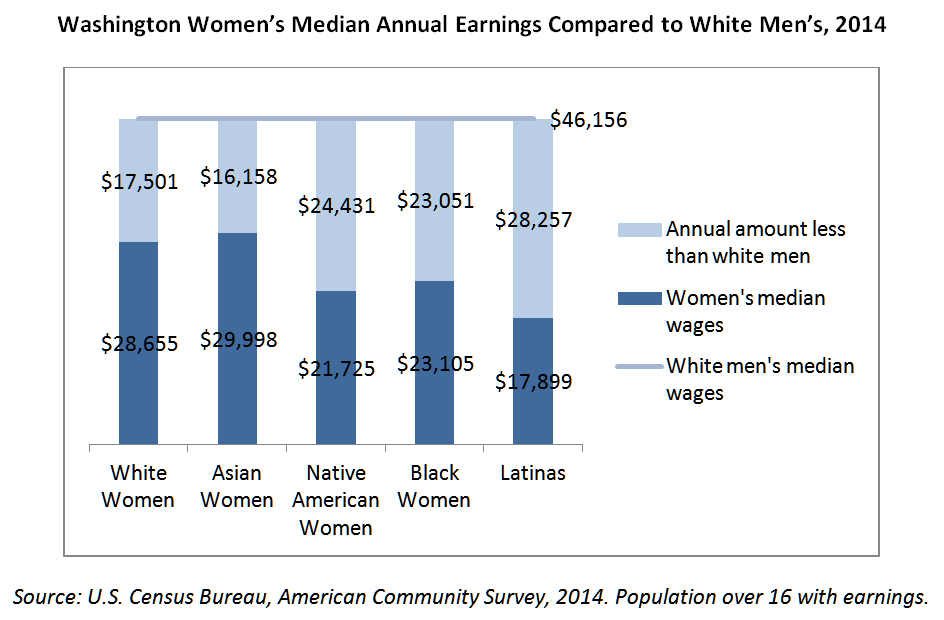

The gender pay gap hurts women and families at every life stage, and is a major contributor to economic insecurity for older women. Single women, women of color, and LGBTQ women typically feel these impacts the most.

Women now make up half the workforce and earn the majority of college and graduate degrees. They still are paid less than men in virtually every occupation. White women in the middle of the income spectrum have to work full-time for a little over 15 months to bring home what a white man can make in 12 months. Black women must toil away for nearly 19 months and Latina women for 22 months to hit that mark.

Depending on race, typical Washington women bring home between $16,000 and $28,000 less each year than white men. Men of color face a less extreme, but still pronounced, wage gap as well. As a result, families struggle to cover basic expenses and businesses have fewer customers.

Many factors contribute to the wage gap, including differences in occupation and time out of the workforce for family care. But discrimination continues to play a role. Men more often get rewarded with the plum assignments and promotions, while strong women are considered “difficult” and sidelined. Even in college science classes, women must significantly out-perform men to be considered knowledgeable by male peers.

Multiple studies have documented a motherhood penalty, with women losing approximately five percent of wages per child when other factors are held constant. Employers tend to evaluate mothers (but not fathers) and people of color more harshly, and are less likely to interview job applicants with ethnic-sounding names. Pay secrecy policies allow employers to get away with paying different wages for similar work.

Lack of access to paid sick days and paid family leave compound the impacts on both short- and long-term economic security. Women are more likely to be employed one year following childbirth—and for higher wages—when they have access to paid maternity leave. Despite the myriad documented benefits to health and wellbeing, California, New Jersey, and Rhode Island are the only states that now guarantee all workers paid family leave. In Washington and the other states, it tends to be the highest paid professional and tech workers who get these benefits.

Lower pay reduces future Social Security and other retirement income. So does time out of the workforce for any reason. Women tend to take more time out than men for family care. Black and Latina women in Washington were also more likely to beunemployed in 2015 than the men in their communities or White workers of either gender. Consequently, women receive on average $4,000 less each a year in Social Security retirement benefits than men.

Only about half of workers have any type of employer-sponsored retirement plan, and employers are most likely to provide these benefits to high-wage and full-time workers. Women are less likely to have retirement plans offered by an employer, but more likely to participate when they are. Well-to-do households can accumulate large, tax-favored retirement accounts, but the typical householder aged 55 to 64 has only$12,000 in retirement savings.

Social Security protects most seniors from dire poverty, but simple reforms would help many now living on the edge. The current benefit formula is already adjusted for family size and progressive, that is, replacing a higher percentage of income for low-wage workers than for the highly paid. But the formula could be tweaked to boost the lowest benefits further and to lessen the financial blow to the survivor when a spouse dies. Basing retirement benefits on 30 years of work history rather than the current 35 would also boost benefits for many women. These benefit improvements could be paid for by “scrapping the cap”—having the highest wage workers pay in at the same rate as the lowest wage.

Other policy changes that address racial and gender disparities and boost economic security for working families now would make a big difference for future generations of seniors. A higher minimum wage, paid sick days, paid family and medical leave insurance, stronger equal pay protections, and an end to mass incarceration would increase both current and future incomes for many. These policies would provide a basic platform of stability that would allow more people to save and accumulate assets needed to assure comfort in retirement.

[Original: AgeWise King County]

More To Read

May 2, 2024

Baby Bonds: A Step Toward Racial and Economic Equity

The Washington Future Fund would bring this innovative, anti-racist policy to the Evergreen State

May 1, 2024

Laws Targeting LGBTQ Youth Aren’t Just Bad for Kids – They’re Bad For The Economy

The harm done by anti-LGBTQ laws expands so much further than queer children and teens

April 26, 2024

What is WA Cares and Why Does It Matter for Washingtonians?

We need to defend this important policy from billionaires looking to save a buck