Washington is one of seven states that currently has no personal income tax. But our state is more of an outlier than even that number would suggest — because of those seven states, six have an alternative source of revenue that Washington lacks.

Alaska, Texas and Wyoming collect taxes on oil and minerals. Nevada taxes gambling, and Florida tourism. South Dakota applies sales tax to a broad range of services. But Washington, for all its abundant resources, doesn’t have huge mineral or gas reserves, white sand beaches, or a sprawling collection of desert casinos and hotels – and most services are exempt from sales tax here.

As Governor Gregoire attempts to engage voters in “transforming Washington’s budget“, it’s also worthwhile to note that in comparison to the other 49 states:

a) Washington’s state and local taxes are below average, and funding for K-12, higher education and health care is slipping.

b) Washington soaks the poor like no other state — that is to say, our low-income residents pay a higher effective tax rate (over 17%, compared to 2.3% for the state’s wealthiest residents) than in any other state.

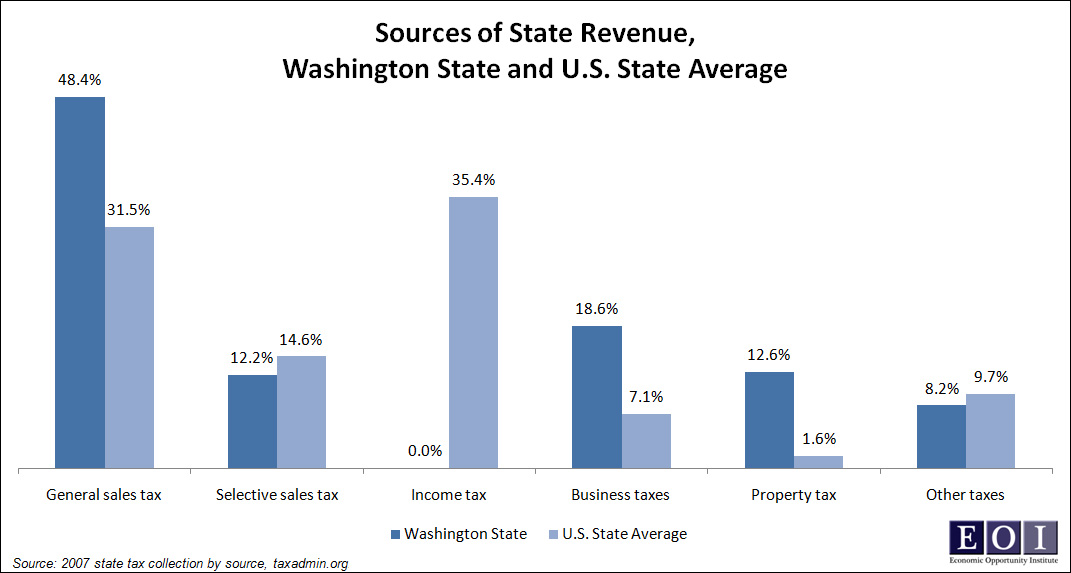

c) As shown in the chart above, Washington State draws a higher than average percentage of revenue from sales, business, and property taxes. (No surprise, really — after all, education, transportation, health care and public safety aren’t free, so without an income tax, our other taxes have to take up the slack.)

But if passed by voters, Initiative 1098 would take steps to remedy all of these imbalances. The measure would eliminate business taxes for 80% of Washington’s businesses (and reduce taxes for another 12%); cut the state portion of the property tax by 20% for residential and commercial property alike; and tax income over $200,000 (single-filer) or $400,000 (joint filer).

I-1098 isn’t going to be a cure-all for our fiscal and economic woes — there are many pieces to that puzzle. But it would be a step in the right direction for Washington State.

Note: These graphs were created based on data provided by the Tax Foundation and the National Federation of Tax Administrators.

Looking for more information about Initiative 1098? Visit the Economic Opportunity Institute website.

More To Read

November 1, 2024

Accessible, affordable health care must be protected

Washington’s elected leaders can further expand essential health care

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.