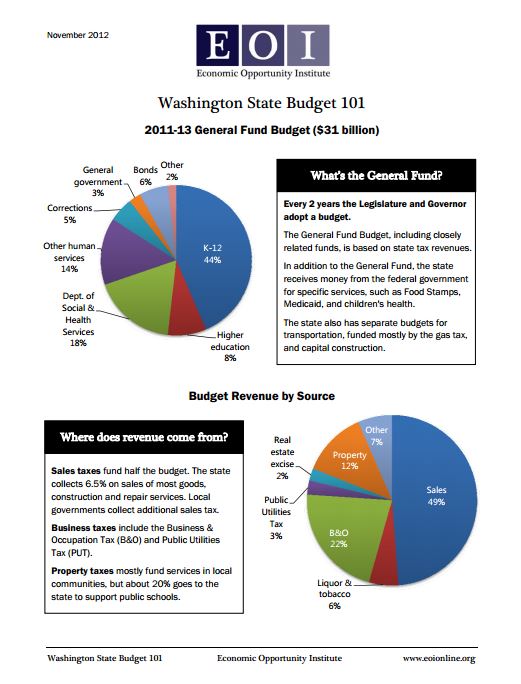

Every 2 years the legislature and Governor adopt a budget.

The General Fund Budget is based on state tax revenues.

In addition to the General Fund, the state receives money from the federal government for specific services, such as Food Stamps, Medicaid, and children’s health.

The state also has separate budgets for transportation, funded by gas tax, and capital construction.

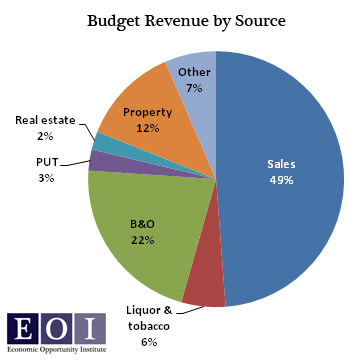

Where does revenue come from?

Sales tax funds half the budget. The state collects 6.2% on sales of most goods, construction and repair services. Local governments collect additional sales tax.

Businesses taxes include the Business & Occupation (B&O) and Public Utilities Tax (PUT).

Property taxes mostly fund services in local communities, but about 20% goes to the state to support public schools.

More To Read

November 1, 2024

Accessible, affordable health care must be protected

Washington’s elected leaders can further expand essential health care

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.