Policy Objective

House Bill 1111 restores fairness to Washington’s tax system by including the investment revenue of wealthy companies and nonprofits in the state’s tax base. Small businesses – many of which are struggling to survive the coronavirus pandemic – pay much higher tax rates than large corporations do in Washington. The bill would also add an estimated $155 million of needed revenue over the next three biennia to meet Washington’s important public service needs that will bolster local economies.

The impetus behind House Bill 1111 was the realization that some of Washington’s largest companies and large nonprofits profit from remarkably large returns on financial investments while enjoying the benefits of an outdated state tax break. A May 2020 New York Times article called attention to the fact that the Providence Health System takes in about $1 billion each year by investing its nearly $12 billion of assets in hedge funds and venture capital funds.[1] None of that $1 billion is taxed in Washington state. In 2020, the tax break on investment returns cost Washington state an estimated total of $270 million in lost tax dollars.[2]

House Bill 1111 removes the investment return tax deduction from the Business and Occupation (B&O) tax for companies and nonprofits outside the finance sector. Under current law, nonfinancial companies and nonprofits deduct investment returns from their revenues prior to calculating their B&O tax on gross receipts. HB 1111 removes this deduction for companies and nonprofits while retaining it for individuals. Under HB 1111, the investment revenue of companies and nonprofits would be classified as “service and other activities,” implying B&O rates of 1.5 percent for taxpayers with less than $1 million of annual receipts in the category and 1.75 percent for taxpayers with larger amounts.

Background and History

Business and Occupation Tax

The Business and Occupation tax is Washington’s primary tax on corporations and is the second largest revenue source for the general fund after the sales tax.[3] Enacted temporarily in 1933 and permanently in 1935, the B&O tax is levied on the gross receipts of all business activities (except utility activities) conducted within the state.[4] Unlike a corporate net income tax, there are no deductions for the costs of doing business.

Because the B&O tax is levied on gross receipts, not profits, its rates are quite low. Washington’s Department of Revenue currently lists 12 different rates. The major rates and classifications range from 0.471 percent for retailing, 0.484 percent for manufacturing, wholesaling, and extracting, to 1.5 percent for services. Along with preferential rates, the B&O tax incorporates nearly 200 credits, deductions, and exemptions.[5]

The B&O tax contributes to the regressivity of Washington’s tax system. Washington’s tax system is consistently ranked among the most regressive in the nation, due largely to its over-reliance on the sales tax for state revenue.[6] Overall, the B&O tax functions like a sales tax, imposing its higher rates relative to income on lower-income businesses and households.[7] In addition, under the B&O tax, new and expanding businesses have a relatively higher tax burden than their more established counterparts.[8]

Investment Returns Exemption

The Legislature voted in 1934 to amend the B&O tax to exempt the investment returns of nonfinancial businesses and nonprofits. The stated rationale for the exemption is to “avoid taxing the income from investment of incidental surplus funds of businesses.”[9] For non-financial firms, returns on financial assets—interest, dividends, capital gains–are not considered part of their primary business activity and are therefore “incidental” and not relevant to business taxation. However, asset returns are taxed in the case of financial firms, where financial investing is the primary business activity.

Nearly a century later, the distinction between financial and nonfinancial firms is naïve and outdated. When a hospital chain like Providence oversees venture capital funds with $300 million in assets and pays its chief executive more than $10 million, the caricature of a small business prudently saving reserves in a bank account no longer applies.[10] Generating financial returns is no longer an “incidental” activity for Washington’s large corporations.

The Legislature should act to remove the exemption that encourages businesses and large nonprofits to speculate in financial markets at the ordinary taxpayer’s expense.

Revenue Implications

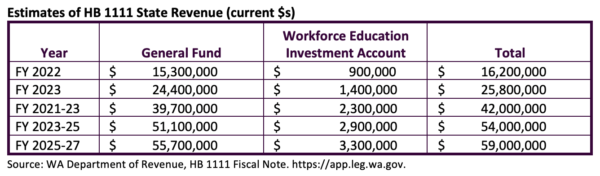

The Washington Department of Revenue estimates the revenue associated with removing the tax break as $42 million in the 2021-23 biennium, $54 million in 2023-25, and $59 million in 2025-27.

Reasons to support HB 1111

- HB 1111 generates additional revenue for Washington state at a time it is desperately needed. The state faces deep needs brought on by the pandemic coupled with an increasingly inadequate and insufficient tax system. HB 1111 would take effect October 1, 2021, providing an estimated $155 million in revenue in the next three biennia.

- HB 1111 moves Washington’s tax system toward fairness. HB 1111 removes an unfair tax break. The measure imposes a low tax rate, 1.5 to 1.75 percent, only on those companies and nonprofits prosperous enough to have sufficient revenues to be making investments to increase their earnings. It very slightly increases the B&O tax paid by companies and nonprofits with cash to spare. At the same, it has a minimal impact on small or struggling businesses and nonprofits, who do not have sufficient revenue to engage in investment activities.

- HB 1111 encourages businesses and nonprofits to put their resources to work. By removing a tax break for passive investment activities, the measure gives businesses greater incentive to use funds to expand their activities through investing in employees, equipment, and research, rather than using their funds to generate returns passively. Likewise, it encourages nonprofits to put their funds into services rather than financial markets.

- HB 1111 broadens the tax base. Tax experts agree that the best tax systems impose low rates on a broad range of economic activity. By removing the exemption for investment activity, HB 1111 slightly broadens Washington’s tax base while still imposing low rates. The measure also increases tax neutrality by removing an exemption that favored one sort of economic activity-investing-over the core activity of businesses and nonprofits.

- HB 1111 adds transparency to Washington’s economy. HB 1111 would require large businesses and nonprofits to report their investment earnings. This reporting adds transparency to Washington’s economy.

- HB 1111 simplifies Washington’s tax system. The measure simplifies the tax system by removing one of the many exemptions that adds complexity to the business and occupation tax.

Removing the tax break for investment revenue is sound economic policy. HB 1111 generates revenue for the state of Washington at a time when it is critically needed. The measure also represents a small step toward increasing the fairness, simplicity, and transparency of Washington’s tax system.

Notes

[1]The article also pointed out that Providence had received at least $509 million in federal coronavirus assistance, despite its substantial financial reserves. https://www.nytimes.com/2020/05/25/business/coronavirus-hospitals-bailout.html

[2] $270 million is the estimated loss of tax revenue across individual, businesses, and nonprofits. https://dor.wa.gov/about/statistics-reports/2020-tax-exemption-study-data-visualization

[3]https://leg.wa.gov/LIC/Documents/EducationAndInformation/Guide%20to%20WA%20State%20Tax%20Structure.pdf

[4] See Smith, Jason, 2002, for a history of Washington’s tax system.

[5] In 2020, the Washington’s Department of Revenue listed a total of 195 exemptions: 23 credits, 47 deductions, 10 exclusions, 85 exemptions, 29 preferential rates, and 1 waiver https://dor.wa.gov/about/statistics-reports/tax-exemptions-2020.

[6] https://itep.org/about-who-pays/, https://www.seattletimes.com/business/economy/washingtons-paradox-progressive-politics-but-regressive-tax-system/

[7] The analysis is complicated by the multiples rates and preference of the B&O tax.

[8] https://dor.wa.gov/about/statistics-reports/tax-structure-final-report, p. 23.

[9] JLARC Report 09-11: 20091. Full Tax Preference Performance Reviews, p. 50.

[10] https://www.nytimes.com/2020/05/25/business/coronavirus-hospitals-bailout.html

Sources

A Legislative Guide to Washington’s Tax Structure, 2020. Prepared by Senate Ways and Means Committee staff and the Legislative Evaluation and Accountability Program.

Drucker, Jesse, Silver-Greenberg, Jessica, and Kliff, Sarah. 2020. Wealthiest Hospitals Got Billions in Bailout for Struggling Health Providers. New York Times. May 25, updated July 1.

https://www.nytimes.com/2020/05/25/business/coronavirus-hospitals-bailout.html. Accessed March 14, 2021.

Economic Opportunity Institute. 2002. A Concise History of Washington’s Tax Structure. Prepared by Jason Smith. August.

Fox, William F., Luna, LeAnne, and Murray, Matthew N. 2007. Emerging State Business Tax Policy: More of the Same, or Fundamental Change? State Tax Notes, May 7. 393-405.

Kooiker, Darcy. 2016. Understanding Gross Receipts Taxes and Steps for Complying with Washington State and City Business and Occupation Taxes. Journal of State Taxation, Fall. 19-36.

Washington Department of Revenue. 2011. Small Business Tax Simplification: A Report to the Governor. Suzan DelBene, Director. June 29, https://dor.wa.gov/sites/default/files/legacy/Docs/Reports/TaxSimplificationReport.pdf

Washington Department of Revenue. 2016 Tax Exemption Study: Business and Occupation Tax.

Washington Department of Revenue.2020 Tax Exemption Study: Business and Occupation Tax.

More To Read

March 20, 2024

I-2111: The Income Tax Ban Is A Spectacle, but One We Can’t Ignore

A way to waste time, energy, and money, I-2111 is costing more than just taxes

February 2, 2024

What is REET and Why Do We Need to Reform It?

Washington State lawmakers have the chance to make a progressive tax more progressive and provide a permanent funding source for affordable housing

January 23, 2024

Report: Washington no longer has the most regressive tax structure in the nation

This is both cause for celebration and a call to action