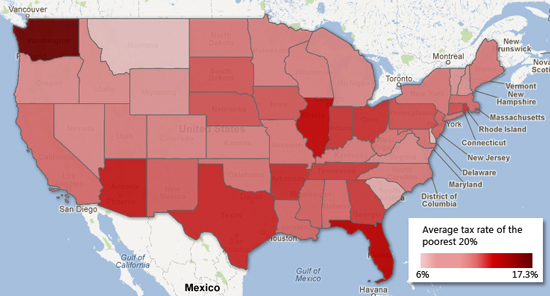

Let’s hear three jeers for Washington, which yet again has the ignoble distinction of the most regressive tax structure in the nation – a “soak the poor” system where those with the least pay the highest tax rates.

An updated report from the Institute on Taxation and Economic Policy (ITEP) that examines how state tax systems influence poverty levels found that for the most part, state taxes do little for families living in poverty. In fact, many systems actually make it more difficult for families living on the margins – because most states tax the poor at a much higher rate than the wealthy.

Washington is (unfortunately) the worst of them all. In 2011, the poorest 20% of Washingtonians – with an average income of just $11,000 – paid 17.3% of their income in state and local taxes. The closest runner-up Florida, where the poorest residents paid at an average rate of 13.5%. At the other end of the income spectrum, Washington’s top 1% pay an average rate of 2.6%, and Florida’s pay an average rate of just 2.1%.

Not surprisingly, Florida and Washington have something in common: both lack a state income tax. Instead, residents pay higher-than-average sales, business and property taxes.

Income taxes are typically less regressive overall because they usually have a built-in exemption, meaning a certain amount of money must be earned before it is subject to income tax. In neighboring Oregon, for example, the first $3,100 earned is exempt from income tax. ITEP reports the poorest 20% of Oregonians pays an average tax rate of just 8.7%. Income taxes are also scaled progressively, so higher earning individuals – who can typically afford to pay a little bit more – do.

Sales taxes have no such income exemption. So even though the same sales tax rules and rates apply to all, it takes a much bigger bite from those with lower incomes, who must spend far more of their income than their high-income counterparts for everyday items like diapers, clothes, or a restaurant meal.

Of course, Washington’s tax structure isn’t just regressive and unfair. It’s also pretty bad at funding public services, actually violating the state Constitution which requires “ample” funding for public education. That’s life when you’re first at being worst.

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits