From the report Evaluating Paid Sick Leave

Part 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |10

In February 2007, San Francisco implemented the nation’s first paid sick days law. It establishes a minimum standard of paid sick leave for all workers within the city.

Workers earn one hour of paid leave for every 30 hours worked. Accrual is capped at 40 hours for workers in companies with fewer than 10 employees and at 72 hours in larger companies.

Employers in San Francisco

The most comprehensive survey of San Francisco employers conducted since implementation of the paid sick days ordinance, found that after three and one half years of experience over two thirds supported the ordinance, with 34% very supportive.

Altogether 64% reported making no changes to paid leave policies as a result of the paid leave ordinance. Thirty-one percent reported making some changes, with 17% each enacting a new policy and expanding a policy to more workers, and 16% increasing the accrual rate.

Among the smallest employers with fewer than 10 employees, 21.6% continued to report not providing paid sick leave. The vast majority of larger employers were in compliance with the law. In looking at the bottom line, 71% of employers said the ordinance made no difference, while 14% reported decreased profits and 15% said they did not know if profits were affected.

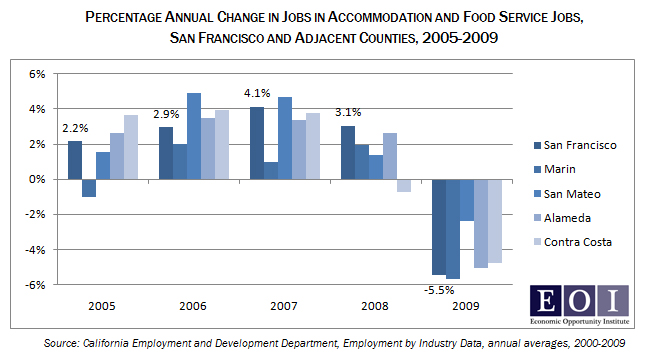

The majority of employers reported having little difficulty understanding and administering the ordinance. Those in accommodation and food service were more likely than all employers to report difficulties in these areas, with 50% reporting some difficulty understanding and 58% some difficulty administering.

Nevertheless, 66% of accommodation and food service employers reported supporting the ordinance, just under the overall rate of 68%.

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits