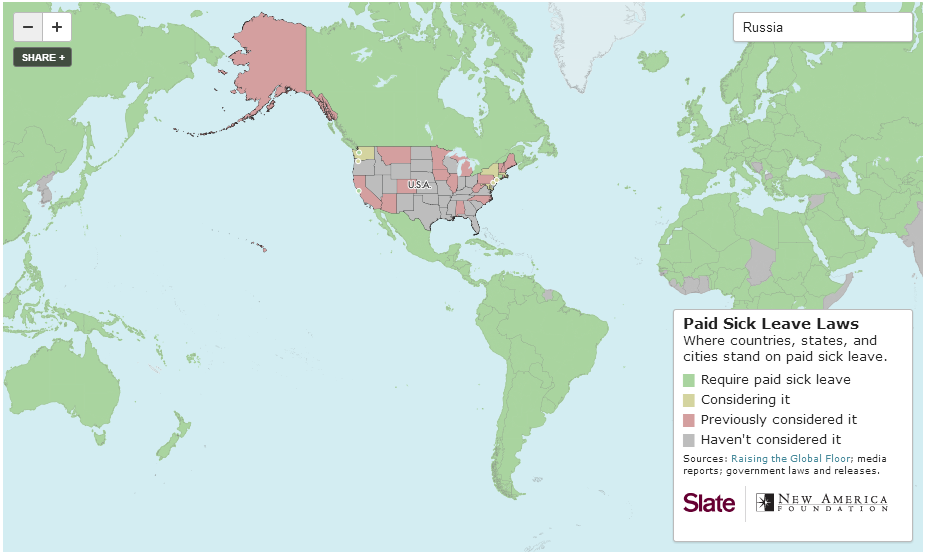

Countries that require paid sick days are shown in green. Click for a full-size interactive map from Slate.

New Jersey is one of just a handful of U.S. states that offers paid family leave, allowing workers up to six weeks of paid time off to bond with a new baby or care for a seriously ill family member. Now, New Jersey State Assemblymembers are set to consider another pro-worker/family bill that would allow all workers in the Garden State to earn paid sick days.

Over 1.2 million workers in New Jersey – or 38% of the state’s private sector workforce – cannot take one paid sick day. When faced with the impossible choice between keeping up on the rent and work sick, many workers have no choice but to go to work sick.

Assemblywoman Pamela R. Lampitt introduced the bill on Monday following the expected passage of a paid sick days bill in New York City. Other cities and that have passed paid sick days laws include Seattle, WA; Portland, OR; Washington, D.C; San Francisco, CA; and Connecticut.

Phyllis Salowe-Kaye, Executive Director of NJ Citizen Action and Co-chain for NJ Time to Care said of the bill:

Providing earned sick days would ensure that no one has to choose between a paycheck and caring for their own health or that of a sick family member. The Legislature should move quickly to pass the bill so families across the state can take time to care when they need it without fear of losing critical income – or even their job.”

The workers most likely to lack paid sick days are lower-wage earners employed in restaurants, hotels, child care centers, retail stores and nursing homes. The proposed legislation would allow people working 30 hours/week to earn about 8 paid sick days in a year, and could be used to recover from an illness, care for a close family member, obtain preventative or diagnostic treatment or deal with fallout from domestic violence.

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits