Now that the legislative session is over, advocates and policymakers have turned their attention to another critical issues: the bundle of three conservative initiatives headed to the ballots this November. Under the umbrella of a campaign called “Lets Go Washington,” these dangerous initiatives are the brainchild of right-wing multi-millionaire Brian Heywood.

Heywood, who the Seattle Times’ Jim Brunner called “Tim Eyman with a gigantic bank account,” ran a $6 million paid petition campaign over the course of the last year. Three of these measures were passed by the Legislature in March. The other three will be on your November ballot — and that’s bad news for working people in Washington. Because these initiatives threaten to roll back the critical progressive wins that keep our air clean, our roads safe, our public schools funded, and our elderly cared for.

Here’s what you need to know about the three initiatives you’ll be voting on this fall:

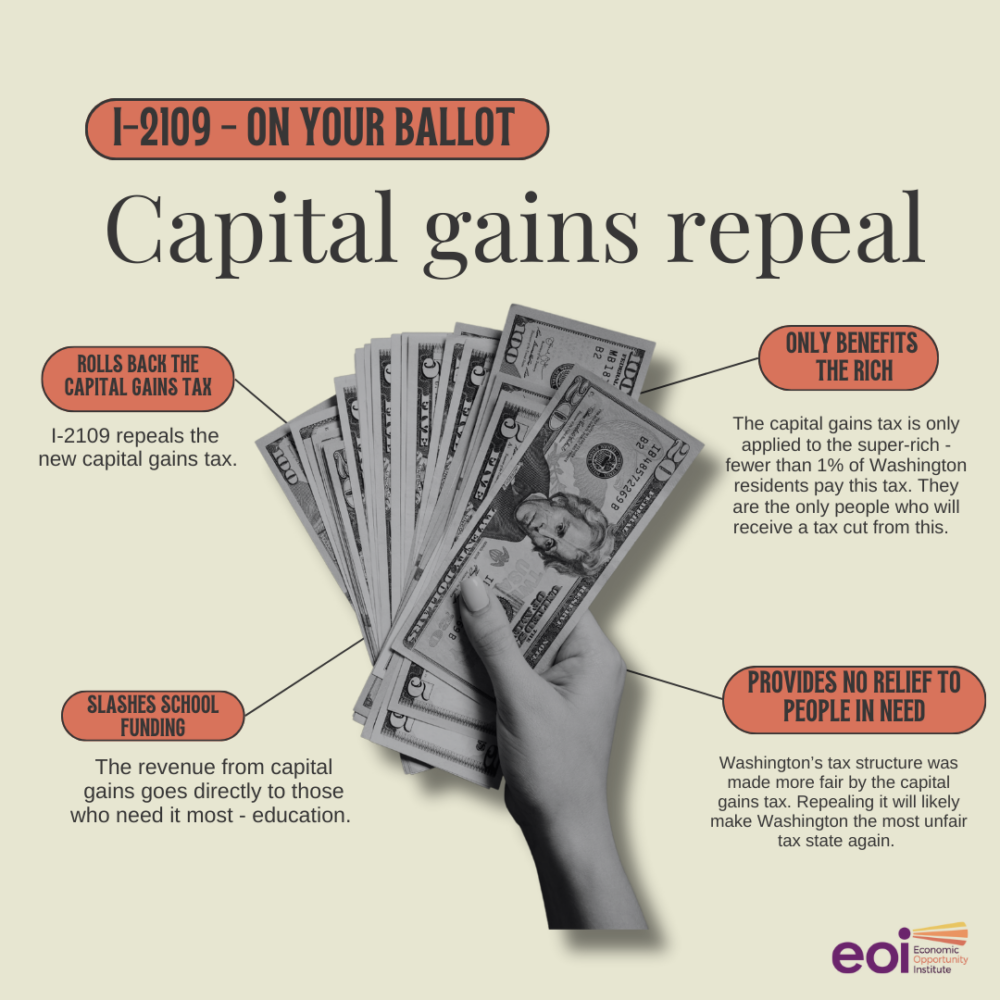

Initiative 2109: Repealing Washington’s Capital Gains Tax on the Wealthy

This initiative would repeal one of Washington’s few progressive taxes, the state’s capital gains tax on the wealthy. The capital gains tax was hard won by advocates and lawmakers in 2021 and has since become a cornerstone of education funding.

The tax applies a marginal tax on the profits from sales of assets (like stocks and bonds) that exceed $250,000. Only around 3,700 of Washington’s wealthiest residents pay into this tax. However, the revenue it generates funds programs and services that impact everyone.

In just its first year, this tax raised nearly $900 million for early learning, K-12 education, and school construction.

Washington has one of the most upside-down tax codes in the nation. That means that our poorest residents pay a far higher percentage of their income in taxes than our highest earners. For years, advocates, including EOI, have been fighting to fix this system, not make it worse. Washington residents are facing steep financial challenges, which means that this initiative just doesn’t make sense.

Now is not the time to consider adding yet another tax break for the wealthy — which is exactly what this means. No middle-class, working Washingtonians will benefit from repealing the capital gains tax

If Heywood succeeds in repealing the capital gains tax, we endanger school construction in rural communities. We risk cuts to infrastructure funding. And we’ll reduce funding for childcare and early learning at a time when thousands of Washington families can’t afford it.

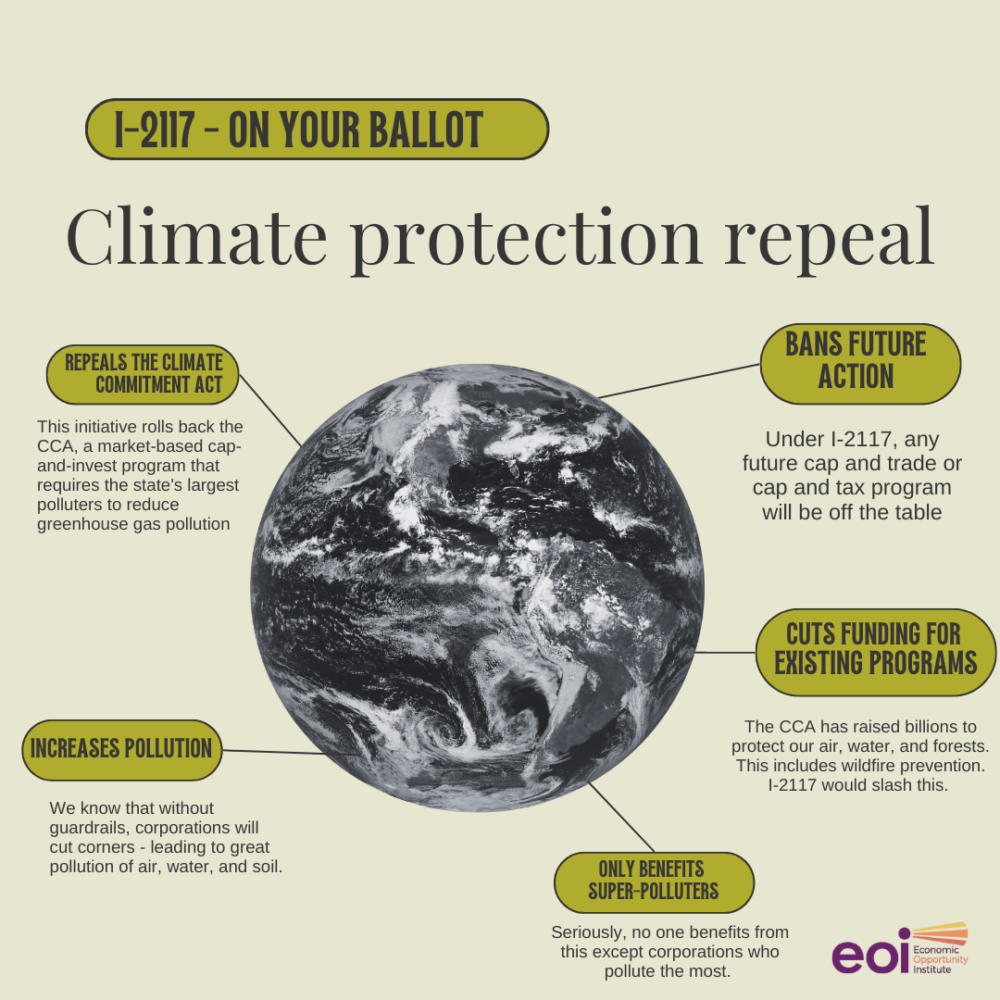

Initiative 2117: Rolling Back Washington’s Historic Climate Commitment Act

Washington has led the nation with regard to climate change. We have taken real action to ensure that the worst polluters are held accountable. This initiative would directly counteract that work.

If passed, it would repeal the Climate Commitment Act. Repealing the CCA would end “cap and trade” limits, which outline how much carbon companies can produce, and revoke the emissions allowances those companies are now required to buy.

With just one vote, we would lose protections for our air, water, forests, and farmlands.

The revenue generated by the CCA is also hugely important. That money pays for electric buses and ferries, wildfire protection, solar panels, salmon recovery, and much, much more. If we repeal cap-and-trade, we’ll lose all of that funding and the benefits it brings. We’ll also likely see higher taxes when the state inevitably looks for funding elsewhere.

Big polluters are among the most profitable companies in the world. The last thing we should do is give them a tax break by repealing a law that protects consumers and finally makes polluters pay.

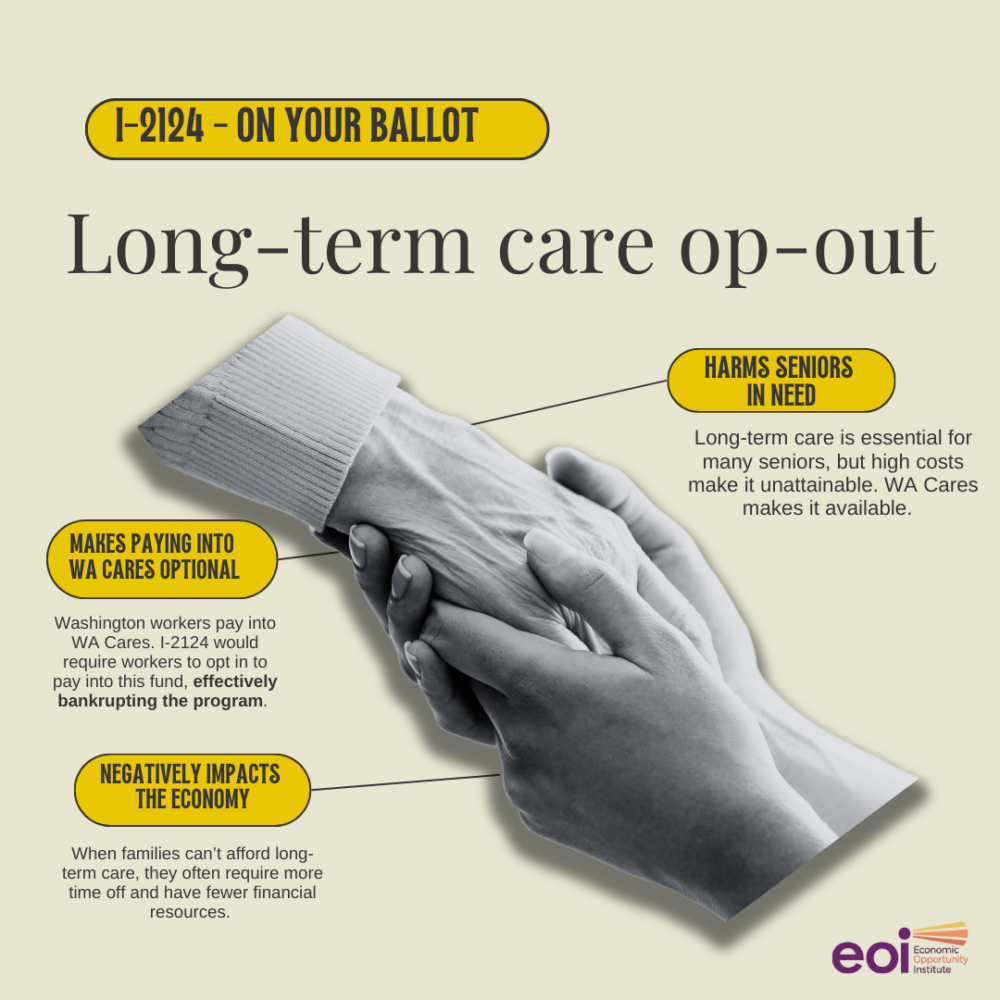

Initiative 2124: Cutting Long Term Care Coverage for Working Washingtonians

Messaging for this bill makes it sound like it will provide lower taxes for workers. In reality, it will rob Washington’s seniors of future care.

This initiative would allow people to opt out of a small payroll tax which just went into effect last year. The revenue goes directly into the WA Cares fund, which helps pay for long-term care. The WA Cares fund can only be used for the purposes of paying for long-term care for Washington workers.

It’s not an especially prohibitive tax — but the rewards are substantial. The program costs 58 cents out of every $100 a worker makes. For a person with a $50,000 annual salary, that’s about $290 a year. In exchange, starting in 2026, those workers are eligible for $36,500 (adjusted for inflation) to cover long-term health care costs.

While proponents claim this is about giving people a choice, expert analysis shows that I-2124 will bankrupt Washington’s long-term care program. By making contributions to the fund optional, this initiative ensures that it will not have enough money to operate. Instead of providing essential services — as is the role of government — Let’s Go Washington seeks to throw every single Washington consumer back to the mercy of expensive long-term care insurers only the wealthiest can afford.

Heywood is a multi-millionaire, so he’s probably fine paying out of pocket. Meanwhile, most people aren’t so lucky. If his initiative passes, it will destabilize funding and eliminate an important public benefit. And in doing so, it will directly harm those who need help paying for long-term health care support and can’t afford private insurance.

How Did We Get Let’s Go Washington?

These initiatives seemed to have swept down out of nowhere, but importantly, there’s a machine behind them. While Heywood may be the funder, he hasn’t been acting alone. This bundle of initiatives has support from inside the Legislature, too.

The Let’s Go Washington campaign is sponsored by Washington State Republican Party Chair Jim Walsh. The initiatives echo many of the Trump-era policies he’s been trying to get passed since his election in 2017. Unable to get them through the Democratically-controlled Legislature and signed by a Democratic governor, now he’s trying something new.

But we can’t let rhetoric about “saving the taxpayers” take hold. These initiatives are expressly designed to promote a conservative austerity agenda — one that both voters and Walsh’s colleagues have repeatedly rejected. The existing laws that Let’s Go Washington is targeting are ones that were either passed by the voters or by the lawmakers we elected and they have support.

In other words, these initiatives are a way to force through policies that simply do not match with what Washington residents chosen for years.

Washingtonians want to keep our air clean, keep our roads safe, and keep our public schools funded. That’s why we continue to put policymakers in office who prioritize climate justice, community safety, and education funding.

Jim Walsh and Brian Heywood want to see how much it costs to buy legislation in Washington state. And that’s what’s really on the ballot this November: Whether or not we will allow our state politics and values to be bought and paid for.

More To Read

January 6, 2025

Initiative Measure 1 offers proven policies to fix Burien’s flawed minimum wage law

The city's current minimum wage ordinance gives with one hand while taking back with the other — but Initiative Measure 1 would fix that

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax loopholes for big tech are costing Washington families

Subsidies for big corporations in our tax code come at a cost for college students and their families