The National Federation of Independent Businesses is ignoring survey results from its own members in order to oppose a minimum wage increase.

The percentage of firms reporting labor costs as their major concern has shown no upward trend, despite minimum wage hikes both in July 2008 and July 2009.

The National Federation of Independent Businesses (NFIB) has already been criticized for its opposition to the Affordable Care Act, despite the law’s demonstrable benefits for small business owners. Now it appears the NFIB is ignoring its own members’ feedback on a possible minimum wage increase, according to the Center for Economic Policy Research:

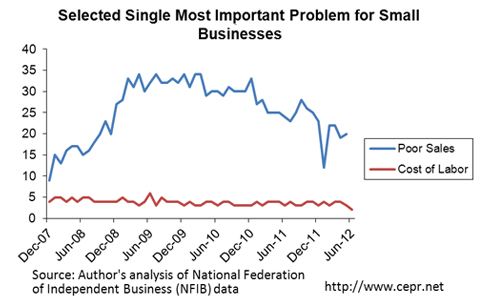

While the NFIB warns that minimum wage increases would create serious cost problems for small businesses, few of their members list “labor costs” as their “most important problem.” Instead, what we see from the NFIB survey results is that the percentage of small businesses listing labor costs as their most important problem has hovered consistently between 3% and 5% since the beginning of the recession in December 2007. In the most recent data, the percentage fell to 2%, its lowest level since the start of the recession.

It appears the real problem facing the NFIB’s small business members is that they don’t have enough customers to generate sales:

At the onset of the recession in December 2007 about 9% of firms said that poor sales were their most serious problem. By 2009 and 2010, the share citing poor sales was as high as 34%. In the most recent data, about 21% of all firms still list poor sales as their biggest challenge.

There’s an easy way to fix that: increase the minimum wage, so people have money in their pockets to go shopping. (This is a very popular idea, btw – and it works.)

The NFIB claims to use a “unique member-only ballot” for members to send their views to lawmakers – but clearly, member views on worker compensation have had little impact on the NFIB’s ideological agenda: their opposition to a minimum wage increase is on record as recently as May 17. You’ve got to wonder: how much longer can the NFIB claim the mantle of “the voice of small business” while ignoring what its own members are telling them?

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits