The Pew Research Center reports that more Americans are worried about financing their retirement – and for good reason.

The Pew Research Center reports that more Americans are worried about financing their retirement – and for good reason.

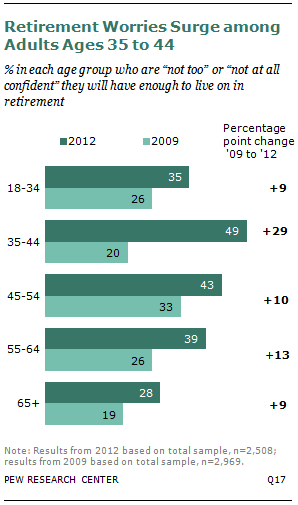

In a recent survey, 38% of respondents said they were “not too” or “not at all” confident they would have enough income and assets for retirement, a big increase from 25% who responded that way in a similar survey in early 2009.

Generational concern has also shifted. In 2009, the Baby Boomer generation was most worried about outliving their retirement savings. Now, it’s their older sons and daughters – people in their late 30s – who report the most concern regarding their retirement.

This age group is concerned, and rightly so. Since 2010, the median wealth of adults aged 35-44 was 56% lower than it was for their counterparts in 2001, the steepest decline among and age group during that decade. In dollars, it amounts to a $56,029 decrease in the median net worth of those in the 35-44 age group, as compared to their counterparts in the early 2000s.

It’s no coincidence that this age group is concerned about retirement at a time when wild swing in the stock market have decimated 401(k)s, home values are stagnant or falling, pensions are quickly becoming a thing of the past, and Social Security is under attack.

Restoring retirement security starts with shoring up Social Security, which has been a target of attack for decades. To maintain and strengthen Social Security, Congress should eliminate the wage cap, so millionaires and billionaires may the same rate into Social Security as ordinary, working class Americans. This tweak, known as scrapping the cap, would virtually close Social Security’s projected funding gap, and ensure benefits could be strengthened for generations to come.

Boosting retirement security also means supporting the expansion of pensions – which keep millions out of poverty – and making it easier and cheaper to save for retirement by pursuing universal retirement savings options. Supporting all three pillars of retirement security – pension, savings, and Social Security – is critical to restoring American’s confidence in a safe and secure retirement.

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits