President Donald Trump and House Republican Leader Kevin McCarthy

Until now, cuts to Social Security payroll taxes seemed like mostly a Trump thing, with GOP leaders themselves rather…skittish…about a proposal that would cut funding for Social Security, one of America’s most beloved and beneficial government programs.

Now it looks like a party-line proposal, as Bloomberg news reporter Erik Watson tweets that according to GOP Leader Kevin McCarthy, the proposed GOP stimulus bill includes a payroll tax cut.

How terrible an idea is this? Los Angeles Times columnist Michael Hitzik says it real loud for those in the back:

A payroll tax cut…would do nothing to help Americans who need the most help. To benefit from the cut, a worker must be paying the payroll tax. That’s not happening for the roughly 32 million Americans who have filed for unemployment benefits in the last few months because of the pandemic, because by definition they’re no longer on a payroll.

The tax cut would have zero benefit for millions of Americans who don’t pay into Social Security, including many state and local workers who aren’t covered by the system and seniors already receiving Social Security benefits, who are no longer paying the tax.

Moreover, even for many workers still receiving paychecks, the tax cut would be relatively trivial. If the payroll tax of 6.2% were to be cut in half, that would give a household collecting $50,000 a year in wages a benefit this year of $1,550, or about $30 a week.

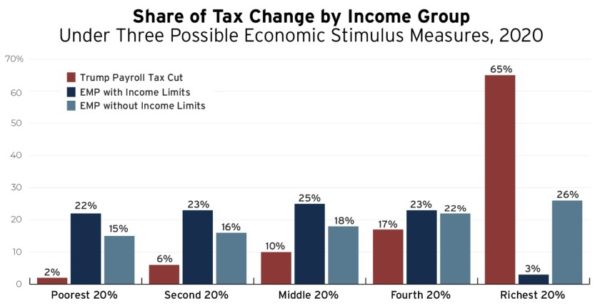

So why the interest in a proposal that will do so little for so many? Just follow the money: according to the non-partisan Institute for Taxation and Economic Policy, the richest 20% of Americans would get two-thirds of the benefits:

Two-thirds of Trump’s payroll tax cut would go to the richest 20% of Americans, with the poorest 40% getting only 6% of the benefit. “EMP” refers to an alternative plan to provide households with targeted lump-sum assistance payments. (Institute on Taxation and Economic Policy)

Color me…unsurprised.

As Hitzik also points out, a payroll tax cut is disdained by economists across the political spectrum — including Michael R. Strain, director of economic policy studies at the pro-business American Enterprise Institute.

But by pushing to cut off the program’s funding stream, President Trump is taking the first step toward dismantling Social Security — a long-sought goal of the far-right politicians who want to portray Social Security and Medicare as the cause of the federal deficit, even after multibillion-dollar tax cuts for corporations and the wealthy.

More To Read

February 27, 2024

Which Washington Member of Congress is Going After Social Security?

A new proposal has Social Security and Medicare in the crosshairs. Here’s what you can do.

February 27, 2024

Hey Congress: “Scrap the Cap” to strengthen social security for future generations

It's time for everyone to pay the same Social Security tax rate — on all of their income

January 22, 2024

“Washington Saves” legislation won’t solve our retirement security crisis. Lawmakers should pass it anyway.

The details of this auto IRA policy matter.