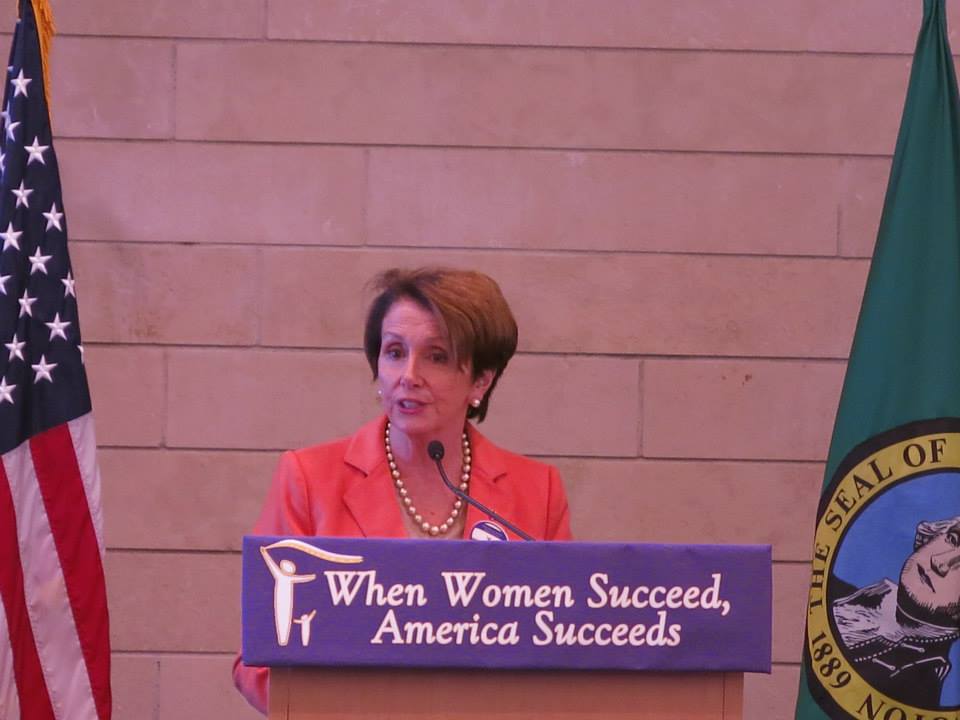

House Minority Leader Nancy Pelosi speaking at a Washington Work and Family Coalition event in November 2013 on women’s economic security.

By House Minority Leader Nancy Pelosi

By helping 1.6 million Californians balance family and work, our state has demonstrated the success of paid family leave – and now it is time for the rest of America to join us.

Paid leave made a tremendous difference to Mary Ignatius when her second son was born with clubfeet. The doctors had explained to her the condition could be corrected, but cautioned that treatment would have to start immediately.

Caring for a newborn and Ignatius’ 4-year-old would have been a handful all on its own, but now there were weeks and weeks of doctors, casts, procedures and leg braces ahead for her baby boy.

Thankfully, Ignatius had access to paid family leave, so she could see her son through his treatments without giving up the paychecks she needed.

Most Americans are not so fortunate. Whether looking after a newborn, or tending to a recuperating family member or nursing a declining parent, too many Americans face an impossible choice between a paycheck they can’t afford to miss and bonding with a new baby or being there in a loved one’s hour of need.

Across the country, only 12 percent of American workers have access to paid family leave through their employers to care for a new child or seriously ill family member. The United States is the only industrialized country in the world that doesn’t guarantee paid maternity leave for new mothers.

For us to grow as an economy and a society, this must change.

Here, as in so many things, California is leading the way for the nation. For 10 years, our paid family leave program has enabled Californians such as Ignatius to take up to six weeks of paid leave to bond with their newborns and newly adopted children, or care for a seriously ill spouse, parent, child or partner. Starting in July, our state will cover care for siblings, grandparents and parents-in-law, too.

The program works by building on the state disability insurance program Californians have paid into for decades, creating minimal added cost to employees. In fact, the silent success of this program has meant that many California workers have no idea they are eligible for paid family leave.

Those who do take paid leave, however, find it invaluable – affording them the breathing room to tend to the health and strength of their families, while maintaining their commitments in the workplace. Businesses and families both benefit.

Expanding paid family leave to all Americans is a central pillar of House Democrats‘ economic agenda for women and families, “When women succeed, America succeeds.”

For our economy to grow, we need to unleash the full potential of women – and strengthen the middle-class families that are the backbone of our democracy.

Paid leave is a keystone of an agenda built to empower all of America’s women, along with raising the minimum wage, insisting on equal pay for equal work and providing affordable, quality child care.

With these measures, we can enable women and men to secure the balance between work and family they need to thrive.

Congress must pass the Family and Medical Insurance Leave Act, which would offer workers 12 weeks of leave at two-thirds of their salary to ensure that working men and women in every state of the union can have access to paid family leave. It proposes increasing the payroll tax contribution by 0.2 percent for employers with a match by employees.

California has once again taken the lead for our nation. Now Congress must act.

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits