Recently, the New York Times released a database examining the incentives and subsidies corporations receive from various states. They identified 48 companies that have received more than $100 million in state grants since 2007, including companies with strong ties to Washington state such as Amazon ($348 million), Boeing ($338 million), Microsoft ($312 million), Weyerhauser ($406 million), and Orca Bay Seafoods ($296 million).

The Times’ database finds Washington state spends $2.35 billion per year on givebacks to corporations – or 15 cents of every dollar spent by the state. Per capita, that’s $349 for every person living in Washington state. By way of comparison, Washington state spent less than half that amount on operating costs at UW, WSU, CWU, EWU, CWU, and 34 Community and Technical colleges combined in 2012.

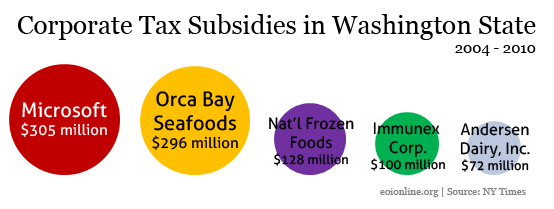

The majority of these exemptions go to corporations engaged in manufacturing, agribusiness, aircraft, and high technology. The Times’ lists these business by name, as well as the amounts they received. Here are the top five recipients of public funds in Washington:

| Amount | Company | Years |

| $305 million | Microsoft | 2004-2010 |

| $296 million | Orca Bay Seafoods | 2006-2009 |

| $128 million | National Frozen Foods | 2004-2008 |

| $100 million | Immunex Corp. | 2004-2009 |

| $72 million | Andersen Dairy Inc. | 2007-2009 |

Legislators should scrutinize tax exemptions as closely as they do every other budget item – which is not the current standard. Why, for example, did Washington state give nearly $450 million to seafood distributors from 2004-2009? If it was to stimulate economic growth and retain good jobs, the state should analyze that expense to ensure it provided a positive return on investment.

Tax preferences are a public expense, and should compete on an equal playing field with other public expenditures that create wealth, like education, health care, and infrastructure building. Once the value of a tax preference is established, legislators should weigh it against other public expenses and determine its value – just like every other item in the budget.

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits