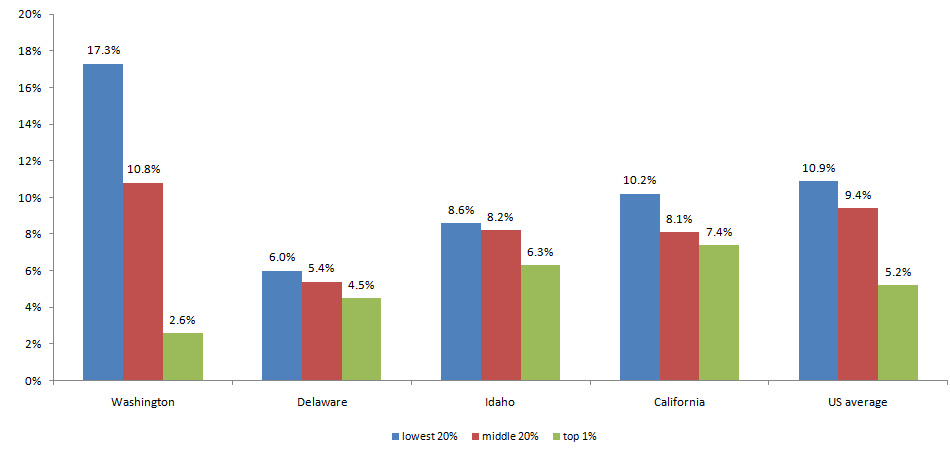

Washington has the most regressive tax structure of any state, taxing the lowest earners at 17.3%, while the top 1% pay just 2.6% of their incomes in taxes. How did we get here?

Well, for one thing, lower- and middle-income people spend a greater percentage of their income on items that are taxed directly — such as gasoline, alcohol, and non-food consumables — than do wealthy people.

But figuring out who is really paying a tax isn’t as simple as calculating sales tax on purchases, or determining the value of land and the associated property taxes. Why? Because often, individuals pay taxes on goods and services that are indirectly included in the total:

- Example 1: Lower- and middle-income people are more likely to rent homes or apartments than buy, and most landlords pass on the cost of property taxes to renters.

- Example 2: Washington’s business and occupation (B&O) tax is levied on gross receipts rather than net profits, and is calculated as a sales tax by many economists and the Federation of Tax Administrators. Businesses typically pass the cost of the tax directly on to consumers.

This chart shows the percentage of income paid in taxes by income group in 4 states, as well as the U.S. average. Washington is dead last in the rankings — and for good reason. The blue bar is the lowest 20% of earners, the red bar is the middle 20%, and the green is the top 1% of earners.

Learn more about these calculations and EOI’s analysis of in the fact sheet: I-1098: Fixing the most regressive tax system in the country

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits