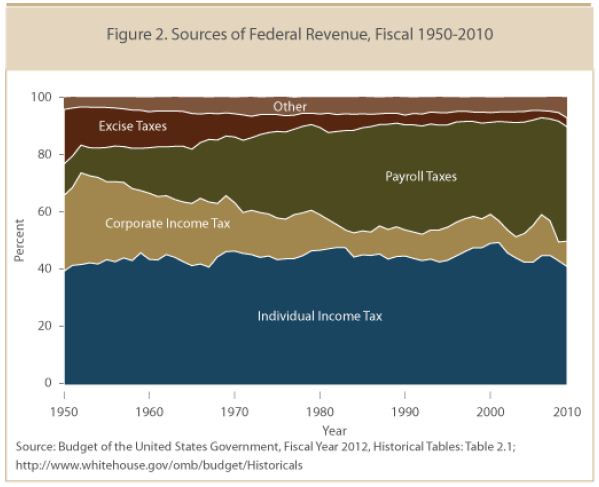

Given all of the recent talk about closing tax loopholes and deductions, here’s a chart showing sources of federal revenue. This chart is interesting because it comes from a recent report issued by the Senate Subcommittee on Investigations, which is exploring “how U.S. citizens and multinational corporations have misused and at time violated tax statutes and regulations and accounting rules to shift profits and valuable assets offshore to avoid U.S. taxes.”

The report notes that in 1952, the corporate tax generated 32.1% of all federal tax revenue. Today, the corporate tax accounts for 8.9% of federal tax revenue.

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits