Excerpted from Washington State Budget 101:

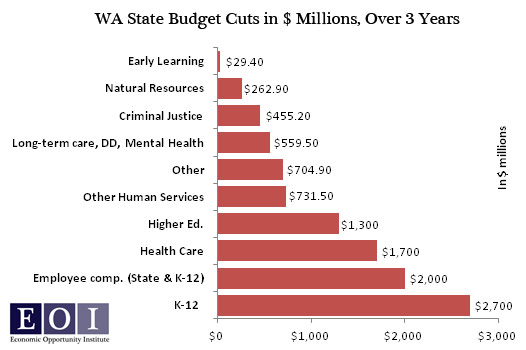

The recession has taken a big toll on jobs and family incomes – and on public revenue. The state has mostly cut services, not raised revenue, resulting in $10.5 billion in cuts. (Note: Federal aid in 2009-10, rainy day funds, and fee increases prevented deeper cuts.)

Cuts from 2009-11 include:

- K-12 education: Elimination of student achievement funds & teacher cost of living adjustments; 7,000 fewer K-12 employees.

- Higher ed: 4-yr college funding reduced 40%, 2-yr reduced 20%, with large tuition increases.

- Health care: 60,000 cut from Basic Health.

- Children’s services: Fewer children receiving health, childcare, and other services.

- Elder care: Reduced home-care hours for vulnerable seniors and disabled.

- Cuts to state agencies: Consolidation of state agencies, elimination of jobs.

- State employees: Mandatory furloughs and higher contributions for health insurance.

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits