Americans are living longer and longer. Even amid other public health challenges, life expectancy has risen steadily for the last four decades. Unfortunately, the infrastructure around aging in America hasn’t kept pace.

Americans are living longer and longer. Even amid other public health challenges, life expectancy has risen steadily for the last four decades. Unfortunately, the infrastructure around aging in America hasn’t kept pace.

For many retired folks, living longer also means living poorer. Lower wages, a higher cost of living, fewer housing options, and cuts to aid have meant that not only is retirement out of reach, but living a decent life is impossible. According to the New York Times, “the proportion of people over age 65 living in poverty climbed from a modern low of 9.5 percent in 2020 to 10.7 percent in 2021.”

It’s not just seniors. People of all age groups feel the impact of upside-down tax structure, reduced investments in almost all areas of public life, and the influence of corporate money in politics. But seniors remain one of our nation’s most vulnerable populations. So how can we help them, specifically, through policy work? How can we make aging in America less undignified?

When saving is impossible

One of the best ways to prepare today’s workers for their retirement is simply to increase workers’ wages. Similarly, ensuring that everyone can save – either through automatic IRAs or retirement accounts (with matching contributions for low-income workers from the local or federal government) – would help the next generation of older folks retire with dignity.

But that isn’t happening in America.

Instead, we have seniors who can’t retire without going broke. Nearly half of Boomers have absolutely no retirement savings. It’s not because they forgot to save. There are many older workers who, during their working days, just weren’t earning enough to put any aside.

Retirement is out of reach

Working more years doesn’t guarantee economic security. When wages remain low and the cost of living rises, those final years of work don’t leave much room for saving. Those who did save haven’t seen the growth they expected. Lower-than-expected interest rates – good for homebuyers but bad for retirement portfolios – have suppressed traditional retirement options. The Great Recession and ensuing implosion of the real estate bubble, too, reduced the value of many retirement portfolios.

Even would-be retirees that followed the advice of financial advisors are looking at their bank accounts and realizing that they simply can’t afford to leave the workforce. Meanwhile, lawmakers – comprised of and elected by Boomers – have shifted power and tax advantages toward corporations and the ultra-wealthy.

As a result, even seniors who were prepared and earned well during their working days are hurting. And their financial pain impacts every other generation.

Social Security is good – but could be (much) better

For most people, Social Security is the backbone of a dignified retirement. It is the nation’s most efficient, secure, universal and portable source of retirement income – and it offers benefits unavailable in the private sector, like progressive and family benefits, automatic inflation adjustments, and benefits for divorced spouses. But too many seniors and families still struggle to make ends meet.

But, like most other entitlements, Social Security benefits haven’t kept up with the cost of housing, medication, healthcare, and everyday goods and services – and the program is constantly used as a political football.

Cuts to or privatization of Social Security are frequently used as threats or bargaining chips by conservative lawmakers. Meanwhile, hundreds of thousands of retirees suffer every month as they try to make ends meet – and their children and grandchildren spend their own income trying to help, creating an economic drain that spans generations.

One simple fix

Fully funding Social Security might sound daunting. Schools can’t afford basic supplies, roads and bridges are crumbling, and housing providers have waitlists that never end. Drumming up additional revenue is a persistent challenge. That said, there is one clear, significant way that Congress can flood Social Security with new cash: scrap the cap on taxable wages.

Today, workers and employers each pay 6.2 percent of wages to finance Social Security — but there’s a cap on taxable wages ($160,200 in 2023) – so while 94 percent of workers pay Social Security tax on every paycheck, most of the earnings of the top 1 percent, and especially the top 0.1 percent, contribute nothing to Social Security at all.

Advocates have long been calling on Congress to “scrap the cap.” As the Center for Economic Research wrote just a few years ago, “the burden of supporting Social Security falls more heavily on those who make less.”

One recent example? Calculations show that Elon Musk reached his Social Security cap in just four days and thus, won’t pay into Social Security the other 361 days of the year. The rest of us who earn less than $160,200, however, will continue to pay all year.

With the extra revenue from scrapping the cap, Social Security’s long-term finances can be improved even while expanding benefits. In other words, by asking the wealthy to pay Social Security on all of their revenue, we would afford a better life for seniors.

Senior poverty impacts everyone

This broken system impacts people of all generations. It weakens our economic structure and undermines our stated values. It delays homebuying, whittles away at college funds, and generally reduces any generational wealth that a family might try to amass.

Adult children of aging parents are often required to take time off to provide care. Unfortunately, even with Washington’s progressive Paid Family Medical Leave (PFML) program, many people can’t take time off. Contractors – like ride-share drivers, freelancers, artists, musicians, and others who don’t work traditional jobs – can’t access this kind of paid leave.

Without enough saved to afford assisted living, home improvements for greater accessibility, and nursing care, many seniors are left to rely on their families. Workers who are still 20 or 30 years away from retirement may have to dip into their own savings to help aging parents. They may even leave the workforce altogether.

Housing: A crisis for seniors

The shortage of assisted living and senior living homes impacts the larger real estate market and often foists intergenerational living on those who can’t really afford it. Though there are an estimated 70 million Baby Boomers, there are just one million assisted living spaces on the market nationwide.

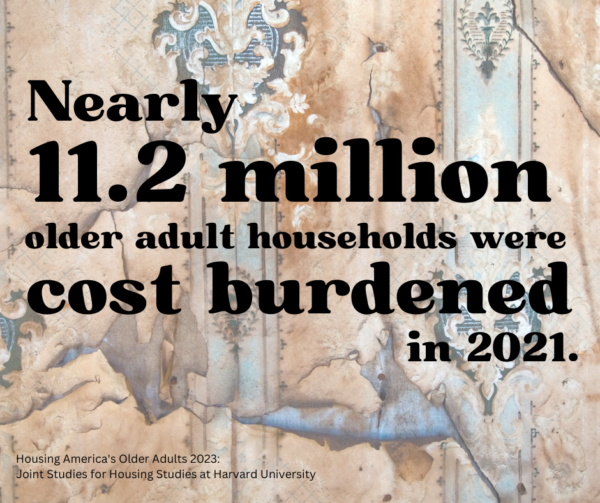

Among those who are housed, about one third of seniors are cost-burdened by their housing. We must expand this number rapidly. utilizing bonding capacity and other forms of funding to ensure that these units are affordable, accessible, and within our communities.

Unsurprisingly, this housing shortage has a greater impact on BIPOC families, poor families, and families in rural areas. NPR reported on a recent study from Harvard and found that “Black households, especially, are more likely to have lower incomes and to rent. Those who do own a house have, on average, less equity in it.”

Preparing for an aging population

The demand for housing for seniors isn’t going to decline. Instead, experts predict that the number of households headed by a person over the age of 80 will double. That means millions more seniors looking for a place to live.

Senior housing is also a potential growth industry and job provider. Nurses and in-home health workers, who are often unionized, can earn a good living while caring for America’s seniors. And, because these facilities are often in smaller communities, they can provide much-needed jobs that can’t be sent overseas.

What else can be done to fix aging in America?

We know the issues behind senior poverty – not enough money in the workplace, not enough savings, and not enough assistance after they retire.

One of the best ways to prepare today’s workers for their retirement is simply to increase wages for those who are still clocking in each day. Ensuring that everyone can save – either through automatic IRAs or retirement accounts with matching contributions by the local or federal government – would help the next generation of older folks retire with dignity. Additionally, reducing healthcare prices, expanding social and workforce housing, and recalibrating our unfair tax code could all offer financial relief to workers, helping them secure their future.

And it’s essential to provide access to information about programs that are available. Even when benefits are available, millions of dollars go unused each year. We must meet seniors where they are and, prioritize spreading the information about available assistance and provide well-paid social workers with tenable caseloads.

The Baby Boom has now entered its final permutation – an explosion of older folks with new and important needs. This should not have been a surprise and yet, lawmakers have failed to plan for this eventuality. There are many policy changes needed to help our seniors age with dignity – and we can’t (and our seniors) wait any longer.

P.S. EOI’s partners on retirement security policy include Puget Sound Alliance for Retirement Action and AARP Washington – hit those links to see what they’re up to!

More To Read

February 27, 2024

Which Washington Member of Congress is Going After Social Security?

A new proposal has Social Security and Medicare in the crosshairs. Here’s what you can do.

February 27, 2024

Hey Congress: “Scrap the Cap” to strengthen social security for future generations

It's time for everyone to pay the same Social Security tax rate — on all of their income

January 22, 2024

“Washington Saves” legislation won’t solve our retirement security crisis. Lawmakers should pass it anyway.

The details of this auto IRA policy matter.