Just two decades ago, fewer than one in ten households held student debt. Now, rapid increases in the sticker price for college has driven more students and their families to take out loans. For most college seniors, the idea of “working your way through college” has all but vanished, replaced by the dread of high loan payments.

Just two decades ago, fewer than one in ten households held student debt. Now, rapid increases in the sticker price for college has driven more students and their families to take out loans. For most college seniors, the idea of “working your way through college” has all but vanished, replaced by the dread of high loan payments.

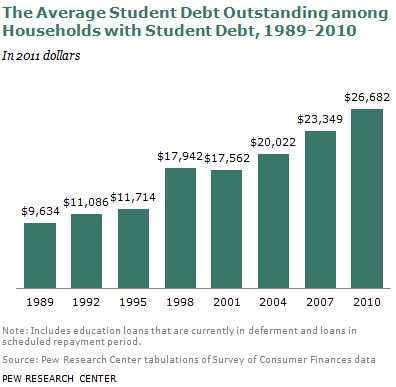

According to the Pew Research Center, student debt is exploding, with a record one in five households now holding student debt. But it’s not just the total number of borrowers that is increasing – it’s also the size of the loans. In 1989 the average student debt was a manageable $9,634. By 2010 it had nearly tripled, to $26,682.

By way of comparison, in 1989 it took an average graduate 2 years and seven months to pay off their student debt of $9,634 with payments of $350 per month. In 2010, it would take the same graduate 8 years and five months, and they would pay nearly 10 times as much in interest. (Note: This assumes a federal unsubsidized student loan rate of 6.8%).

High levels of student debt – brought on by shifting the cost of higher education to students and families – limits post-college options for graduates, and puts a damper on economic growth. Studies show growing debt-to-income ratios among grads are locking many otherwise-qualified borrowers out of the housing market, and research also indicates individuals with student loans are less likely to start a business, and more likely to delay major purchases such as a car or home.

That’s a worry for Washington’s economy, which – like others – is heavily dependent on strong consumer demand.

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits