Our Successes

Paid Family and Medical Leave

EOI brought together organizations representing seniors, women, labor, health professionals, children, faith communities, low income workers, and employers – the Washington Work and Family Coalition – to update the state’s workplace standards to meet the needs of today’s families and businesses. The coalition worked for almost two decades, and in 2017, Washington State passed a paid family and medical leave law which allows up to 16 weeks of paid family and medical leave, or 18 if it includes a pregnancy complication. Benefits began in 2020, covering 3.3 million workers.

Governor Jay Inslee signing paid family and medical leave into law.

Paid Sick and Safe Days

EOI developed a coalition that included representatives from public health groups, businesses, unions and community organizations to establish paid sick days in cities across the state. We were successful in Seattle in 2011, Tacoma in 2015, and Spokane in 2016. Then EOI backed Initiative 1433, a broad community effort passed by voters in November 2016, enabling paid sick days for workers across the state with benefits beginning in 2018. Most workers in Washington now have the right to earn at least one hour of paid sick leave for every 40 hours they work. This leave can be used for illnesses, injuries, or medical appointments of workers or their families, as well as for legal or safety concerns related to domestic violence, sexual assault, or stalking.

Minimum Wage

In 1998, EOI joined the Washington State Labor Council and dozens of other organizations and businesses to support Initiative 688, the Paycheck Protection Act, which boosted the state’s minimum wage and implemented the nation’s first automatic cost-of-living adjustment for the minimum wage. Passage of the measure – approved by majorities in every one of Washington’s 39 counties – was a national political landmark. Since then, 24 states have increased their minimum wage above the federal level, and nine states and one city followed Washington’s lead by adding annual inflation adjustments to their minimum wages. Years later, with Washington’s cost of living outpacing inflation, EOI again worked with community allies to help pass Initiative 1433. The resulting increases – to $13.50/hour in 2020, inflation-adjusted in years following – are providing much-needed compensation to low-wage workers across the state.

Overtime

In 2019, EOI contributed important policy analysis expertise and outreach to support a major change in Washington Administrative Code regulations governing who is covered by overtime and paid sick and safe leave laws. The minimum salary threshold to be exempt from overtime and sick leave protections began gradually rising in 2020 and will reach 2.5 times Washington’s minimum wage in 2028, making Washington’s protections the strongest in the nation.

Cascade Care

EOI successfully advanced Cascade Care in 2019, which mandates standard plans on the health benefit marketplace and creates a public option. Cascade Care will expand health care access to more than 300,000 Washingtonians. EOI continues supporting the implementation process and is advocating for ample state subsidies for the public option, set to go into effect on January 1, 2021.

Equal Pay

The EOI-led Equal Pay and Opportunity Act went into effect on June 7, 2018, ending pay secrecy policies and requiring employers to provide job-related reasons for differences in pay and opportunity. The new rights granted under this act protect and support workers as they identify wage discrimination and advocate for their deserved pay and opportunity. It will help combat Washington’s wage gaps – among the worst in the nation – which perpetuate discrimination against women, people of color, and the LGBTQ community.

Progressive Income Tax

Just a few months after EOI and the Trump-Proof Seattle Coalition proposed a tax on the wealthy, the Seattle City Council unanimously passed a progressive income tax on July 10, 2017 to help finance public services. The legislation would have placed a 2.25 percent tax rate on income over $250,000 a year. Due to legal decisions, this legislation is on hold, while EOI is working with partners to develop a 1% income tax in the city of Seattle and other cities. At the state level, EOI is working on a wealth tax, an inheritance tax, a tax on corporate compensation, and numerous other progressive tax measures, including a reformed and more robust state estate tax.

EOI Executive Director John Burbank speaking at a rally ahead of the Seattle City Council vote.

Progressive State Estate Tax

Congress voted in June 2001 to phase out the federal estate tax over the following decade. In response, EOI worked with Bill Gates Sr. in successfully urging the state legislature to pass a standalone state estate tax, with revenue dedicated to K-12 schools, higher education, and early learning. In 2006, our policy research and media outreach helped win the fight to preserve Washington’s estate tax, defeating a statewide initiative to repeal it. Through this legislative action and popular vote, Washington has the most progressive state estate tax in the nation – in fact it is our only progressive tax.

Retirement Security Accounts

Working in tandem with the Center for Economic Policy Research and national pension experts, EOI developed an innovative proposal, dubbed Retirement Security Accounts (RSAs), to provide Washington workers and small businesses with the option of a professionally managed, portable retirement plan. While the program has not reached all of the goals envisioned for it, the legislation did establish a clear role for the state in promoting and improving retirement security for its residents, and we will build on that success in the years to come.

Social Security Protection

In the 1990s, a growing number of employers defaulted on their pension plans, and political moves to privatize Social Security gained momentum. For the first time in generations, the promise of a secure and dignified retirement after a lifetime of hard work seemed to fade. Working with the national Economic Policy Institute, unions and women’s organizations, EOI began a statewide campaign to educate Washington citizens about the dangers of Social Security privatization. We delved into the data and showed Social Security was – and is – on sound financial footing far into the future. Especially in light of today’s economic turbulence, we’re proud to say that our efforts, combined with those of others, paid off. Social Security is the bedrock for millions of American workers, children and families, and will continue to be so for generations to come. Our intent now is to develop and propose policy changes to increase Social Security benefits.

Early Victories

Cigarette Tax for Health Care

In the late 1980s, Washington State took a major step forward to improve health care coverage by creating the Basic Health Plan (BHP), which provided basic health insurance to low-income working families. But after a decade of chronic underfunding, in 2001, only 125,000 people were enrolled in the plan, leaving hundreds of thousands of workers with inadequate health coverage – or none at all.

EOI responded by spearheading policy research and design for Initiative 773, and building a coalition of health care activists and organizations, including the Community Health Plan of Washington, Group Health Cooperative and the American Lung Association, to promote the initiative.

Passed by Washington voters with a 2 to 1 majority, I-773 increased taxes on cigarettes, directing the proceeds into the BHP to provide additional coverage for low-income adults and children. The increased tax brought another benefit: the state’s youth smoking rate declined by nearly 50 percent.

During the 2003 recession, Washington legislators reallocated state funds. The BHP suffered deep budget cuts But without I-773, the BHP would not have survived that budget crisis at all. Hundreds of thousands of Washingtonians – including 105,500 individuals enrolled in the BHP in 2008 – would have no health coverage. Further, the BHP provided Washington state with the experience and policy platform for implementation of the Affordable Care Act, beginning in 2012.

Community Jobs

As reforms to federal welfare programs unfolded in the late 1990s, people with the greatest barriers to employment faced losing financial support, without the skills and services they needed to find and keep a job.

In response, as one of its early projects, EOI helped design and implement the Community Jobs program in 1999, an innovative public-private partnership administered by the Washington State Office of Trade & Economic Development. Community Jobswas the first program of its kind in the nation to provide welfare recipients with paychecks for their work in the public and nonprofit sectors. Participants worked at least 20 hours per week, while utilizing wrap-around counseling, GED and ESL classes, childcare, and transportation services.

The partnership between EOI, Washington state agencies, community organizations and private sector employers helped build CJ into one of the most successful welfare-to-work programs in the country. As other states and localities began similar programs, EOI helped found the Transitional Jobs Network to share best practices, provide technical assistance, and advocate for increased federal funding for job advancement programs across the nation.

Early Childhood Educator Career and Wage Ladder

High-quality teachers transform childcare into an environment where early learning blossoms, boosting a child’s health, improving social cooperation and individual initiative, and improving their chances for success later in life.

In 1998, EOI set out with labor leaders, childcare center providers and parents to find a way to improve pay and training for teachers, keeping high-quality staff on the job. The result was the Early Childhood Educator Career and Wage Ladder. The program provided wage incentives for early childhood educators to pursue higher education relevant to their work and to excel in their chosen field. It was an immediate success. With $12 million in funding from 2000-2003, approximately 125 centers implemented the Ladder, covering 1,500 employees caring for 15,000 children.

Funding for the program was cut short when the state faced prolonged budget deficits – but when the economic tide turned, EOI, AFT Washington and other allies lobbied for restoration. Lawmakers responded by putting the Ladder into state statute. Ongoing budget allocations from 2007 to 2011 covered more than 70 centers.

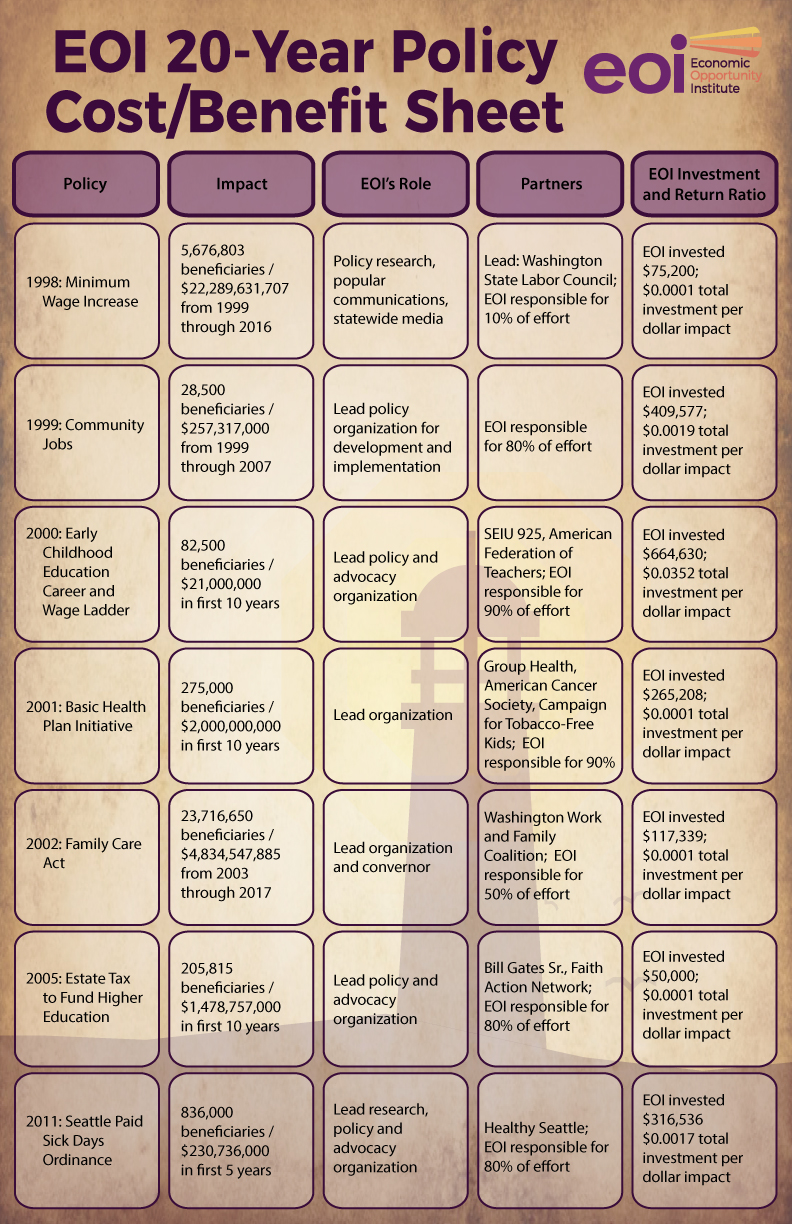

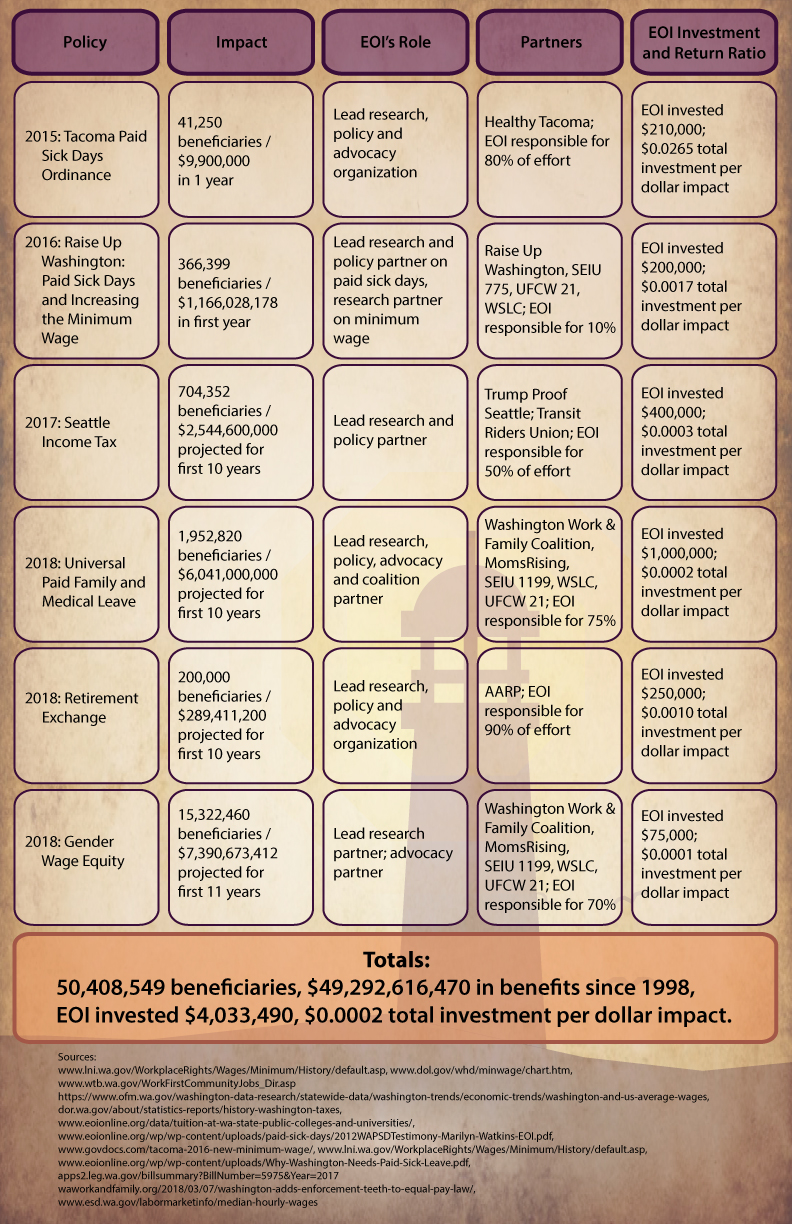

EOI Policy 20 Year Cost-Benefit Analysis