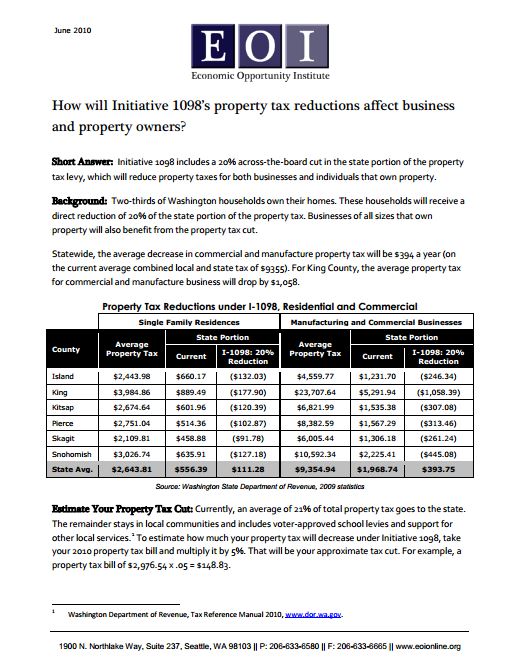

Short Answer: Initiative 1098 includes a 20% across-the-board cut in the state portion of the property tax levy, which will reduce property taxes for both businesses and individuals that own property.

Background: Two-thirds of Washington households own their homes. These households will receive a direct reduction of 20% of the state portion of the property tax. Businesses of all sizes that own property will also benefit from the property tax cut.

Statewide, the average decrease in commercial and manufacture property tax will be $394 a year (on the current average combined local and state tax of $9355). For King County, the average property tax for commercial and manufacture business will drop by $1,058.

Estimate Your Property Tax Cut: Currently, an average of 21% of total property tax goes to the state. The remainder stays in local communities and includes voter-approved school levies and support for other local services. To estimate how much your property tax will decrease under Initiative 1098, take your 2010 property tax bill and multiply it by 5%. That will be your approximate tax cut. For example, a property tax bill of $2,976.54 x .05 = $148.83.

From EOI’s fact sheet: Initiative 1098: How will a 20% reduction in the state property tax affect residential and commercial property owners?

Looking for more information about Initiative 1098? Visit the Economic Opportunity Institute website.

More To Read

October 14, 2025

Opportunity for many is out of reach

New data shows racial earnings gap worsens in Washington

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House