Last month, the U.S. Census Bureau released the most recent batch of data on income, poverty, and inequality across the United States. This data provides essential tracking for evidence-based decision-making and policy planning. This data allows us to produce critical research and document how policy has immediate and tangible effects on Washingtonians.

Here are some of the biggest takeaways from the 2024 release.

In some cases, poverty rates increased.

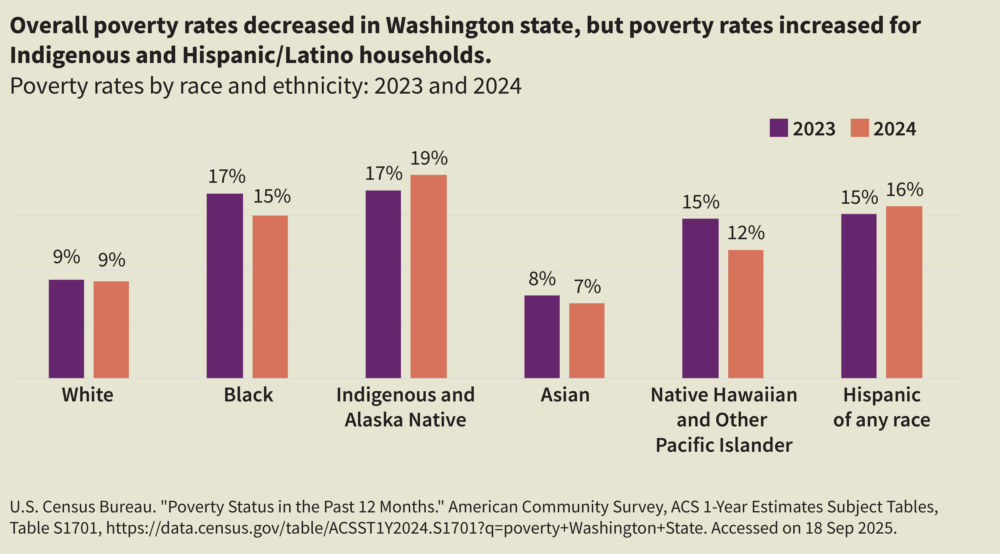

Washingtonians experienced a small decrease in the overall rate of poverty (10.3% to 9.9%) between 2023 and 2024. However, there were some notable disparities in that trend:

- Indigenous and Hispanic households experienced an increase in poverty. With poverty rates already far above the average for Washington (9.9%), Indigenous and Hispanic families are being left out of small positive gains in poverty reduction throughout the state.

Poverty tracking through the Census reflects dire poverty — for example, a family of three is considered ‘in poverty’ by the Census only if their annual income is less than $26,650 in 2025. To highlight just how low and unreasonable this threshold is, the average cost of rent for a two-bedroom in Seattle is around $35,500 per year. Additionally, the Census does not distinguish cost of living by location — meaning someone living in a less expensive place (i.e., Ritzville) uses the same threshold as a more expensive place (i.e,. Bellevue).

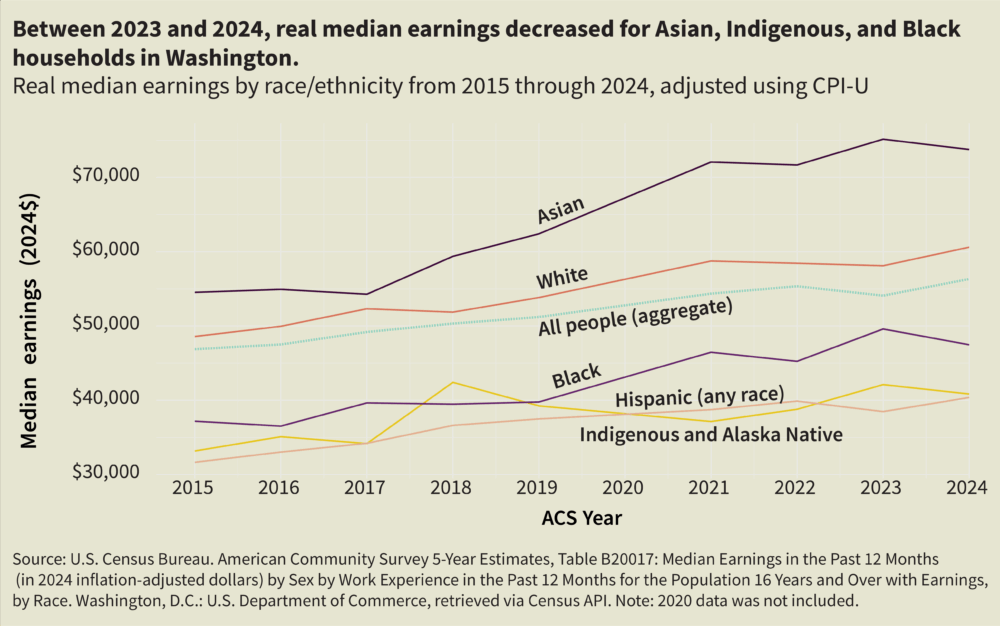

Racial earnings gaps worsen.

In Washington state, real median earnings for all households increased from 2023 to 2024 by 4%. Again, positive gains for Washingtonians were not distributed equally when disaggregating by race/ethnicity. Real median earnings decreased for Asian (-2%), Indigenous (and Alaska Native) (-3%), and Black (-4%) communities. These drops point to a discouraging trend in Washington state: racial earnings gaps that are continuing to worsen. Indigenous, Hispanic, Native Hawaiian and Pacific Islander, and Black households have significantly lower annual median earnings than White and Asian households.

Progressive revenue slows down income inequality.

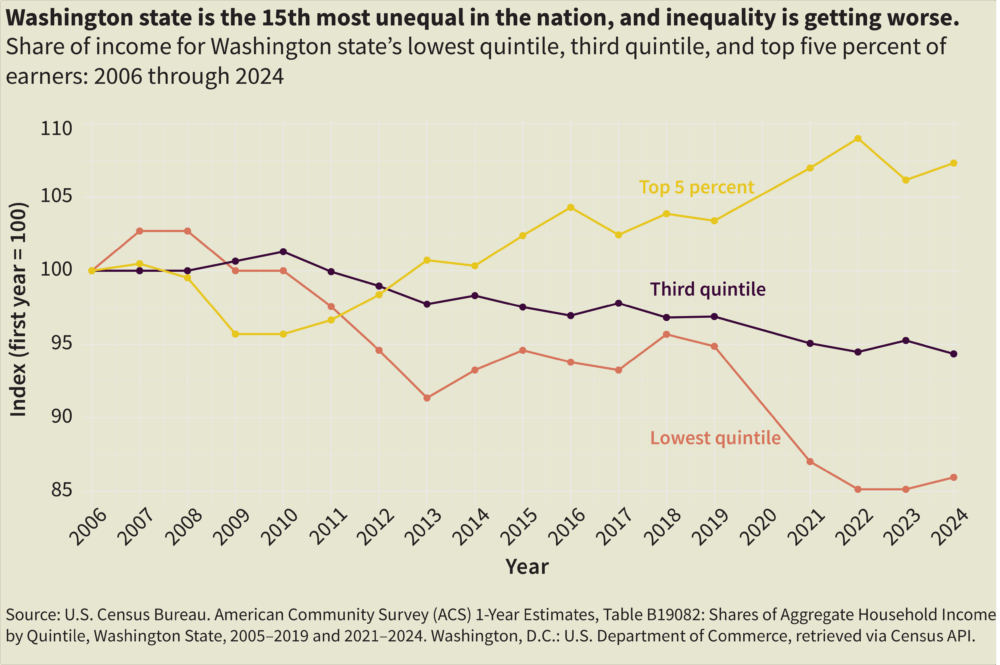

During the same time frame (2023 to 2024), income inequality increased — making Washington the 15th most unequal state in the country (right behind Georgia and Alabama).

This recent batch of Census data shows us that in Washington state, the lowest 20% of income earners take home only 3% of aggregate income, while the top 5% of income earners take home 22%.

While some heavier weighting of income at the higher end is expected, the graph above shows that Washington is becoming increasingly unequal — a trend that worsened during the period of 2019 through 2022, and will be compounded by the regressive tax reductions in the federal tax code. As a proportion of income, the average tax reductions for the richest 1% of Washingtonians will be three times those received by people earning the lowest 20% of income.

More economic inequality leads to less opportunity, increased rates of poverty, and more instability. Solutions like a progressive tax system could reverse some of these trends and create more fairness, opportunity, and joy for hardworking Washingtonians.

- Leave a Reply

More To Read

October 14, 2025

Opportunity for many is out of reach

New data shows racial earnings gap worsens in Washington

January 17, 2025

A look into the Department of Revenue’s Wealth Tax Study

A wealth tax can be reasonably and effectively implemented in Washington state

January 6, 2025

Initiative Measure 1 offers proven policies to fix Burien’s flawed minimum wage law

The city's current minimum wage ordinance gives with one hand while taking back with the other — but Initiative Measure 1 would fix that