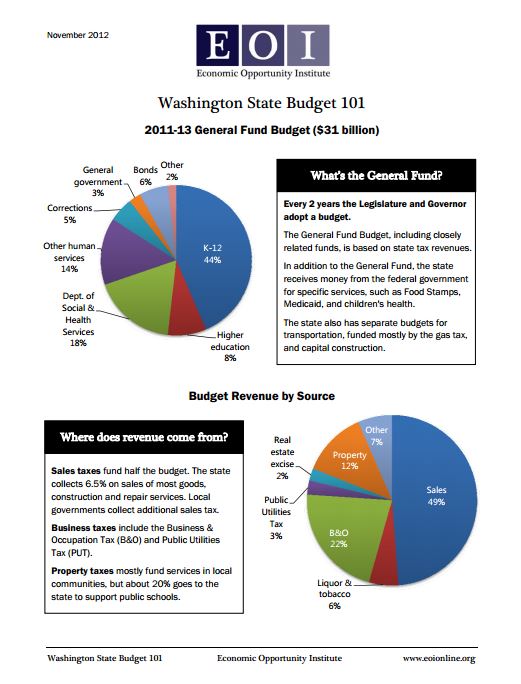

Every 2 years the legislature and Governor adopt a budget.

The General Fund Budget is based on state tax revenues.

In addition to the General Fund, the state receives money from the federal government for specific services, such as Food Stamps, Medicaid, and children’s health.

The state also has separate budgets for transportation, funded by gas tax, and capital construction.

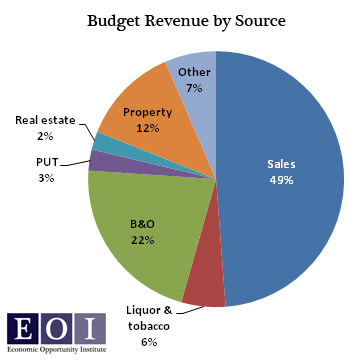

Where does revenue come from?

Sales tax funds half the budget. The state collects 6.2% on sales of most goods, construction and repair services. Local governments collect additional sales tax.

Businesses taxes include the Business & Occupation (B&O) and Public Utilities Tax (PUT).

Property taxes mostly fund services in local communities, but about 20% goes to the state to support public schools.

More To Read

April 17, 2024

2023-24 Impact and Gratitude Report

Reflecting on a year of progress and transition at EOI

April 12, 2024

Welcoming our New Executive Director, Rian Watt!

EOI is excited to begin its next chapter under new leadership

April 4, 2024

Is There a Valid Argument Against Cost-Free College in Washington?

Cost-free college is a meaningful investment that would change lives. What's stopping Washington from making it happen?